Why Settlement Time Matters for Your Card Balance

Ever notice your card balance update hours or days after you’ve already paid? That delay is settlement time. This guide explains how card transactions really work, why balances don’t change instantly, and how on-chain settlement with KAST helps your balance update faster and more transparently.

Key Takeaways

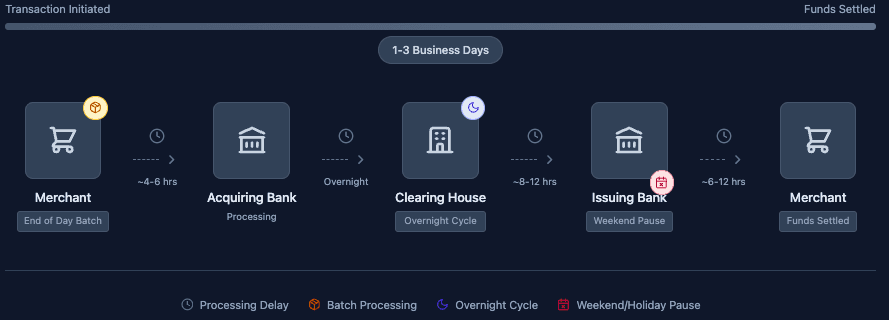

- Card networks show "pending" transactions instantly, but settlement to your actual balance can take 1-3 business days.

- The delay exists because merchants batch transactions for settlement, and banks process them in waves, not in real time.

- With crypto cards, settlement happens on-chain after the merchant finalizes, which means your spendable balance updates faster than traditional banking.

You check your card balance. It says $500.

You buy coffee for $5. Your balance still says $500.

Then an hour later, it says $495.

But wait, you already drank the coffee an hour ago. Why did your balance just update now?

This isn't a bug. It's card settlement time, the delay between paying and when your balance actually updates.

Here’s the deal: when you pay with a card, the system says “yeah, you’ve got the money” instantly. But the money doesn’t actually move right away. Merchants batch transactions. Banks process them later. Sometimes days later. Weekends? Forget it.

Neither is quite right.

This article breaks down what card settlement time really is, why it exists, and how the KAST Card optimizes it.

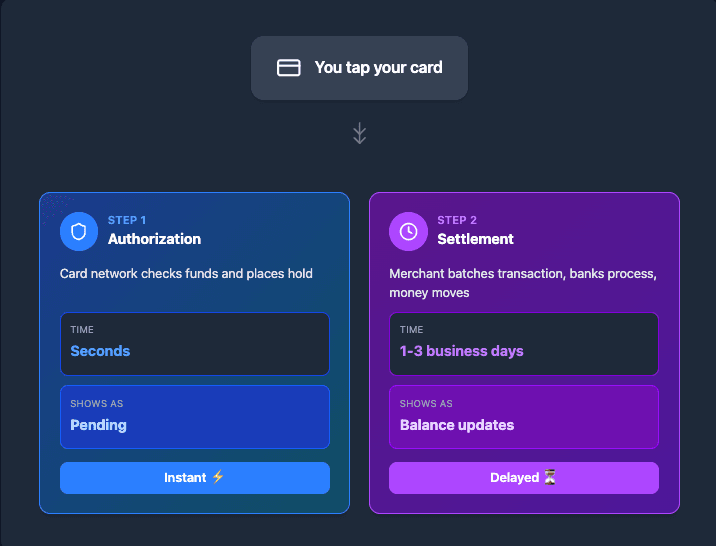

What Actually Happens When You Pay

When you tap your card, two separate things happen.

First: Authorization.

The card network checks if you have enough money and places a temporary hold. This takes seconds. That’s what shows up as pending.

Second: Settlement.

The merchant sends the transaction for processing, banks pass it along, and the money actually moves. This happens later.

You see the first step instantly.

The second step is where the waiting begins.

So when your balance looks wrong, it’s not lying, it’s just early.

What Is Settlement Time?

Settlement time is the delay between when you make a purchase and when the funds officially move from your account to the merchant.

That delay usually lasts 1–3 business days, not because anything went wrong or your bank forgot, but because the system was built long before real-time payments were a thing.

Why Settlement Takes Days

This part feels personal, but it isn’t.

Merchants Batch Transactions

Most merchants don’t send every transaction the moment it happens.

They collect everything from the day and submit it all at once, usually at closing time. It’s cheaper and easier for them.

Your $5 coffee sits in a queue until then.

Banks Process in Scheduled Cycles

Once the merchant sends the batch, banks don’t process it instantly either.

They run clearing cycles at set times, often overnight.

By the time your transaction gets picked up, a day may have already passed.

Weekends and Holidays Pause Everything

Banks don’t process settlements on weekends or holidays.

Buy something Friday night?

Settlement might not even start until Monday.

If Monday’s a holiday, add another day.

This is why “3–5 business days” often feels like forever.

