What Is RWA Backing? Tutorial on How Treasury Bills Secure Your Yield

Real-World Assets (RWAs) bring familiar assets like U.S. Treasury bills and bonds onchain. RWAs let you earn yield backed by traditional financial instruments. This guide explains how RWA backing works, why it exists in crypto, and how KAST Earn uses it to help you generate steady yield.

Key Takeaways

- Real-World Assets are things like Treasury bills, bonds, and real estate that now exist onchain through tokenization.

- Treasury-backed RWAs generate yield from government interest, not trading volume or leverage.

- With KAST Earn, your USD is allocated across DeFi and RWA-backed strategies when they make sense.

You’ve probably heard people talk about Real-World Assets in crypto.

It sounds impressive.

It also sounds like something everyone else already understands.

That reaction makes sense. The term gets thrown around a lot, usually without much explanation.

So let’s slow it down and clear it up.

Real-World Assets, or RWAs, are regular assets you already know, like Treasury bills, real estate, or bonds, that you can now access onchain. Same assets, same value, just easier to reach.

This guide walks you through what they are, why they exist in crypto at all, and how you can actually benefit from them using KAST Earn.

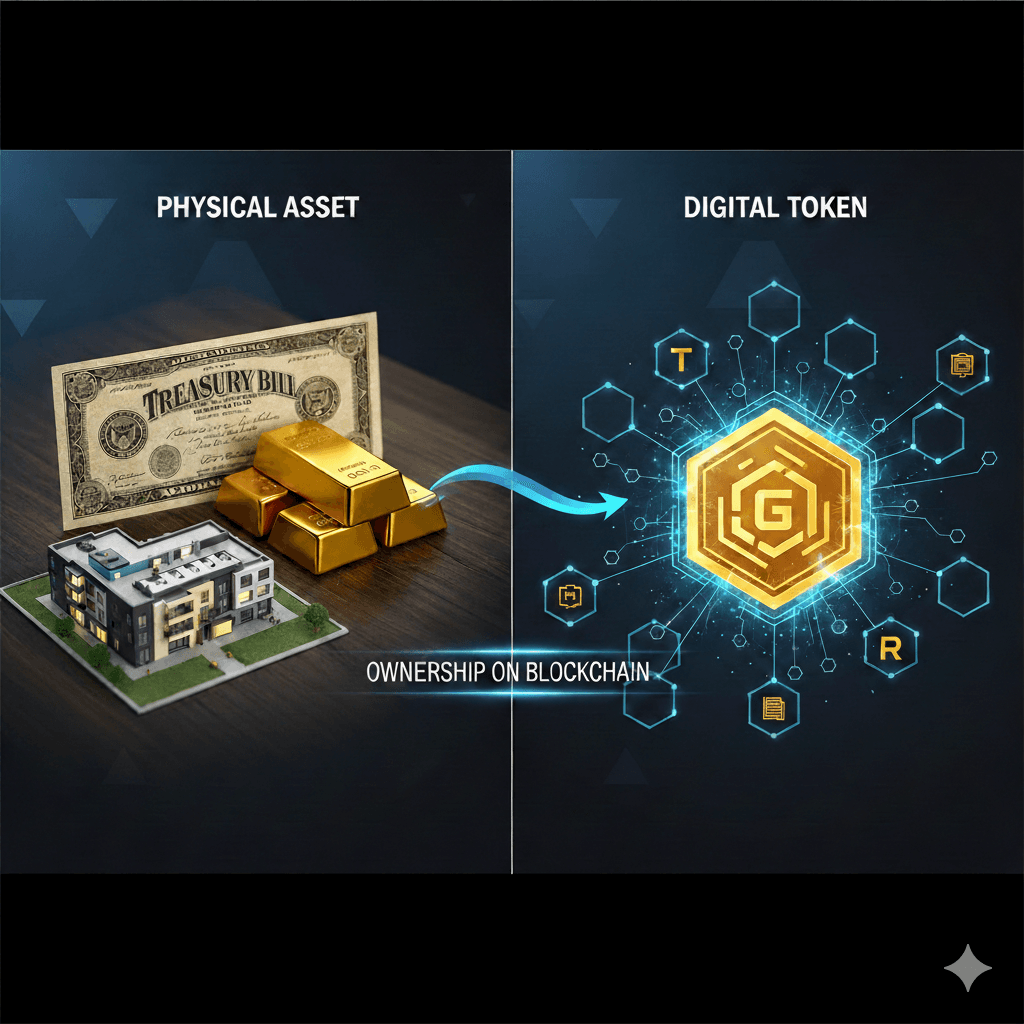

What Are Real-World Assets?

Traditional assets existed a long time before crypto.

Real-World Assets are physical or traditional financial assets that live outside the blockchain. Think things that generate value in familiar ways, not experimental ones.

