Can a Stablecoin Lose Its Value? Real Risks Explained

Stablecoins are designed to hold a $1 value, but history shows they can lose their peg. This guide explains how stablecoins work, why depegs happen, which designs are riskier, and how KAST decides which stablecoins to support.

Key Takeaways

- Stablecoins are supposed to stay at a fixed value, but they can drop above or below that target.

- Algorithmic stablecoins are riskier because they depend on market mechanics instead of actual reserves.

- Reserve-backed stablecoins like USDC and USDT are usually more stable because they have transparent backing and regular checks.

If you hold stablecoins or use them for payments, you've probably heard this: one stablecoin equals one dollar, always.

So… is that actually true?

Short answer: no. Stablecoins try to stay stable, but they can depeg, trading below their target price. Knowing why this happens, and which ones are riskier, helps you decide where your money belongs.

This guide will explain how stablecoins work, what causes them to lose their value, and why some are much safer than others and how KAST decides what stablecoins to support.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to hold a steady value relative to another asset, usually the US dollar.

Unlike Bitcoin or Ethereum, which can swing 10% or more in a single day, stablecoins try to stay at $1.00. That’s why you use them for payments, savings, and moving money globally without surprises.

Stable is the goal. The work is getting there.

Three main types of stablecoins:

Most stablecoins people use every day are fiat-collateralized. They're backed by real dollars or short-term US Treasury bills.

How Stablecoins Depeg?

A stablecoin loses its peg when it trades meaningfully above or below its target price.

For dollar-pegged coins, that means moving away from $1.00. Sometimes it's a little. Sometimes it's a lot.

Here's what usually causes it:

- Market Panic: Confidence drops, everyone rushes to sell, and the price falls

- Liquidity Problems: Too many people try to cash out at once and the issuer can’t keep up

- Reserve Concerns: People question whether the reserves really exist

- Structural Problems: The design breaks under stress. Algorithmic coins usually run into this

Many times, when a stablecoin loses its peg, it recovers quickly. USDC and USDT have both dipped during stressful moments and bounced back within hours or days.

But some don’t.

The Terra USD Collapse: A Stablecoin Depeg Example

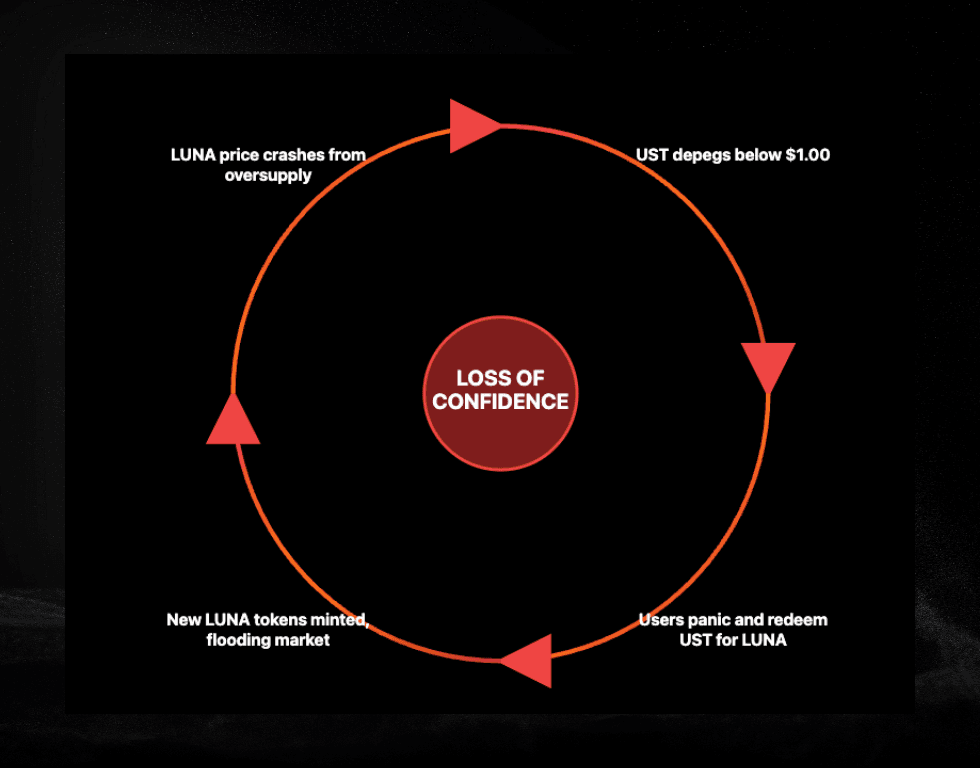

In May 2022, Terra USD (UST) fell from $1.00 to almost zero in less than a week. Over $40 billion vanished.