Fraud Checks Add Friction

Banks also use settlement time to look for suspicious activity.

That protects you. It also means some transactions stay in limbo longer than expected.

Nothing’s broken. It’s just slow by design.

What "Pending" Really Means

When you see a pending charge, it means the purchase was approved and the funds are temporarily reserved.

You can’t spend that money again, even though the final amount may still change.

Pending doesn’t mean the transaction is finished, just that it’s in progress.

Your available balance already reflects pending charges, but your actual balance won’t update until settlement is complete. That gap between approval and settlement is where most confusion comes from.

How This Affects Your Card Balance

The gap between authorization and settlement is where most confusion comes from.

Here are the most common scenarios:

Restaurants

The authorization might be $50.

You tip. The final charge becomes $60.

Your balance updates later. If you weren’t expecting it, it feels like money disappeared.

It didn’t. It just finished settling.

Gas Stations

You pump $30.

The station places a $100 hold because they don’t know how much you’ll pump when you swipe.

The extra drops after settlement. Until then, your available balance looks worse than reality.

Hotels and Rental Cars

Same idea.

They authorize more than your bill to cover incidentals or damages.

You check out. The final charge is lower. The extra hold sticks around for days.

Refunds

Refunds follow the same process as purchases.

Even if the merchant processes it instantly, banks still batch and clear it later.

That’s why refunds often take 3–7 business days.

How to Avoid Balance Surprises

1. Check Both Available and Actual Balance

Most card apps show two numbers:

- Available balance: What you can spend right now (minus pending transactions)

- Actual balance: What you actually have after settlement

Your available balance and actual balance don’t always match. Don’t rely on just one. Look at both.

2. Expect Holds at Gas Stations, Hotels, and Rentals

If you're filling up, checking in, or renting a car, expect an extra hold.

Plan for it. Give your balance some breathing room until it clears.

3. Track Your Own Spending

Don’t let your card balance be the only thing keeping score.

A quick mental tally or a spending tracker helps pending charges feel a lot less surprising.

4. Give Refunds Time

If a merchant says they processed your refund, they probably did.

It just still has to settle.

How Crypto Cards Handle Settlement

Crypto cards work a little differently.

When you use a card like KAST, authorization still happens instantly through the Visa network, just like any other card.

But settlement happens on-chain, not through the traditional banking system.

Faster Balance Updates

Once the merchant finalizes the transaction, settlement happens on the blockchain.

Blockchain transactions don't wait for end-of-day batches or bank processing windows. They confirm in seconds to minutes, depending on the network.

Your actual balance updates faster because there's no multi-day clearing cycle.

Transparent Transaction History

Every settlement is recorded onchain.

You can see when the transaction was authorized, when it settled, and exactly how much was transferred.

No mystery holds. No wondering when a refund will finally appear.

No Weekend Delays

Blockchains don't take weekends off.

If a transaction settles on Saturday, it settles on Saturday. You don't have to wait until Monday for the bank to catch up.

Lower Fees Mean Faster Merchant Processing

Merchants using crypto rails pay lower fees than traditional card processing.

Lower fees mean they're more likely to settle transactions quickly instead of waiting to batch at the end of the day.

Fewer delays on their side means fewer delays on yours.

Why This Matters for KAST Users

KAST Card still runs on Visa, so paying works the same way it does with any other card. The difference comes after the swipe.

Because settlement happens onchain, the time between “pending” and “settled” is shorter, which means your balance updates faster once a merchant finalizes a transaction.

You get clearer visibility into what’s authorized versus what’s actually settled, without weekend delays from bank processing schedules.

Instead of guessing when your balance will change, with KAST you can see where your money stands in near real time.

Topping Up Your KAST Balance

Now let’s talk about adding money.

When you send crypto to KAST, your balance updates once the network confirms the transaction.

No manual approval.

No business hours.

No waiting days.

KAST supports multiple blockchain networks, each with different confirmation speeds:

Once confirmed, your balance updates automatically. That’s it.