That includes real estate, commodities like gold or oil, government bonds such as U.S. Treasuries, corporate debt, art, collectibles, and even invoices or receivables.

These assets earn money through rent, interest, appreciation, or cash flows. They’ve been doing this for decades.

You’re not missing anything here.

What is new is how you can access them.

Today, ownership of these assets can be represented onchain, which makes them easier to move, split, and use inside crypto systems.

What Is Tokenization

Tokenization sounds technical, but the idea is simple.

It’s the process of turning ownership rights of a real-world asset into a digital token on a blockchain.

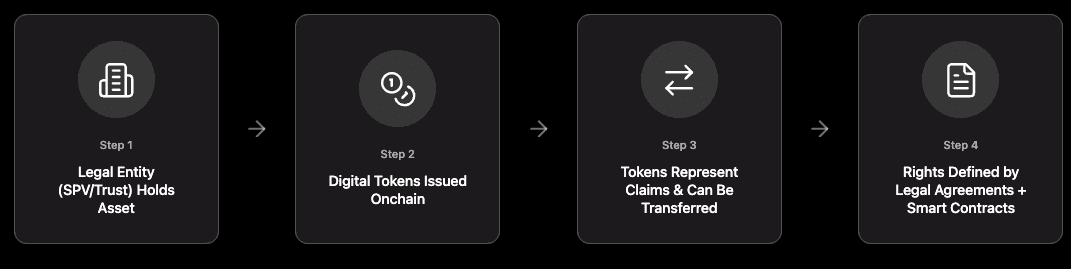

Here’s the usual flow:

First, a legal entity, often a Special Purpose Vehicle (SPV) or trust, holds the asset. Then, digital tokens are issued onchain.

Each token represents a claim on part of that asset. Those tokens can be transferred or traded without touching the underlying asset itself. Your rights to value or cash flows are defined by legal agreements and enforced alongside smart contracts.

The asset stays where it is.

The token gives you flexibility.

Why Tokenize Real-World Assets at All?

Because traditional finance does not always work smoothly.

Many assets require large minimum investments. Tokenization lets you own a portion instead of the whole thing. Selling assets like real estate or private credit can take months.

Tokenized versions can move much faster. Ownership and transfers are recorded onchain, so you can verify them yourself. Fewer intermediaries usually means fewer fees. And access isn’t tied to a specific country or bank.

Tokenization doesn’t change what the asset is.

It changes how easily you can use it.

