Blockchain Confirmations Guide: ‘Instant’ Payments Aren't Always Final

Crypto payments feel instant, but finality takes time. Here’s what really happens after you hit send, why confirmations matter, and how KAST removes that friction from everyday spending.

Key Takeaways

- Transactions feel instant because they’re broadcast immediately, but they only become final after validators confirm and settle them on the blockchain.

- Confirmation times vary by network design, fees, and congestion, which is why fast blockchains are not always instantly settled.

- KAST lets you spend immediately by handling blockchain settlement in the background, so confirmations never slow down your payments.

Have you ever panicked after sending a transaction, since it disappeared from your original address and didn’t show up in the new one yet?

We’ve all been there. You hit “send” on a crypto transaction, your wallet balance updates immediately, and the funds look like they’re gone.

Everything feels instant. Then you check the status and see the word everyone side-eyes: “Pending” or “Unconfirmed.”

This isn’t unique to crypto. In traditional payments, card authorizations happen in milliseconds, but final settlement between banks can take days. Crypto cuts out the banks, but it doesn’t cut out verification and settlement.

To understand why this gap exists, and how KAST closes it in your day-to-day experience, it helps to first see what actually happens when you send a blockchain transaction.

What Really Happens When You Send a Crypto Transaction

When you send cryptocurrency, you aren’t physically moving coins. Instead, you’re creating a signed message that tells the network:

“I authorize X amount of funds to move from my address to another address.”

