How Stablecoins Earn Yield: The Real Sources Behind Your Returns

Stablecoin yield comes from real onchain demand, borrowing, trading, and capital deployment, not inflation or promos. When demand rises, yields rise. When it falls, so does yield.

Key Takeaways

- Sustainable stablecoin yield is driven by real economic activity, such as lending, trading fees, and interest from tokenized Treasury bills.

- Rates move with market demand, so yields rise when stablecoins are in demand and fall when capital sits idle.

- Understanding where yield comes from helps you judge risk and choose options that fit how you want your money to work.

Stablecoins are designed to hold their value. One USDC today is intended to be worth one dollar tomorrow, next week, and next year.

So when you see offers like “Earn 5% APY on your USDC”, a reasonable question follows:

Where does that yield come from?

Stablecoin yield is the return you earn when your USDC or other stablecoins are used in onchain lending, trading, or real-world asset strategies.

In this guide, we explain where stablecoin yield comes from. At the end, we’ll show how KAST Earn gives you access to this yield without managing Decentralized Finance (DeFi) yourself.

How Stablecoin Yield Works

Stablecoin yield comes from a mix of on-chain borrowing demand and the interest earned on the real-world assets (like Treasuries) backing the coins.

Also, various incentives are temporary subsidies used to bootstrap new protocols or attract liquidity.

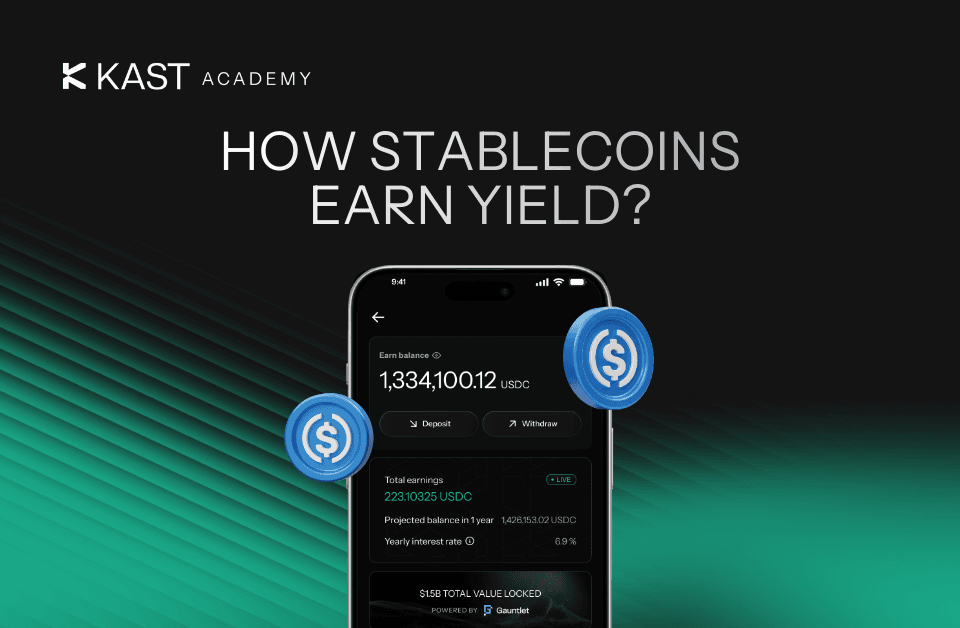

People and protocols need stablecoins for real economic activity:

- Borrowing

- Trading

- Providing liquidity

- Deploying capital into tokenized traditional assets

When demand for stablecoins is high, borrowers and traders are willing to pay more to access them. When demand is low, rates fall.

There are no fixed returns. Yields move because this is a real market.

When you supply stablecoins, you’re making this activity possible. In return, you earn a share of the value being generated.

This is not staking. You’re not securing a network.

You’re supplying capital and getting paid because others need it.

Your dollars are working.

Where Stablecoin Yield Comes From

There are many strategies in DeFi, but most stablecoin yield comes from three places.

1. Lending Protocols

The most common source of stablecoin yield is onchain lending.

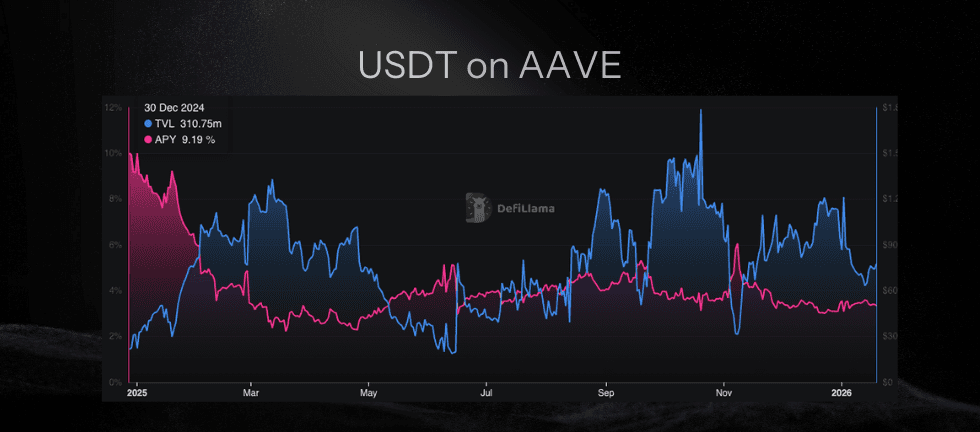

You deposit stablecoins into a shared pool on platforms like Aave, Compound, or Morpho. Borrowers come along, put up collateral, take out loans, and pay interest.