How RWAs Show Up in Crypto

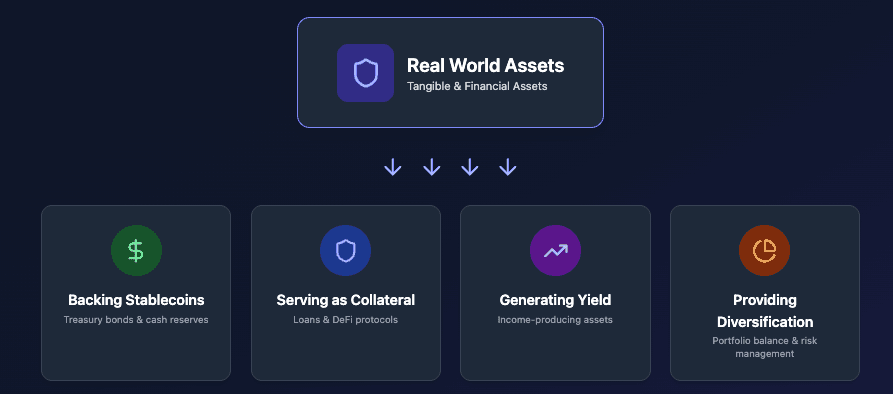

Once RWAs enter crypto, they usually show up in a few familiar ways.

Yield generation

This is how most people interact with RWAs today.

Protocols tokenize income-producing assets like U.S. Treasury bills or bonds. You hold the token, and the yield flows to you. Projects like Ondo, BlackRock’s BUIDL, and Franklin Templeton’s FOBXX work this way.

As of January 2026, there are over $10 billion in tokenized U.S. Treasuries and more than $5 billion in commodities.

Simple idea: real-world interest, delivered onchain.

Stablecoin backing

RWAs also support stablecoins behind the scenes.

Stablecoins like USDC and USDT hold U.S. Treasury bills alongside cash and other assets, and publish reports showing what backs each token. Treasuries are liquid, predictable, and earn interest.

You don’t receive that yield directly, but it helps keep stablecoins sustainable without quietly charging you for it.

Collateral for lending

RWAs are also used as collateral.

Most crypto lending relies on volatile assets, which creates liquidation risk. RWAs offer a steadier option. Protocols like MakerDAO allow loans backed by bank loans, real estate, or other real-world assets.

The terms are clearer. Price swings are smaller.

Diversification

Finally, RWAs add diversification.

Crypto markets move fast. RWAs don’t. If you want returns that aren’t tied to trading volume or borrowing demand, RWAs give you another option.

Steady has its place.

What Can Go Wrong

RWAs reduce some crypto risks, but they introduce others.

Legal structures matter, and regulations can change. You rely on custodians, fund managers, and service providers.

Redemptions can slow down during periods of stress. Smart contracts can fail. And if transparency is missing, you’re trusting without verification.

RWAs shift risk. They don’t erase it.

That’s why disclosures and reporting matter.

How RWA-Backed Yield Works

Behind the scenes, the process is straightforward: you deposit stablecoins, which are converted to dollars and used to buy Treasuries or similar assets.

As interest accrues, the yield is paid out to you, and you can redeem whenever you want. No tricks, just traditional finance, delivered through blockchain infrastructure.

RWA Yield vs. DeFi Yield

RWAs aren’t trying to outdo Decentralized Finance (DeFi).

Treasury-backed RWAs generate government interest and come with lower risk. DeFi lending earns from crypto borrowers and adds smart contract and liquidation risk.

Liquidity pools earn trading fees but introduce impermanent loss. Leverage strategies push yields higher, along with risk.

RWA yield is usually lower, but steadier. Different tools for different goals.

