Can I Withdraw Cash at an ATM Using My Crypto Card?

Crypto cards can withdraw cash at ATMs worldwide, but understanding how the process works matters. This guide breaks down how crypto card ATM withdrawals function behind the scenes, where fees come from, what determines limits, and when using an ATM actually makes sense.

Key Takeaways

- Crypto card ATM withdrawals work like normal debit withdrawals, with crypto sold in real time to fund the cash payout.

- Fees come from multiple layers, including conversion spread, issuer fees, and ATM operator charges.

- ATM access depends on issuer rules, region, KYC level, and limits, not on crypto itself.

Let’s break it down in a simple way: If your card runs on a major network like Visa or Mastercard, the ATM processes the transaction exactly like a standard debit withdrawal.

KAST issues a Visa card → Know more about the KAST Cards

From the ATM's perspective, a crypto card is indistinguishable from any other Visa debit card. So:

You choose the amount.

You confirm.

Cash comes out.

That’s it. But…

How Does an ATM Withdrawal With a Crypto Card Actually Work?

Aren't you a little curious about what happens behind the scenes?

Let’s unwrap this: Think of a crypto card ATM withdrawal as a quick conversion.

- First, the issuer checks your available crypto balance.

- It then calculates how much crypto must be sold to cover:

- the requested amount

- issuer fees

- network and ATM fees

- The Visa or Mastercard network authorizes the transaction.

- The ATM dispenses local currency.

You are not "withdrawing crypto."

You are selling crypto to fund a fiat withdrawal. This distinction matters, because it explains fees, limits, and regional behavior.

Will Your Crypto Card Work at Every ATM?

If your friend tells you "it won't work in any ATM because it's crypto," get a new friend 😆

Remember: ATM compatibility depends on issuer policy, not on crypto itself.

ATMs evaluate:

- The card network (Visa / Mastercard).

- The BIN category (debit, prepaid, fintech-issued).

- Whether the issuer permits cash withdrawal transactions in that country.

Most crypto cards that advertise ATM access share three traits:

- They run on a major card network.

- They restrict withdrawals by region and KYC tier.

- They maintain a fiat settlement layer fed by crypto conversion.

If any of those fail, the ATM declines.

ATM Fees: Where the Cost Actually Comes From

ATM withdrawals with cards can stack multiple cost layers.

1. Conversion spread

The rate at which your crypto is sold rarely matches the mid-market price.

Typical spreads range from ~1–3%.

2. Issuer ATM fee

Often a flat fee or a percentage (commonly 1–3%).

3. ATM operator fee

Charged by the bank that owns the machine.

Usually a flat local fee (often $2–$5 equivalent).

Example: Withdrawing the equivalent of $100

This explains two common realities:

👎 Small withdrawals are disproportionately expensive.

💰 ATM access prioritizes liquidity, not cost efficiency.

What Determines ATM Cash Withdrawal Limits on Crypto Cards?

Your actual limit is the smallest of these factors:

- The ATM’s per-transaction cap.

- The issuer’s daily withdrawal limit.

- Monthly or rolling limits tied to KYC.

- Country-specific compliance rules.

For example, the KAST card has the following ATM cash limits:

