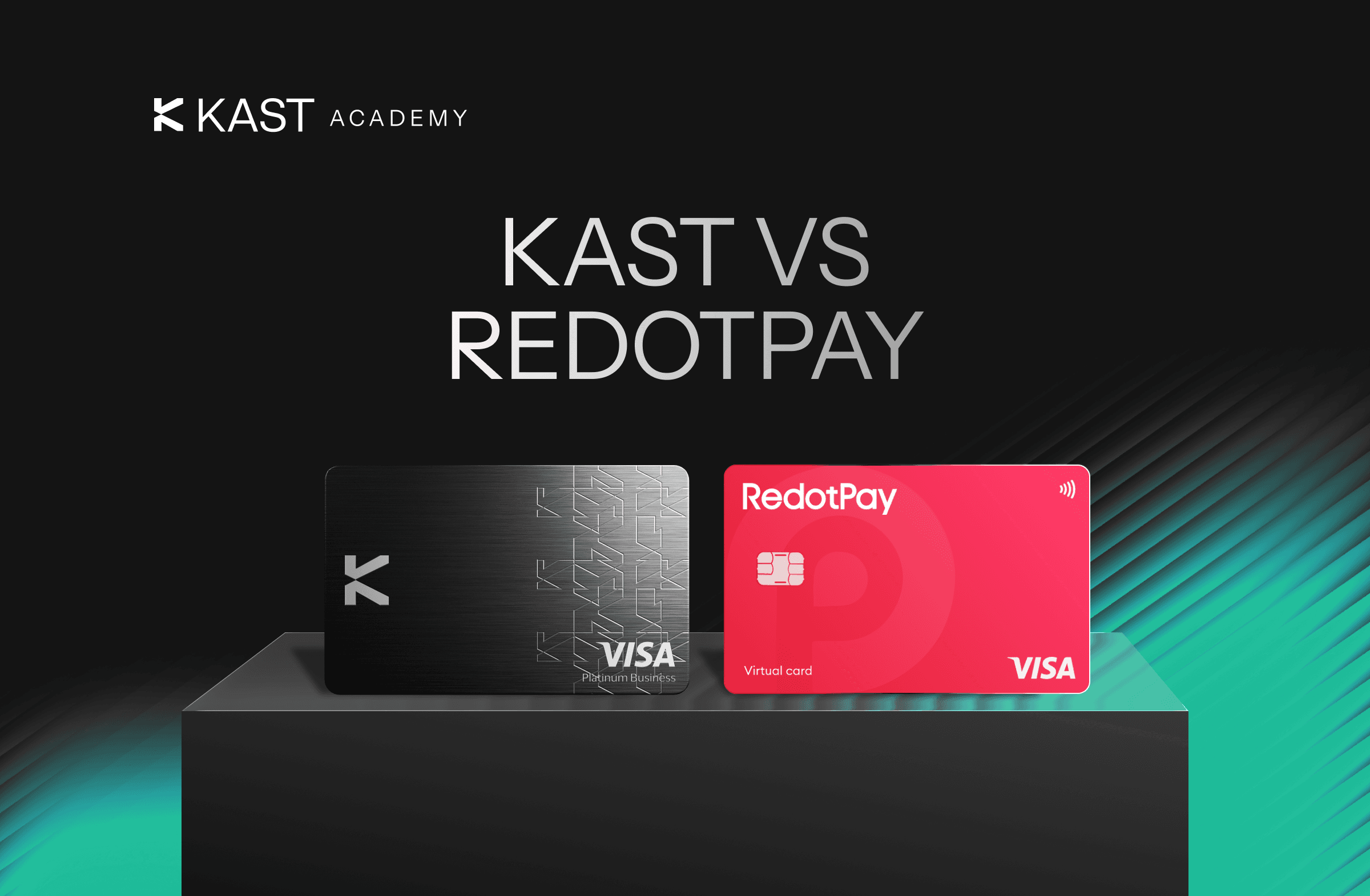

KAST vs RedotPay: Which Crypto Card Is Better for Everyday Spending?

A clear comparison of KAST vs RedotPay. See fees, cashback, limits, and real-world costs to choose the right crypto card for your spending.

Key Takeaways

- KAST is better suited for everyday spending thanks to higher cashback, free cards, and simpler, more predictable fees.