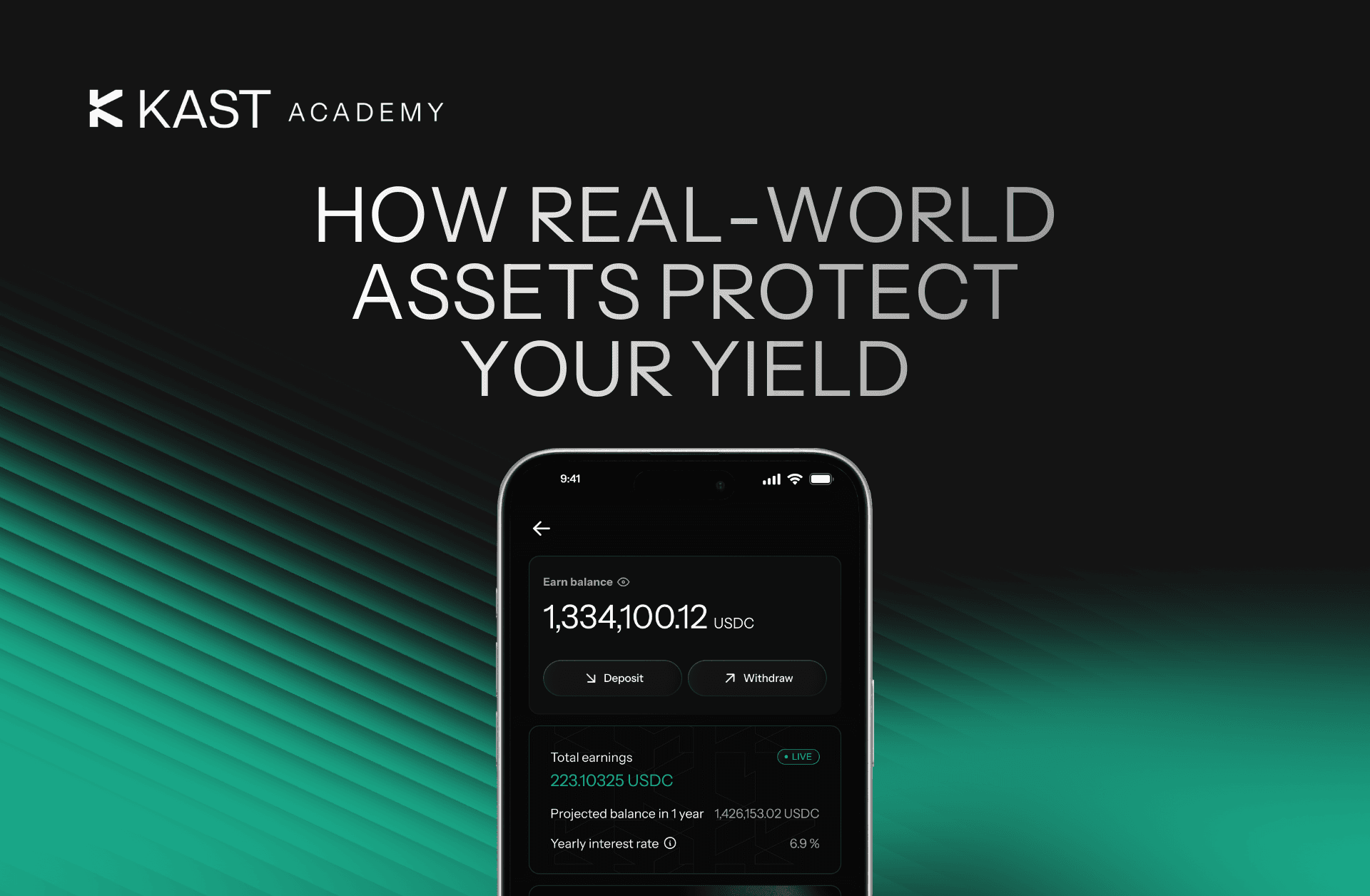

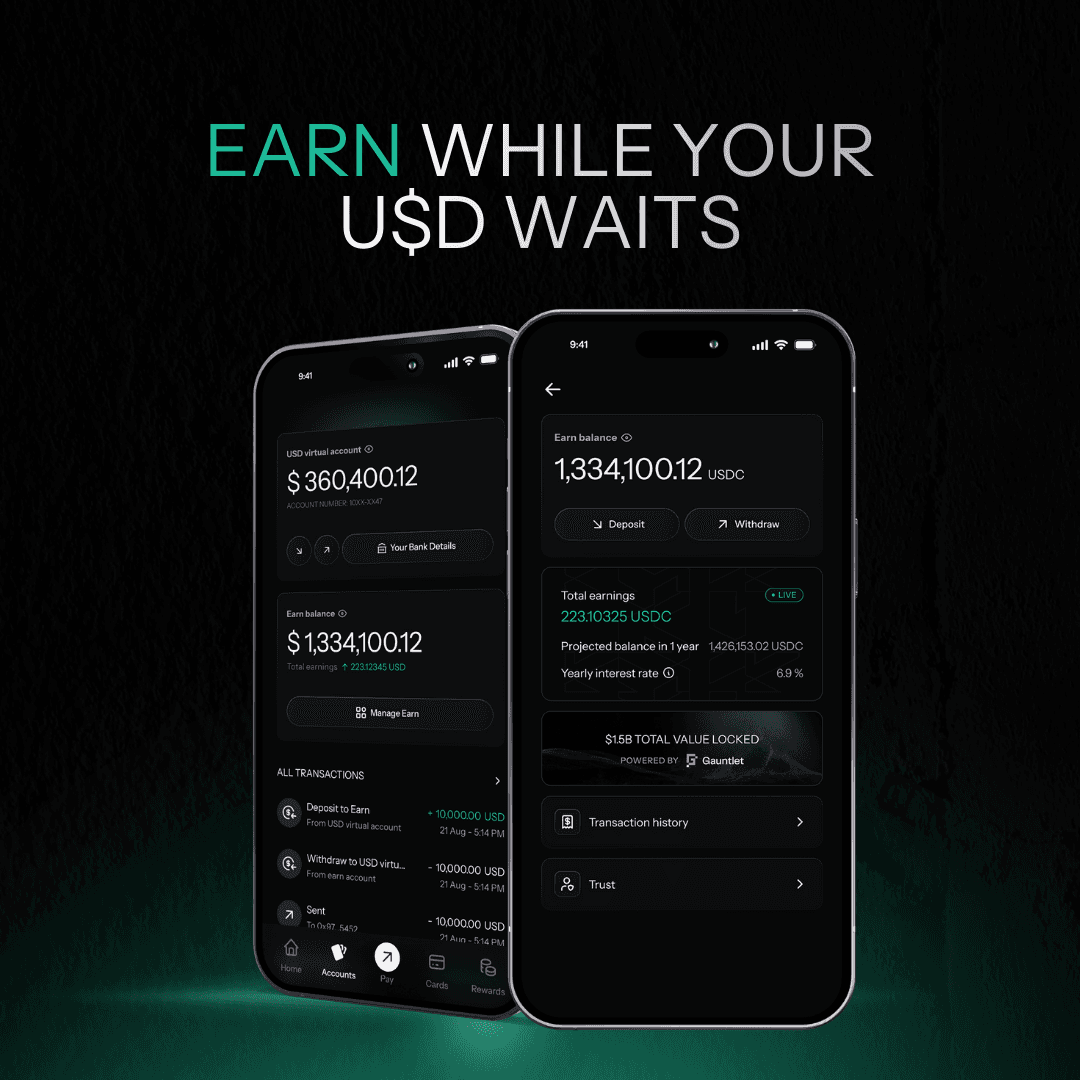

How This Shows Up in KAST Earn

All of this theory matters only if it works in real life.

With KAST Earn, you don’t need to track protocols or rebalance positions.

Your USD goes into the Gauntlet USD Alpha vault, where allocations are managed across DeFi lending, RWA-backed strategies, and other institutional-grade yield sources.

For most people, RWAs aren’t about chasing higher yields.

They’re about putting idle USD to work in a way that feels familiar.

Instead of your dollars sitting still, part of your balance can earn yield from assets like U.S. Treasuries, assets governments, banks, and institutions have relied on for decades.

You don’t pick strategies, or monitor markets. You just earn.

There are no lockups, no fees, auto-sweep for idle USD, and you can deposit or withdraw anytime.

Why This Actually Matters

Real-World Assets bring familiar, income-generating assets onchain.

They give you access to government securities, bonds, and more, without leaving crypto or managing every moving part yourself.

They aren’t risk-free. But they’re predictable, transparent, and grounded in systems that have worked for decades.

You shouldn’t have to manage all of this just to earn on your USD.

Now you don’t.

If you want to keep going, open the KAST app and start earning.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.