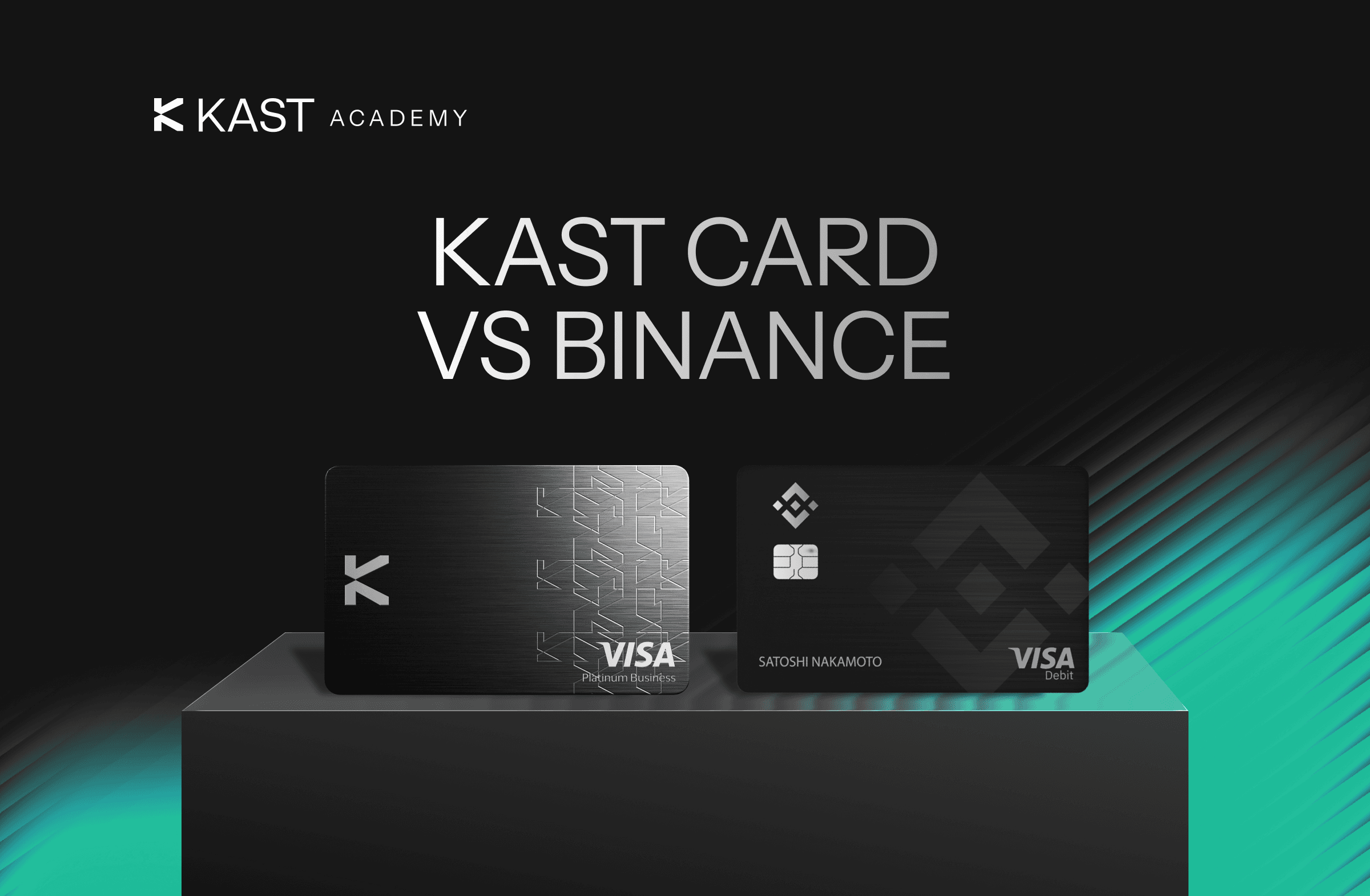

KAST Card vs Binance Card: Full Comparison for Crypto Spending

Wondering which crypto card actually fits how you spend? This KAST vs Binance Card comparison cuts through the hype to show how each card really works in day-to-day life. We break down fees, funding, rewards, and checkout experience so you can see what matters.