- RedotPay’s main strength is its high card and ATM limits, which matter most if you regularly move large amounts of cash.

- Choosing between KAST and RedotPay ultimately comes down to how you spend, withdraw, and manage your stablecoins day to day.

Trying to figure out which crypto card fits your spending habits?

This comparison looks at KAST vs RedotPay, two popular stablecoin debit cards, breaking down how each one actually works.

We’ll look at cashback, card costs, funding fees, withdrawals, FX charges, and limits to show where they are similar and where they differ.

Whether you’re looking to spend daily or just a way to off-ramp to your bank, here is how they compare in the real world.

KAST vs RedotPay

Both KAST and RedotPay offer stablecoin debit cards that let you spend crypto through a traditional card network. The key difference is how fees, rewards, and FX are structured.

What is KAST?

KAST is a stablecoin-based USD account that functions as a crypto debit card. You deposit stablecoins or fiat into your USD balance first, then spend directly from that balance.

Crypto-to-fiat conversion happens before you pay. No conversion at checkout.

You hold USD in your account, then spend it like a regular debit card.

KAST offers three tiers:

- Standard (plastic card, 2% KAST Points rewards + 4% MOVE rewards)

- Premium (metal card, 5% KAST Points rewards + 4% MOVE rewards)

- Luxe (limited metal card, 8% KAST Points rewards + 4% MOVE rewards)

Virtual card: free ($2 in select countries)

First physical card: free (not including shipping fee)

What is RedotPay?

RedotPay is also a stablecoin-based card, but it focuses more on high limits than tiered rewards.

There are no tiered cashback levels. Instead:

- Virtual card costs $10

- Physical card costs $100

- Replacements cost the same

While KAST focuses on predictable USD spending, RedotPay focuses on high limits with more fee variables.

Cashback and Rewards: KAST vs RedotPay

Cashback is one of the clearest differences between KAST and RedotPay, and you’ll notice it quickly once you start spending.

KAST rewards come from two separate reward types:

• KAST Points: You earn points on every eligible card purchase. The earn rate depends on your card tier and the current rewards season.

• MOVE Token Bonus: You also earn 4% back in MOVE tokens on qualifying spend, subject to a monthly cap of $80.

Together, these make up your total reward experience.

RedotPay’s cashback is capped and conditional. You earn 1.5% on the first three transactions per day, with a maximum of $10 in rewards.

Additionally, you can get a 3% cashback if you refer someone and they buy the Solana card. Cashback is promotion-based, which means it isn’t always available. If you spend regularly, you’ll hit the cap faster than expected.

Some KAST rewards scale with spending, while RedotPay rewards are capped and conditional.

KAST vs RedotPay Card Pricing

For KAST, the virtual card is free (some countries charge up to $2), and the first physical KAST card is also free (not including shipping). You can upgrade later, but you do not need to pay upfront just to start using the card.

For RedotPay, the virtual card costs $10, while the physical card costs $100 (including shipping). Replacement cards cost the same as the original, which makes getting started more expensive if you want a physical card right away.

Funding Fees for Each Crypto Debit Card

Stablecoin deposits are free on both KAST and RedotPay, but that is where the comparisons end.

With KAST, you can fund your account in three main ways. Supported stablecoins are converted 1:1 into your USD balance with no deposit fee.

You can also fund via USD bank transfer using your KAST virtual account. With KAST, ACH transfers cost $2 and Fedwire transfers cost $15. With RedotPay, both ACH and Fedwire cost $15.

KAST also offers Payment Link, which allows fiat funding via card. This option carries a 0.6% processing fee plus a 0.3% FX fee, with all fees shown upfront before confirmation. Payment Link availability depends on region and is primarily supported in the EU.

RedotPay also supports free stablecoin deposits. In addition, users can fund through third-party methods such as card or PayPal, depending on region. These funding routes typically carry percentage-based fees that vary by provider and promotion, meaning the cost increases with the amount you top up.

KAST keeps funding costs predictable, while RedotPay’s costs can increase depending on the funding method used.

Withdrawal & Off-Ramp Fees: KAST vs RedotPay

KAST and RedotPay differ in international payout costs, and how currency value is handled during cash-out.