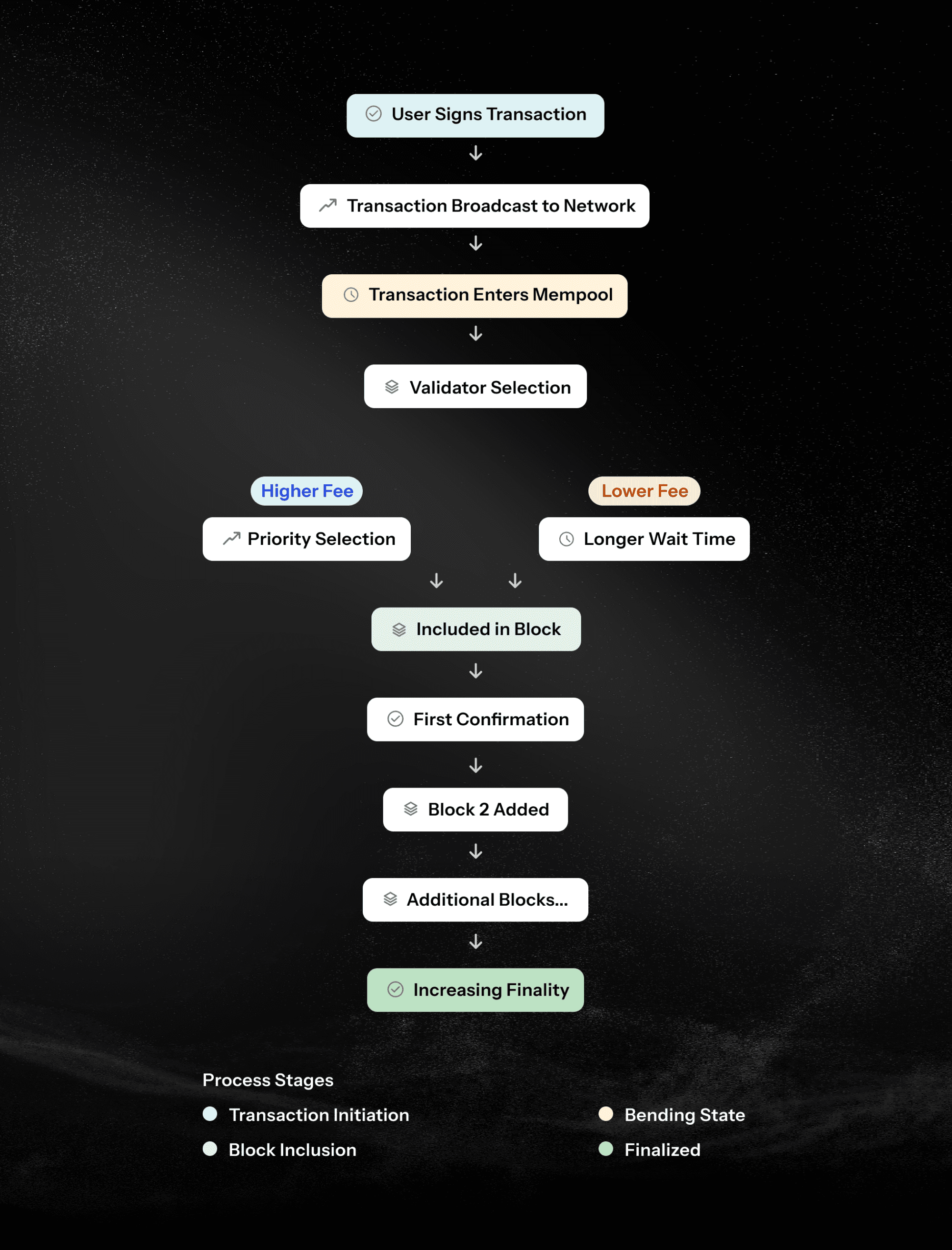

Your wallet signs this message with your private keys and broadcasts it to the network. The moment this happens, wallets and explorers can see the transaction almost instantly. That’s why it feels fast.

But visibility is not confirmation. Think of it as “Hey, I’m here!” rather than “All systems go.” Yes, you’re visible… but you’re not official yet.

At this stage, your transaction has only been announced. It hasn’t been validated, ordered, or permanently written to the blockchain.

Once broadcast, your transaction enters a shared waiting area known as the mempool.

The mempool is a pool of pending transactions. They’ve been sent, the network knows about them, and now they’re just waiting for miners or validators to pick them up and include them in a block.

Validators don’t process transactions in strict first-come, first-served order. They’re economically incentivized to prioritize transactions that pay higher fees.

That’s where priority fees, sometimes called tips, come in. A higher fee bumps your transaction up the line, increasing the odds it’ll get into the next block sooner.

When a validator includes your transaction in a block, it receives its first confirmation.

Every block added on top adds another confirmation, making the transaction increasingly hard to reverse.

Different blockchains require different numbers of confirmations for a transaction to be considered final. And because block times vary, fewer confirmations don’t always mean faster settlement.

For example, Bitcoin typically requires 3 to 6 confirmations with a 10-minute block time, resulting in roughly 30 to 60 minutes. A chain with a 3-second block time could require 100 confirmations and still finish in about five minutes.

Why Settlement Takes Time

For a transaction to be considered settled, the network must be confident it won’t be reversed.

How long this takes depends on the blockchain and its consensus model.

Proof-of-Work Networks

On Proof-of-Work networks like Bitcoin, miners compete to solve cryptographic puzzles. This process is very secure, but also slow and resource-intensive.

Because chain reorganizations are possible, merchants accepting Bitcoin directly often wait for multiple confirmations before treating funds as final. In practice, this can mean waiting close to an hour.

