USD vs AED: Which One Should You Pick on the Terminal in the UAE?

When a card terminal in the UAE asks whether to pay in USD or AED, that choice decides who sets your exchange rate. In most cases, choosing AED is cheaper. Here’s why.

Key Takeaways

- When paying in the UAE, choosing AED lets your card issuer handle FX, which is usually cheaper than accepting USD via Dynamic Currency Conversion.

- DCC looks convenient but typically adds a larger hidden markup than standard issuer exchange rates.

- The AED–USD peg is stable, but who converts your money determines how much extra you actually pay.

You tap your card in Dubai.

The screen asks:

“Pay in AED or pay in USD?”

If you’re using an international card like your KAST card, that one decision determines who sets your exchange rate and how much extra spread you pay.

Here is the short answer first:

In the UAE, for almost all normal card payments, choosing AED on the terminal is usually cheaper than choosing USD.

Now let’s walk through why.

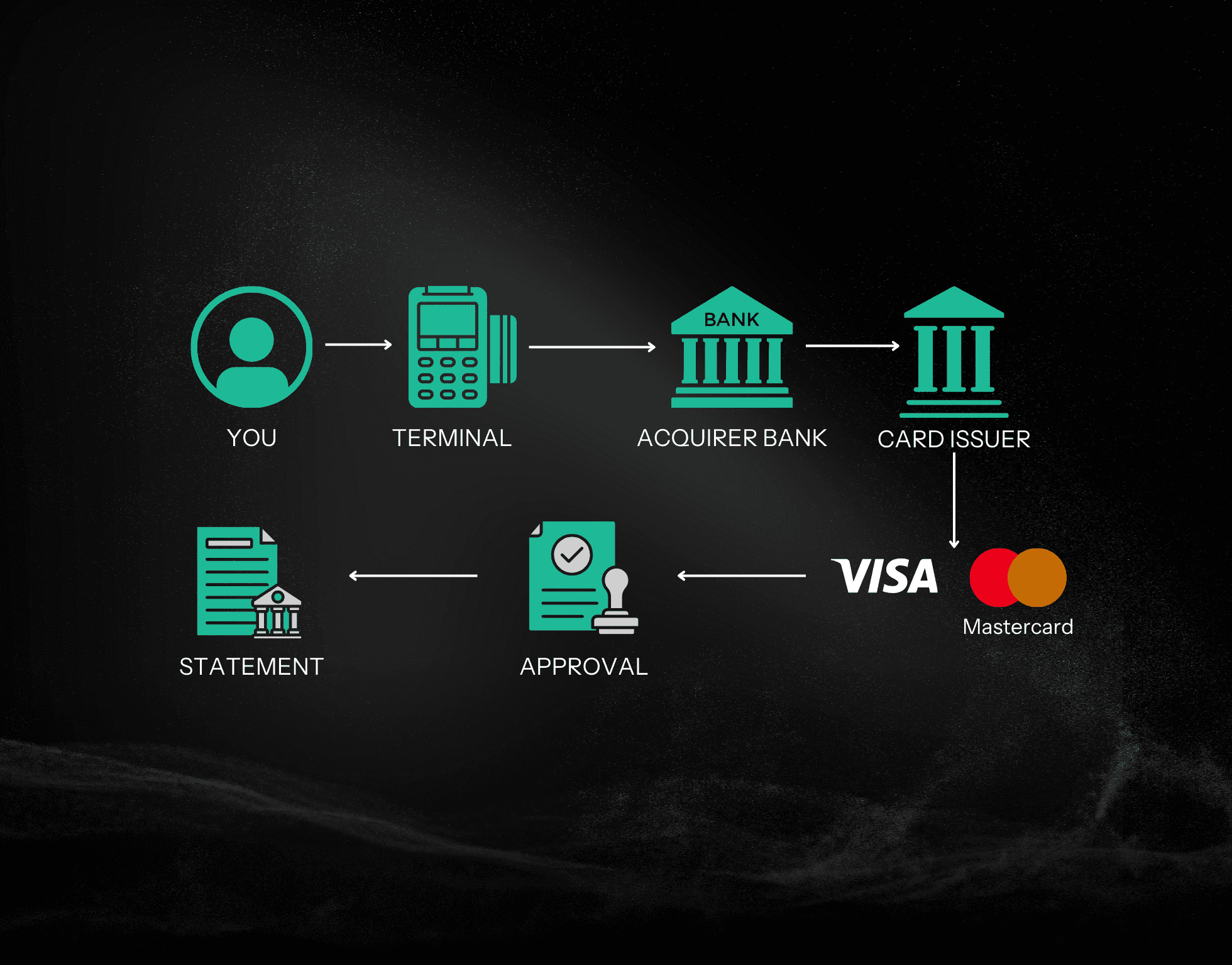

What Actually Happens When You Tap Your Card

When you tap your card, the payment makes a small trip:

- The store’s payment terminal sends the charge in a currency (like AED or USD) to the acquirer, which is the bank that processes payments for the merchant.

- The acquirer passes it through Visa or Mastercard.

- Your issuer (the bank or fintech behind your card) approves the payment and then charges you in your card’s billing currency, such as USD or EUR.

How Currency Conversion Is Handled

There are two main ways the currency conversion can happen when you pay:

- Paying in Local Currency (No Dynamic Currency Conversion)

You choose AED on the payment terminal. The transaction is sent in AED, and your issuer (the bank or fintech that issued your card) later converts the amount from AED to USD using its own exchange rate. Many cards also add a foreign transaction fee, which is typically around 1–3%.