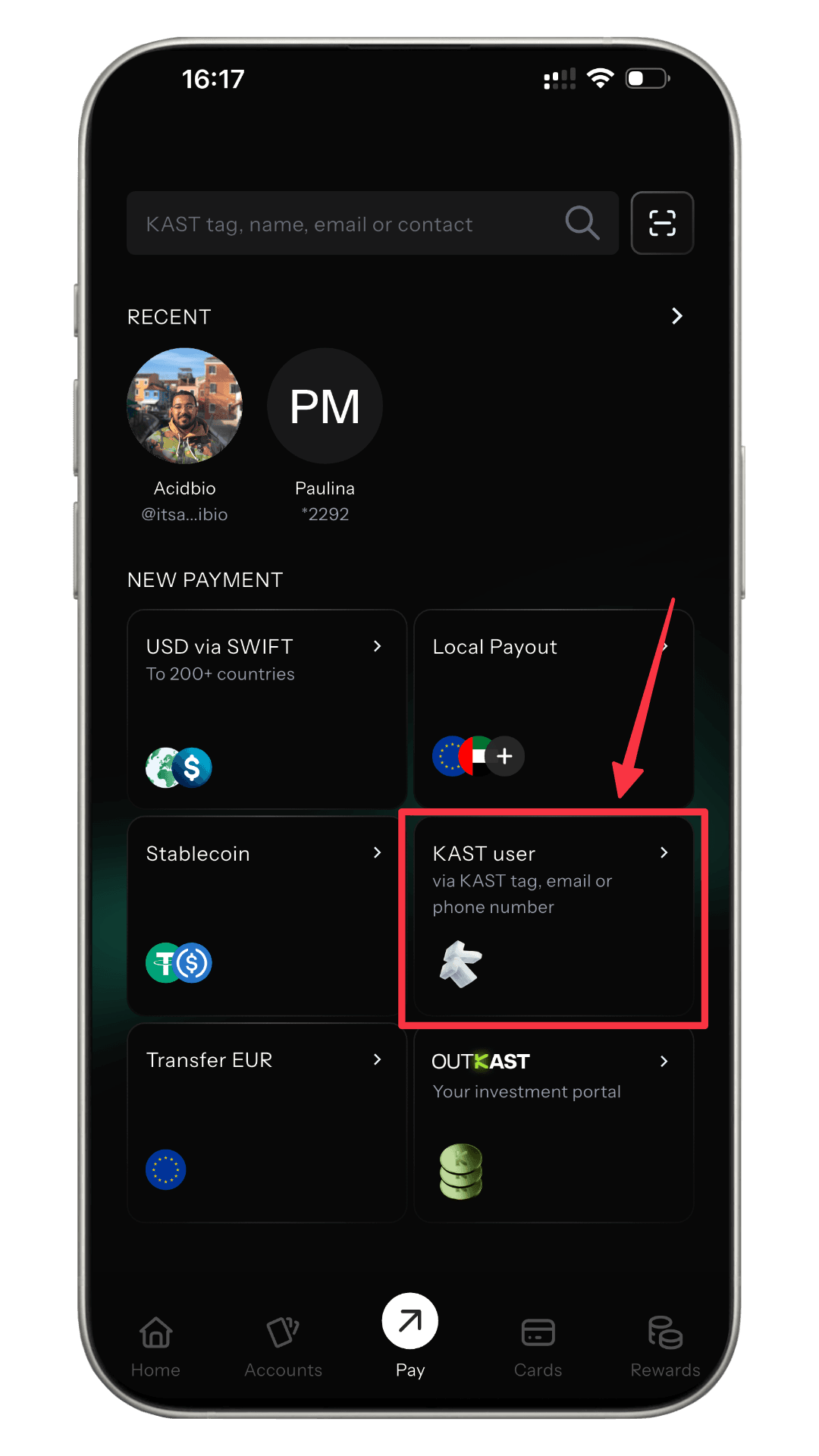

Sending Money Between KAST Users

Sending money to another KAST user using a KAST Tag, email, or phone number is even faster.

Transfers between KAST users are instant and free.

The balance updates immediately. No confirmations. No fees. No delays.

This is how money should move.

The Difference Is the Infrastructure

Traditional banks rely on systems built decades ago. They batch, process overnight, and pause on weekends.

KAST runs on blockchains that operate 24/7 and confirm transactions in seconds.

When you add funds to KAST, you’re not waiting on bank schedules. You’re waiting for the next block.

And that happens quickly.

What You Should Remember Next Time You Swipe

Settlement time is the gap between when you swipe and when the money actually moves.

It exists because of batching, processing cycles, and old infrastructure.

You can’t remove authorization delays, but you can shorten settlement by using faster rails.

With KAST, settlement happens on-chain. That means fewer surprises, quicker updates, and a balance that’s easier to trust.

You shouldn’t have to guess when your money will move.

Now you don’t.

Ready for a card that settles as fast as you spend?

Get your KAST Card and see the difference.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

Blockchain Confirmations Guide: ‘Instant’ Payments Aren't Always Final

Crypto payments feel instant, but finality takes time. Here’s what really happens after you hit send, why confirmations matter, and how KAST removes that friction from everyday spending.

How to Read a Block Explorer: Tracking Your Card Top-Ups

Ever sent crypto and wondered if it actually went through? This guide shows you how to use a block explorer to track your transaction in real time, understand confirmations, and see exactly when your KAST card top-up is ready to spend.

What Stablecoins And Networks Are Supported By KAST?

Did you know KAST supports stablecoins like USDC, USDT, PYUSD, RLUSD and networks like Solana, Ethereum, Polygon, Tron, BSC, and more? Learn how to choose the right network based on transaction fees, speed, and compatibility.