UST was algorithmic. There were no dollars in a bank. Its value depended on trading back and forth with another token called LUNA.

Here's how it was supposed to work:

- If UST goes above $1.00, you burn LUNA and create new UST

- If UST goes below $1.00, you burn UST and create new LUNA

In theory, these incentives keep everything balanced.

In reality, they didn’t.

Here's what actually happened:

As UST slipped below $1, withdrawals from a platform called Anchor caused people to panic.

As holders swapped UST for LUNA, the protocol minted large amounts of new LUNA, which flooded the market and drove LUNA’s price down.

As LUNA fell, the system unraveled fast:

- UST dropped

- More LUNA was created

- LUNA dropped faster

- Confidence disappeared

Within days, UST traded near $0.10. LUNA became worthless.

What you should take away from this:

Algorithmic stablecoins can work when markets are calm. But when confidence breaks, their design can actually speed up the collapse.

Clever code is nice. Real reserves are better.

Is USDe an Algorithmic Stablecoin?

USDe (Ethena) often gets grouped with algorithmic stablecoins, but it works differently from Terra-style failures.

How USDe keeps its value:

It's backed by:

- ETH and BTC collateral

- Delta-neutral hedging using perpetual futures

- Yield from staking and funding rates

USDe doesn't create or destroy a companion token to defend its value. It uses crypto assets plus hedging strategies instead.

USDe compared to Terra USD:

USDe has real backing, which matters. If things go wrong, there are assets that can be unwound. Terra didn't have that.

Still, USDe has risks: derivatives, smart contracts, and funding rates. It's built for users who understand those trade-offs.

Why USDC and USDT Are Different

USDC and USDT are backed by real assets, not algorithms or trading incentives.

Each token is meant to be redeemable 1:1 for US dollars or highly liquid dollar-equivalent assets like short-term US Treasury bills. This redemption promise is what keeps them stable.

That means when you hold USDC or USDT, there's supposed to be real money or near-cash assets backing every token in circulation.

USDC: Regulated and Transparent

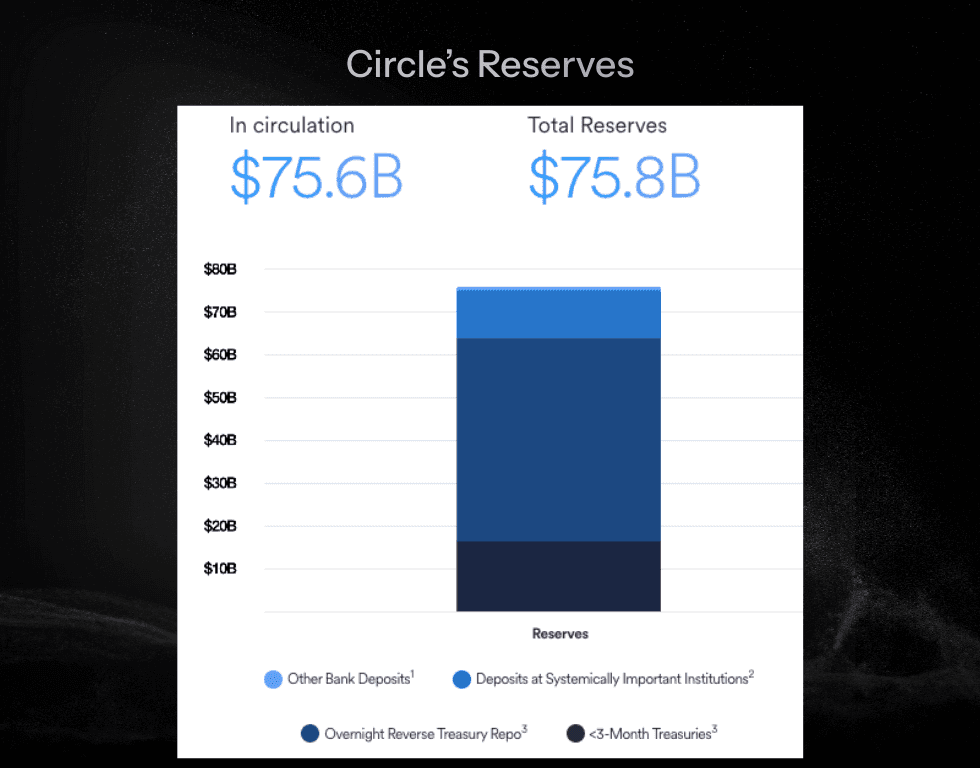

USDC is issued by Circle, a US-based, regulated financial company. Circle publishes monthly reserve reports that show exactly what assets back USDC, where they're held, and how often they're reviewed.

According to Circle's transparency reports, USDC reserves are designed to be conservative and easy to access.