Key Takeaways

- Crypto cards promise to let you spend crypto anywhere, but the real differences show up in how balances are funded, converted, and settled at checkout.

- The Binance Card is best for active Binance users who want to spend directly from exchange-held crypto with simple, capped cashback and full control over which assets get converted at checkout.

- The KAST Card is built for everyday and international spending, offering a unified USD balance, broader availability, and tier-based rewards designed to scale with long-term use.

Trying to figure out which crypto card actually fits how you spend?

This is a straight-up comparison of KAST vs. Binance cards, covering what works, what doesn’t, and what matters once the hype wears off. Both promise “spend crypto anywhere.” In real life, it’s all about fees, flexibility, rewards, and how smooth checkout feels.

If you actually use your crypto for travel, international payments, or stablecoin spending, this guide will help you pick the card that deserves a spot in your wallet.

KAST vs Binance Card

So… What Is the KAST Card?

Meet the KAST Card Family

First things first: the KAST Card isn't just one card. It's a whole family of cards.

KAST cards bridge crypto with real-world spending. But KAST doesn't do generic. Instead, it builds cards for specific ecosystems, designed to feel right at home in the communities they represent.

Case in point:

- The KAST Solana Card, offered in Illuma, Gold, and Solid Gold

- The KAST Bitcoin Card, available in Silver and Black

Each card is more than a way to pay. It’s a signal that says, “I know exactly where I belong.”

Card Tiers and Where You Fit In

KAST organizes its cards into four tiers so you can choose how far you want to go. Standard cards are designed for easy entry and everyday spending, Premium cards upgrade both the feel and the rewards, Luxe cards deliver maximum perks and unmistakable presence, and the Limited tier is reserved for early supporters who want something truly rare.

In short, KAST isn’t trying to be everyone’s card. It’s built to meet you exactly where you are, and grow with you from there.

What’s the Binance Card?

The Binance Card is exactly what you’d expect from the world’s largest crypto exchange: practical, efficient, and tightly connected to trading.

It’s essentially an extension of your Binance account that lets you spend crypto straight from your spot wallet. When you pay, Binance converts your crypto to fiat in real time. No frills, no identity crisis, it knows what it is.

Where It Works and Who It’s For

Binance has rolled out its card in select regions, including parts of Europe and Latin America, with availability shifting as regulations change.

Because the card is deeply embedded in the Binance ecosystem, it works best if:

- You actively trade

- You already keep funds on the exchange

- You want quick, no-nonsense access to your balances

If KAST feels like a lifestyle card that happens to be crypto-native, the Binance Card feels like a trading tool that learned how to tap at checkout.

Currencies, Funding, and How Spending Actually Works

KAST and Binance take two very different approaches to funding and spending.

With KAST, you can deposit stablecoins, major cryptocurrencies, or fiat currencies like USD and EUR, all of which are converted into a single USD-denominated stable balance that your card spends from automatically, keeping checkout smooth and predictable.

Binance, on the other hand, lets you spend directly from a wide range of crypto assets by setting a priority order, converting the required amount into fiat at the moment of purchase. In short, KAST simplifies spending by unifying your balance up front, while Binance gives you more control by converting assets in real time at checkout.

Click here for an, up-to-date list of supported networks and tokens on KAST.

Rewards, Perks, and Cashback

KAST and Binance reward spending in very different ways.

KAST ties rewards to your card tier, combining fixed $MOVE cashback with KAST Points that scale as you move up tiers, plus bonuses and affiliate upside at higher levels.

Binance bases rewards purely on monthly spend, applying higher cashback rates retroactively as you cross spending thresholds, with cashback paid in USD the following month and capped monthly.