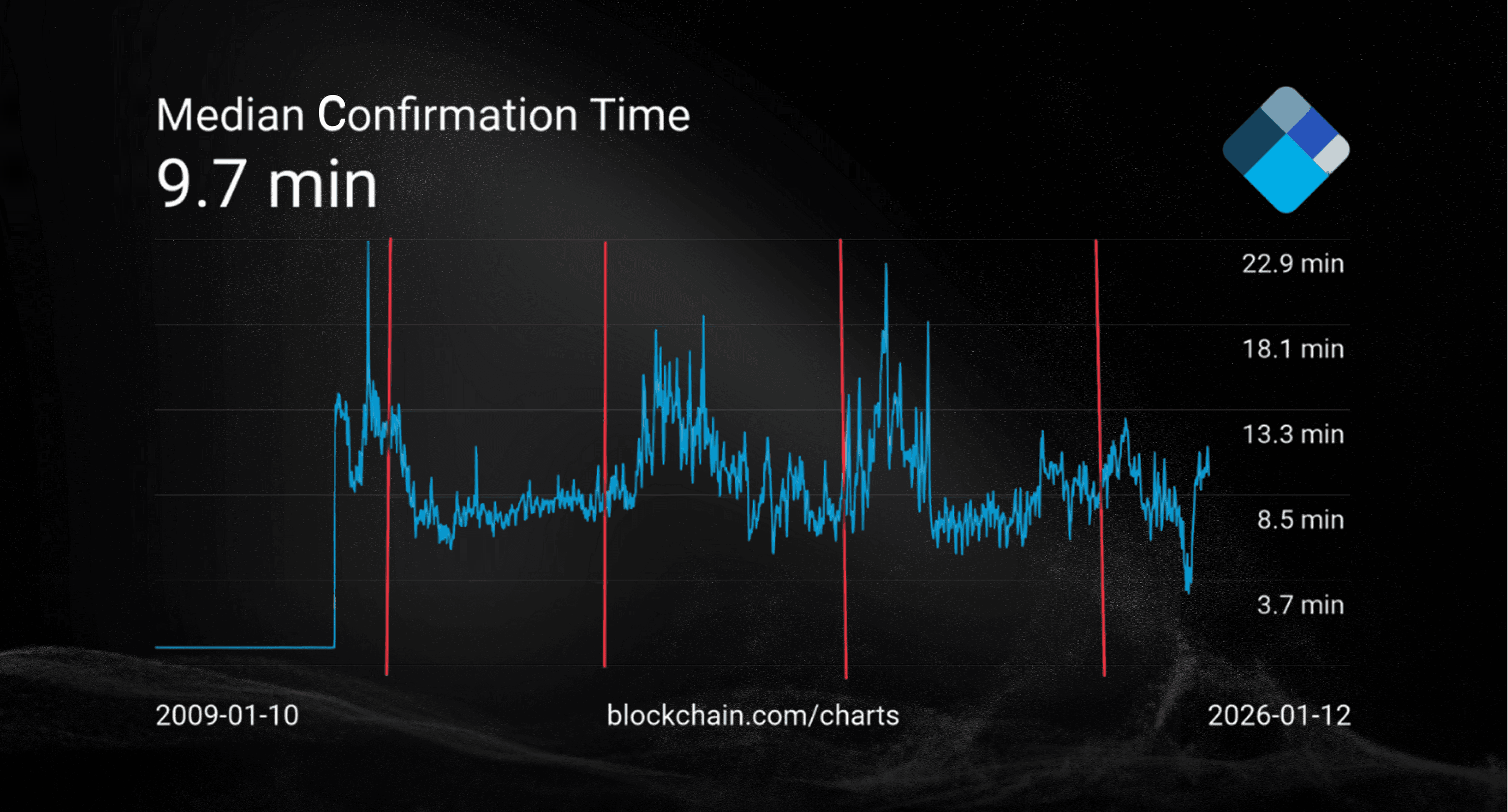

Median confirmation times for Bitcoin aren’t fixed. Short-term swings happen because blocks target ~10 minutes, but in reality, block times vary.

Over the long term, halvings are the main driver. When miners earn 50% less BTC per block, some temporarily shut off equipment, slowing the network until the next difficulty adjustment.

Lower rewards also make miners rely on transaction fees, prioritizing high-fee transactions and leaving lower-fee ones waiting longer.

Historically, median confirmation times have spiked after each halving.

The three main reasons for Bitcoin block-time variance:

- Post-halving profitability drop: Miners earn 50% less BTC per block, reducing incentive until the BTC price rises.