- Up to $250 per withdrawal

- Up to 3 withdrawals per 24 hours

Use Your Crypto Card at ATMs Worldwide When Traveling

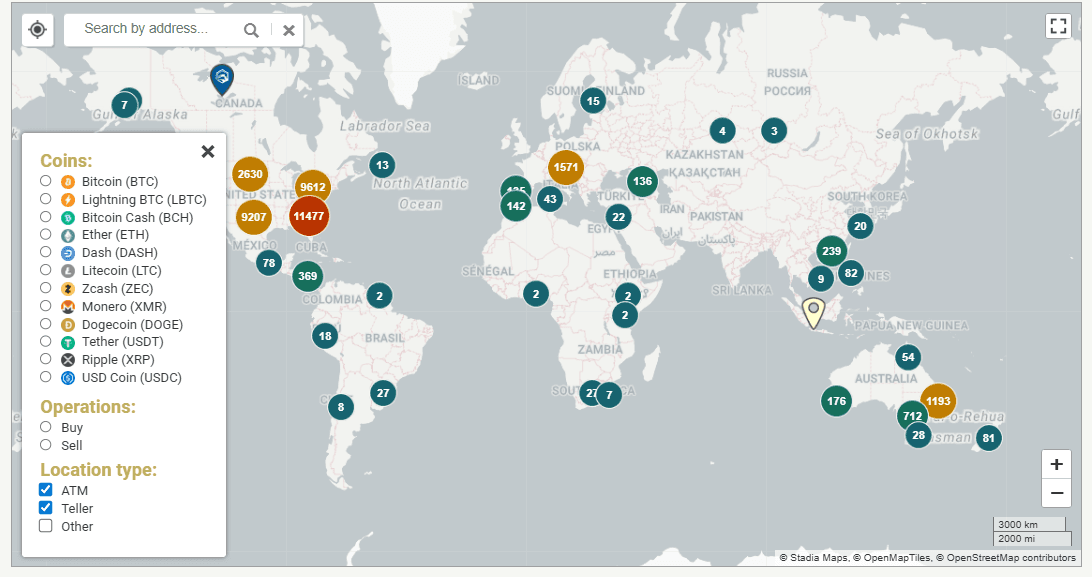

Where your crypto card functions at an ATM depends on three things: the card network, local banking policy, and your issuer's country whitelist.

Europe / UK

Visa and Mastercard acceptance is near-universal. If your issuer permits the country, the transaction clears. ATM operator fees vary, but the technical layer is stable.

United States

Acceptance is uneven. Issuer policy, state regulations, and KYC tier determine whether you can withdraw. Some cards work nationwide; others restrict cash access to verified users or specific states.

Latin America

The network rails support most withdrawals, but ATM operator fees on foreign or prepaid cards run high. Cash access is possible, but cost per transaction often exceeds what you pay in Europe or the US.

Asia and Middle East

In financial centers, Visa and Mastercard penetration is strong. Yet many banks categorize foreign-issued fintech cards as elevated risk, leading to more declines, additional verification prompts, or lower caps on cash withdrawals.

Source: Coinatmradar

Note: Think of this as a conceptual guide, not a legal reference. Your issuer's country list and KYC tier always take precedence.

Why Are Crypto Cards Declined at ATMs?

Most declines fall into a small set of causes:

- Cash withdrawals disabled on the card product.

- Country not supported by the issuer.

- KYC tier insufficient for ATM access.

- Daily or monthly limits exceeded.

- ATM bank blocks the card’s BIN category.

- Insufficient crypto after fees and spread.

Issuer apps usually surface the specific reason.

When Should You Use Your Crypto Card to Withdraw Cash from an ATM?

ATM withdrawals are justified when:

- Cash is required

- Card payments unavailable

- Speed and access over cost

For routine spending, direct card payments are usually cheaper because they avoid ATM operator fees and reduce the overall fee stack.

Recommendations: Check Before You Withdraw

Before heading to an ATM, verify these items to avoid declined transactions and unexpected fees:

✅ ATM cash withdrawal support: Confirm your card product allows cash withdrawals.

✅ Regional availability: Check that your current country and currency are supported.

✅ Account requirements: Verify your KYC tier meets the minimum level for ATM access.

✅ Sufficient balance: Ensure you have enough crypto to cover the withdrawal amount plus all fees.

✅ Network compatibility: Look for the Visa or Mastercard logo on both your card and the ATM.

✅ Operator fees: Expect an additional fee from the ATM operator, shown on the confirmation screen.

✅ When all these conditions are met, your crypto card will process the withdrawal just like a standard debit card.

If an ATM Retains Your Card

Crypto cards follow standard debit-card rules at ATMs.

If a card is retained:

⚠️ Freeze the card immediately in-app.

⚠️ Record the ATM bank, location, and terminal ID.

⚠️ Contact issuer support from the app.

⚠️ Request a replacement card.

⚠️ Remember physical recovery is rare.

Ready to bridge the gap between crypto and everyday spending?

Start using your crypto with KAST Card today.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

How Does a Crypto Card Work Behind the Scenes?

Ever tapped your card and thought, “Wait, did I just spend Bitcoin?” That’s the magic of a crypto card - simple on the surface, but powered by incredible tech underneath. Let’s unpack how it all works, and how your KAST Card makes it real, simple, and powerful for you.

Where Can I Use a Crypto Card: Online, In-Store, or at ATMs?

Crypto cards work everywhere traditional cards do: in-store, online, and at ATMs. Learn how to spend your Bitcoin and stablecoins seamlessly at any retailer accepting Visa or Mastercard, with instant crypto-to-fiat conversion happening behind the scenes.

Are Crypto Cards Safe to Use?

Crypto cards are powerful tools for spending your digital assets in the real world. Like any other card, they're safe when you follow the right security practices.