USDC reserves include:

- Cash held at regulated financial institutions

- Short-term US Treasury bills

These assets are chosen because they can be accessed quickly, even when markets are stressed. Independent accounting firms review and verify these reserves every month, giving you regular visibility into what's backing USDC.

In March 2023, USDC briefly fell to $0.88 during the Silicon Valley Bank crisis. A portion of Circle's cash reserves got temporarily stuck.

Once U.S. authorities guaranteed those deposits, USDC recovered within days. It was a real-world stress test. The redemption system worked.

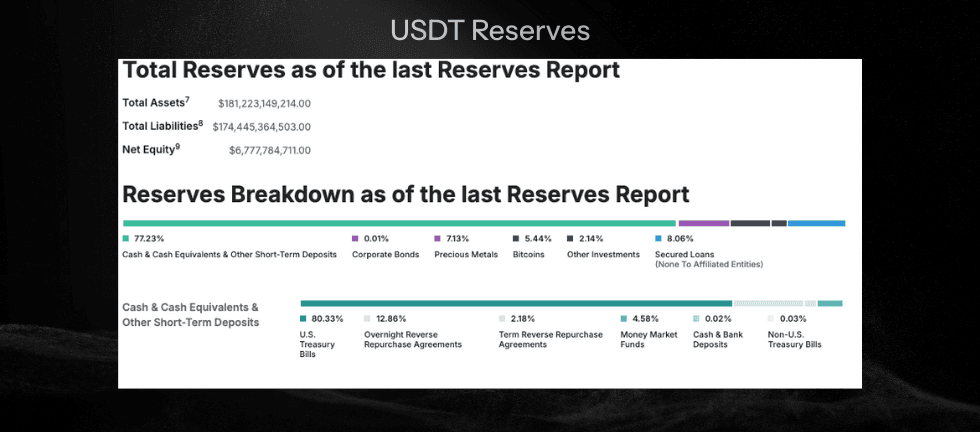

USDT: Liquid and Battle-Tested

USDT, issued by Tether, is the largest stablecoin out there, with over $186 billion in circulation. It's also one of the most actively used assets in crypto trading, payments, and liquidity markets.

Tether publishes quarterly reserve reports that show what assets back USDT. While they report less frequently than USDC, the reports show a strong focus on liquidity.

USDT reserves include:

- US Treasury bills

- Cash and cash equivalents

- Other short-term liquid assets, including small amounts of gold and Bitcoin

Over time, Tether has reduced riskier holdings and increased exposure to US Treasuries, making its reserves more conservative than in earlier years.

Despite repeated market crashes, regulatory pressure, and massive redemptions, USDT has consistently kept its value with only brief, small deviations. Its ability to process huge redemptions during panic has made it one of the most battle-tested stablecoins in the market.

That history matters when you’re choosing what to trust.

How to Evaluate Stablecoin Risk

When choosing stablecoins, check for:

✓ Real reserves

✓ Frequent attestations

✓ Regulatory oversight

✓ A proven track record

✓ Strong liquidity

Reserve-backed stablecoins check most boxes. Algorithmic ones don’t.

How KAST Chooses Stablecoins

KAST is a card for spending stablecoins in the real-world, straight from your wallet.

KAST supports stablecoins that focus on safety and demonstrated stability.

Currently supported:

- USDC

- USDT

- USDe (for advanced users)

- PYUSD

- RLUSD

Algorithmic stablecoins without verifiable reserves aren’t supported.

Your stablecoins stay in your wallet. You keep control, and you decide how to spend or move them.

The Bottom Line

Not all stablecoins actually stay stable.

Algorithmic designs can fall apart fast when people lose confidence. Terra showed just how bad that can get.

Reserve-backed stablecoins like USDC and USDT are backed by real assets and have survived real stress.

What that gives you:

✓ Assets backing every token

✓ Independent verification

✓ Survival through market chaos

✓ Reliable redemption

Stablecoins only matter if they work when you need them. KAST just makes using them easier.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

What Stablecoins And Networks Are Supported By KAST?

Did you know KAST supports stablecoins like USDC, USDT, PYUSD, RLUSD and networks like Solana, Ethereum, Polygon, Tron, BSC, and more? Learn how to choose the right network based on transaction fees, speed, and compatibility.

How Stablecoins Earn Yield: The Real Sources Behind Your Returns

Stablecoin yield comes from real onchain demand, borrowing, trading, and capital deployment, not inflation or promos. When demand rises, yields rise. When it falls, so does yield.

What Is RWA Backing? Tutorial on How Treasury Bills Secure Your Yield

Real-World Assets (RWAs) bring familiar assets like U.S. Treasury bills and bonds onchain. RWAs let you earn yield backed by traditional financial instruments. This guide explains how RWA backing works, why it exists in crypto, and how KAST Earn uses it to help you generate steady yield.