- Temporary hash rate reduction: Some miners pause operations, slowing block production.

- Fee-based prioritization: Higher-fee transactions go first, so lower-fee ones wait longer.

Proof-of-Stake Networks

Proof-of-Stake networks like Solana or BNB Chain rely on validators who lock up capital to secure the network. This lets blocks be produced faster and with less energy.

Even so, congestion, low fees, or validator load can still leave transactions pending longer than expected.

Across all chains, the trade-off is the same. Speed improves user experience, while confirmations provide security.

Median confirmation times on PoS chains are generally stable. Short-term delays come from network latency, congestion, or transaction fee prioritization.

Unlike PoW, there’s no mining reward drop, so block production is mostly predictable.

Key factors:

- Protocol-defined block intervals (minor variations possible).

- Fee-based prioritization (higher-fee transactions first).

- Network congestion (slows things down a bit).

PoW vs PoS: Why Confirmation Times Vary

How KAST Solves This Problem

Blockchains are great at securing value, but they weren’t designed for instant spending.

No one wants to wait for block confirmations at checkout.

That’s the settlement gap. The network needs time to finalize transactions, but users want to spend now.

KAST separates the user experience from the underlying settlement process.

While the blockchain does its validation in the background, KAST lets you move and spend value immediately.

Our system is built around one principle: Transfer money instantly. No bank fees. No waiting.

Stablecoins as the Instant Layer

KAST bridges the settlement gap using stablecoins as the medium of exchange.

When you deposit crypto, you can swap volatile assets directly into USDC or USDT. These stablecoins are optimized for fast, low-cost transfers across blockchains.

Once converted, your balance is spendable immediately.

No bank withdrawals. No intermediaries. No waiting.

This is crypto to payment, straight-up.

Networks, Fees, and Speed

KAST supports multiple blockchains so you can pick the balance between speed and cost when sending or receiving crypto.

For stablecoins, supported networks are Solana, Arbitrum, Tron, and Ethereum.

USDC Transfers

USDT Transfers

When receiving stablecoins, many additional networks are supported, each with different cost and congestion profiles.

Low-fee networks such as Solana, Tron, Polygon, Binance Smart Chain, and Stellar usually confirm in seconds and cost only a few cents.

Moderate-fee networks like Avalanche, Arbitrum, Optimism, and Base typically settle in under a minute with fees below a dollar.

High-fee networks such as Ethereum can cost several dollars and take longer during busy periods.

The Tap and Go Experience

All of this complexity disappears.

With KAST, you don’t need to think about block times, confirmations, or mempools.

Send money using a KAST Tag, email address, or phone number, no blockchain addresses needed.

Transfers between KAST users are instant and free. The recipient sees the balance update immediately.

The Bottom Line

Blockchains provide security and finality.

KAST provides speed and usability.

By understanding confirmations, you can appreciate why settlement takes time, while still enjoying payments that feel instant.

Stop checking confirmations.

Start spending.

Ready to bridge the gap between crypto and everyday spending?

Start using your crypto with KAST Card today.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

What Are Gas Fees and Why Are They So Cheap on Solana?

Gas fees are the cost of processing transactions on a blockchain. Some networks charge dollars or more per transaction, while others charge fractions of a cent. The difference comes down to how each blockchain is designed, and why Solana makes everyday crypto spending fast and cheap.

Gas Limits: A Beginner's Guide on Optimizing Your Transaction Fees

Gas limits and gas prices decide whether a crypto transaction succeeds, fails, or gets stuck waiting. This guide breaks down what those numbers actually mean, how fees are calculated, and how to avoid paying for transactions that don’t go through.

Why Settlement Time Matters for Your Card Balance

Ever notice your card balance update hours or days after you’ve already paid? That delay is settlement time. This guide explains how card transactions really work, why balances don’t change instantly, and how on-chain settlement with KAST helps your balance update faster and more transparently.