You earn a portion of that interest.

How much you earn depends on borrowing demand:

- High demand = You earn more

- Low demand = You earn less

If a lot of money flows into a protocol but borrowing doesn’t increase, some capital sits idle. When that happens, yields fall.

The beautiful part? Everything is transparent. You can check pool balances, see how much is being borrowed, and watch rates update, all onchain.

2. Liquidity Provision

Decentralized exchanges need liquidity to work. Without it, nobody can trade.

When you add stablecoins to liquidity pools, you're enabling people to swap assets without relying on a centralized order book. Every time someone makes a trade, they pay a small fee. You get a cut.

Stablecoin-to-stablecoin pools are popular because:

- Prices stay relatively stable

- Impermanent loss is minimal if both assets maintain their peg to the dollar.

- Returns are smaller but more predictable

Liquidity provision isn’t completely passive. Positions need monitoring, and returns depend on trading volume.

3. Real-World Assets (RWAs)

Some protocols earn yield by deploying stablecoins into tokenized traditional assets like U.S. Treasury bills.

This is known as stablecoin yield from RWAs, where onchain dollars earn returns backed by traditional financial instruments.

Because of this, RWA yields tend to be more predictable than purely crypto-native strategies.

Today, large issuers like BlackRock and Franklin Templeton offer onchain funds with RWA yields.

Total RWA value onchain has grown quickly and exceeds $22 billion as of January 2026.

Advanced Stablecoin Strategies

Beyond lending, trading fees, and RWAs, there are more advanced ways stablecoins can generate yield. These strategies are more complex and require active management.

Arbitrage and market making strategies capture small price differences across markets, such as platform price gaps or funding rate mismatches. These opportunities are short-lived and rely on automation and constant risk monitoring, so most people access them through managed vaults rather than running them directly.

Yield-bearing stablecoins build yield directly into the token. The issuer manages the strategy behind the scenes, combining your principal and returns into one asset.

Examples include Ethena’s sUSDe, Level’s slvlUSD, Falcon Finance’s sUSDf, and Resolv’s stUSR. These can offer higher yields than basic lending, but they’re harder to evaluate and less predictable.

These strategies sit at the advanced end of DeFi. They provide useful context, but they’re not designed to be simple savings options.

Stablecoin Yield Risks

Not all yield is created equal.

When you see high APYs, there's usually a reason. Higher risk, more leverage, or temporary incentives.

If a protocol is paying you mostly in their own token, watch out. Those yields tend to crash once the incentive program ends.

Sustainable yield comes from real, observable activity:

- Borrowers paying interest

- Traders paying fees

- Protocols earning consistent revenue

- Tokenized treasuries

If you can't figure out where the yield is coming from, be cautious.

For more information on risks associated with stablecoins, read: "Can a Stablecoin Lose its Value? Real Risks Explained"

How KAST Earn Generates Stablecoin Yield

KAST lets you hold, move, spend, and earn on your USD from one app.

When you deposit USD into the KAST app, your funds are deployed into the Gauntlet USD Alpha vault.

Gauntlet is a leading risk manager in DeFi. They manage capital across established lending protocols and adjust positions as market conditions change, with a focus on capital preservation and risk-adjusted returns.

Here’s what happens:

- You deposit USD in the app

- Your funds are converted into vault shares

- Those shares represent your portion of the vault

- Yield accrues automatically over time

- You can deposit or withdraw whenever you want

Your funds remain custodial. There are no lockups and no manual rebalancing required.

What You Get With KAST Earn

KAST Earn is built around a few core principles:

Here's the Bottom Line

Stablecoin yield isn't magic. It comes from real things: borrowers paying interest, traders paying fees, protocols earning revenue.

The problem is that accessing it directly takes time, expertise, and capital most people don't have.

KAST Earn fixes that. Professional management. Institutional-grade strategies. Transparent execution. All in one app. No DeFi degree required.

What you get:

✓ You control deposits and withdrawals

✓ You can move money in or out anytime

✓ You earn yield without managing DeFi positions yourself

Your USD earns instead of sitting there.

Open the KAST app and start earning today.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

What Stablecoins And Networks Are Supported By KAST?

Did you know KAST supports stablecoins like USDC, USDT, PYUSD, RLUSD and networks like Solana, Ethereum, Polygon, Tron, BSC, and more? Learn how to choose the right network based on transaction fees, speed, and compatibility.

How Stablecoins Earn Yield: The Real Sources Behind Your Returns

Stablecoin yield comes from real onchain demand, borrowing, trading, and capital deployment, not inflation or promos. When demand rises, yields rise. When it falls, so does yield.

Can a Stablecoin Lose Its Value? Real Risks Explained

Stablecoins are designed to hold a $1 value, but history shows they can lose their peg. This guide explains how stablecoins work, why depegs happen, which designs are riskier, and how KAST decides which stablecoins to support.