KAST Card Rewards

Binance Card Rewards

Binance cashback is based on your total monthly card spend. As you move up tiers, the higher cashback rate is applied retroactively to all eligible spending for that month.

Cashback is calculated on completed purchases and credited in USD by the 10th of the following month, with a monthly cap of $20.

Tiers reset at the start of each month.

Pricing, Fees, and What to Expect

KAST Fees

KAST card pricing depends on card tier, not subscriptions. Standard tier cards are free to issue, while Premium, Limited, and Luxe cards carry a one-time purchase cost tied to their materials, rewards, and exclusivity. There are no monthly or annual maintenance fees across the lineup.

FX, ATM usage, and payouts

KAST is designed to keep spending predictable. Card transactions settle from a unified USD-denominated balance, which minimizes FX friction at checkout.

ATM withdrawals incur a $3 flat fee plus 2% of the withdrawal amount, with an additional 2% FX fee for non-USD withdrawals. Withdrawals are capped at $250 per transaction, with a daily limit of three withdrawals or $750.

For the most current fee breakdown and limits by region and KYC level, see KAST’s fee page.

Binance Card Fees

Issuance and subscription

The Binance Card is typically issued for free, with no annual or subscription fees, making entry straightforward for existing Binance users.

Spending and foreign exchange

When you spend with the Binance Card, crypto is converted to fiat at the point of purchase. Binance charges a 0.9% crypto conversion fee, though payments made in USDC are exempt. Binance does not add an additional FX fee on top of standard card network exchange rates.

ATM withdrawals

ATM withdrawal limits and fees vary by region and KYC level, and certain withdrawals may be excluded from cashback eligibility. Users can view their daily and monthly limits directly in the Binance Card Dashboard.

Upsides and Trade-Offs

No card is perfect. Here’s where each one shines and where you’ll want to think twice, depending on how you spend.

KAST Card

Binance Card

Who Each Card Is Best For

Choose KAST if you:

- Spend internationally and want your card to work almost anywhere

- Want a predictable USD balance at checkout

- Care about maximizing rewards through Points, $MOVE, and long-term upside

- Want a card that feels more lifestyle-first, not exchange-first

Choose Binance Card if you:

- Are deeply crypto-native and actively trade on Binance

- Want to choose exactly which token gets spent at checkout

- Keep most of your funds on the exchange already

- Prefer simple, capped cashback with no tiers or card purchases

- Do not need wide country availability

At a glance, KAST and Binance cards solve different problems.

KAST is built for spending comfort. It simplifies funding by converting everything into a single USD balance, supports fiat, crypto, and stablecoins, works in more countries, and offers tier-based rewards that scale meaningfully over time.

Binance, by contrast, is optimized for exchange-native users who want direct access to their crypto and control over which assets get spent at checkout, with a simple, capped cashback structure.

So what’s the right pick? If you travel, earn or spend in stablecoins, want predictable balances, or care about maximizing long-term rewards, KAST is the better fit. If you actively trade, keep funds on Binance, and want a straightforward way to spend crypto without extra setup, the Binance Card gets the job done.

👉 Get KAST Now!

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

USD to Naira Conversion Fees Explained: KAST vs Bitget P2P

USD to local currency fees include exchange-rate spreads, platform or trading fees, and payout costs. Understanding these fees helps you compare platforms and avoid hidden reductions in your final payout.

USD vs AED: Which One Should You Pick on the Terminal in the UAE?

When a card terminal in the UAE asks whether to pay in USD or AED, that choice decides who sets your exchange rate. In most cases, choosing AED is cheaper. Here’s why.

Cold Storage vs. Card Wallet: How Much Should You Keep on KAST?

Most crypto advice frames storage as a binary choice. A better approach is separating long-term holdings from a working balance. Cold storage keeps funds safe by staying out of reach, while a card wallet like KAST keeps money accessible for spending, transfers, and everyday life.