With KAST, local bank payouts typically cost $0–3 plus a 1% FX fee, except Morocco, which has a 2% FX fee. Local transfers in USD cost $2 (ACH) or $15 (Fedwire) and have a 0.5% FX fee, which is waived until February 2026.

A global SWIFT payout costs $30 and has a 0.5% FX fee, also waived until February 2026. USDT withdrawals range from $1–6 plus a 0.1% fee, depending on the network. There is no minimum withdrawal requirement, and fees are clearly stated upfront.

With RedotPay, SWIFT payouts cost $45. Local bank transfers in USD cost a fixed $15. Withdrawing USDT has no visible fee, but includes a 1.2% markup, as $1 USDT is valued at $0.988 on withdrawal, effectively reducing the payout by 1.2%.

Local EUR payouts in Europe carry a 2.8% fixed fee.

Overall, KAST and RedotPay differ mainly in total withdrawal cost structure and transparency. KAST applies fixed, clearly stated fees with no high minimum, while RedotPay combines higher SWIFT costs, a minimum withdrawal threshold, and an embedded FX-style markup on certain withdrawals.

KAST vs RedotPay FX & Spending Fees

KAST and RedotPay differ in how their FX and transaction fees stack up in real-world spending.

With KAST, USD card transactions carry a 0% fee. When you spend in a non-USD currency, a 0.5–1.75% FX fee applies depending on the currency and network. There are no merchant-specific surcharges layered on top, so the fee structure stays consistent across transactions.

With RedotPay, spending in your default currency has no fee. Non-default currency spending includes a 1.2% FX fee. Certain transactions may also carry a 1% fee, and some merchants can apply an additional 1.5% surcharge, with only three waivers per month.

KAST and RedotPay both offer zero fees in their base currency, but they differ in structure. KAST applies a variable 0.5–1.75% FX fee with no added merchant surcharges, while RedotPay combines a 1.2% FX fee with potential extra transaction and merchant fees that can increase the total cost.

How ATM Limits Differ Between KAST and RedotPay

KAST and RedotPay take different approaches to ATM withdrawals.

With KAST, each withdrawal costs $3 plus 2% of the amount. Non-USD withdrawals include an FX fee. Withdrawals are capped at $250 per transaction, with a maximum of three per 24 hours, creating a daily limit of $750. Card spending, balances, and deposits remain unlimited.

With RedotPay, ATM withdrawals cost 2%, plus 1.2% FX for foreign currency. After $10,000 in monthly withdrawals, the fee increases to 3%. Limits are much higher, with $3,750 per day and $50,000 per month. Card transaction limits are listed at $100,000 per transaction and $1,000,000 daily.

KAST keeps ATM access simple but capped, while RedotPay offers much higher limits with volume-based fee increases.

KAST vs RedotPay: Who Wins?

In this KAST vs RedotPay crypto debit card comparison, KAST may feel simpler to use if you prefer fewer caps and a more straightforward fee structure.

KAST performs strongly in day-to-day categories like rewards, upfront card cost, fee clarity, and cash-out structure. If you want a card you can use without constantly tracking rules, caps, and fine print, KAST may feel easier to manage.

RedotPay’s main advantage is ATM limits. If you regularly withdraw large amounts of cash, those higher caps can matter. Outside that specific use case, KAST is the more predictable and easier card to live with.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

KAST Card vs Binance Card: Full Comparison for Crypto Spending

Wondering which crypto card actually fits how you spend? This KAST vs Binance Card comparison cuts through the hype to show how each card really works in day-to-day life. We break down fees, funding, rewards, and checkout experience so you can see what matters.

How Does a Crypto Card Work Behind the Scenes?

Ever tapped your card and thought, “Wait, did I just spend Bitcoin?” That’s the magic of a crypto card - simple on the surface, but powered by incredible tech underneath. Let’s unpack how it all works, and how your KAST Card makes it real, simple, and powerful for you.

Where Can I Use a Crypto Card: Online, In-Store, or at ATMs?

Crypto cards work everywhere traditional cards do: in-store, online, and at ATMs. Learn how to spend your Bitcoin and stablecoins seamlessly at any retailer accepting Visa or Mastercard, with instant crypto-to-fiat conversion happening behind the scenes.