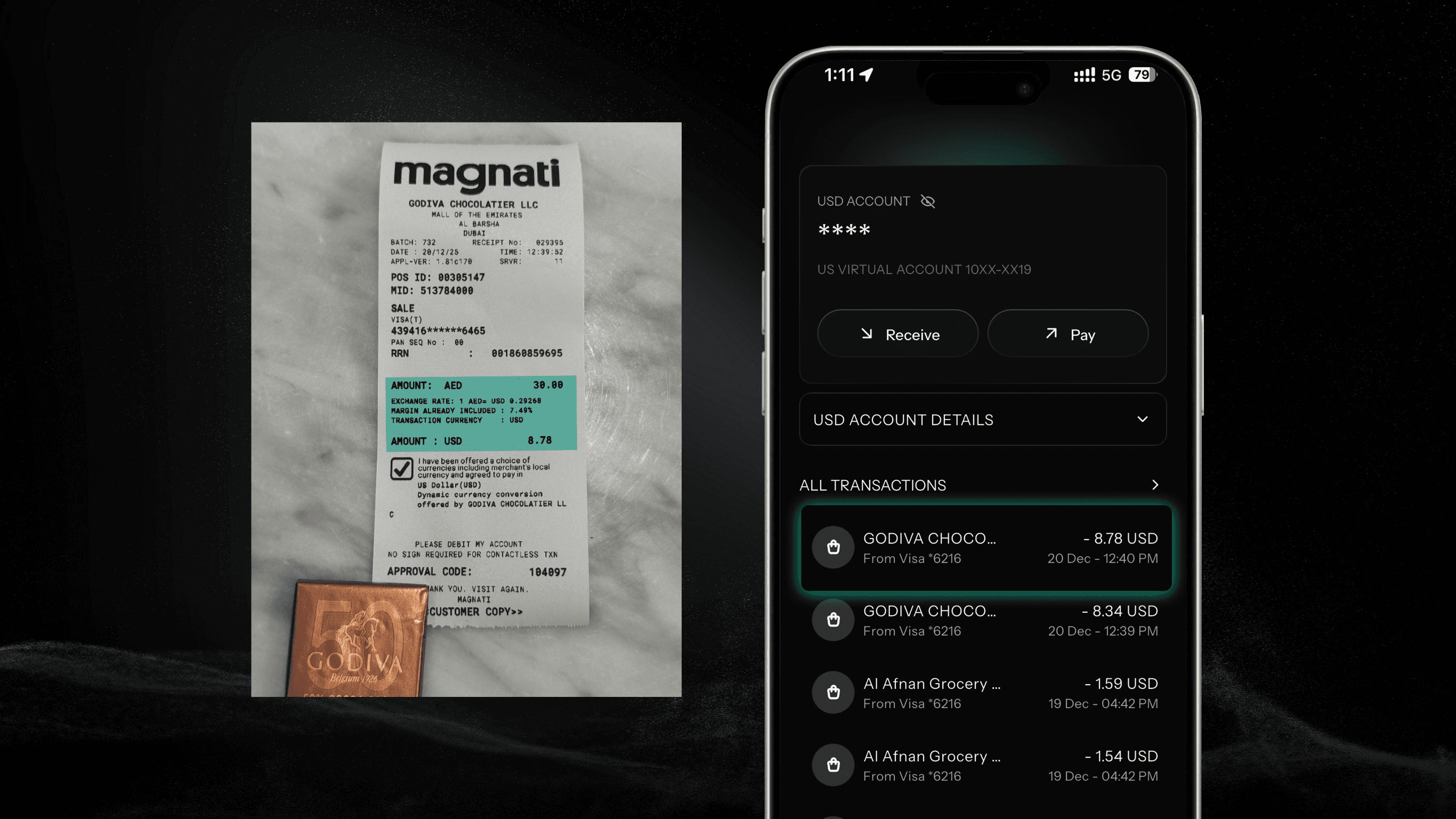

2. Paying in USD Using Dynamic Currency Conversion (DCC)

You choose USD on the terminal. A DCC provider (Dynamic Currency Conversion service) converts the amount from AED to USD immediately and displays a USD price on the screen.

This price already includes the provider’s exchange-rate markup, which research shows often averages around 5%, and can sometimes be significantly higher.

Visa and Mastercard have rules around Dynamic Currency Conversion (DCC):

- DCC must be optional, you should always be able to choose the local currency instead.

- The terminal must show you the local amount, the converted amount, and the exchange rate being used.

In practice, the terminal often just shows two buttons with little explanation. That’s why understanding the AED–USD peg and doing a bit of simple math can help you make the cheaper choice.

AED Is Pegged to USD, but Your Costs Are Not

The UAE dirham is pegged to the US dollar at 1 USD = 3.6725 AED and has held that level for many years.

So for a mid-market rate, 1,000 AED is:

- 1,000 ÷ 3.6725 ≈ 272.29 USD

The peg is strong and very stable. However, the peg does not mean:

- Banks will convert at exactly 3.6725 with no spread.

- DCC providers will also respect that rate with no markup.

In reality:

- Your issuer charges its own spread around the mid-market rate plus any foreign transaction fee (often 1–3%).

- The DCC provider at the terminal adds its own markup to the rate, which research shows can easily average around 5%.

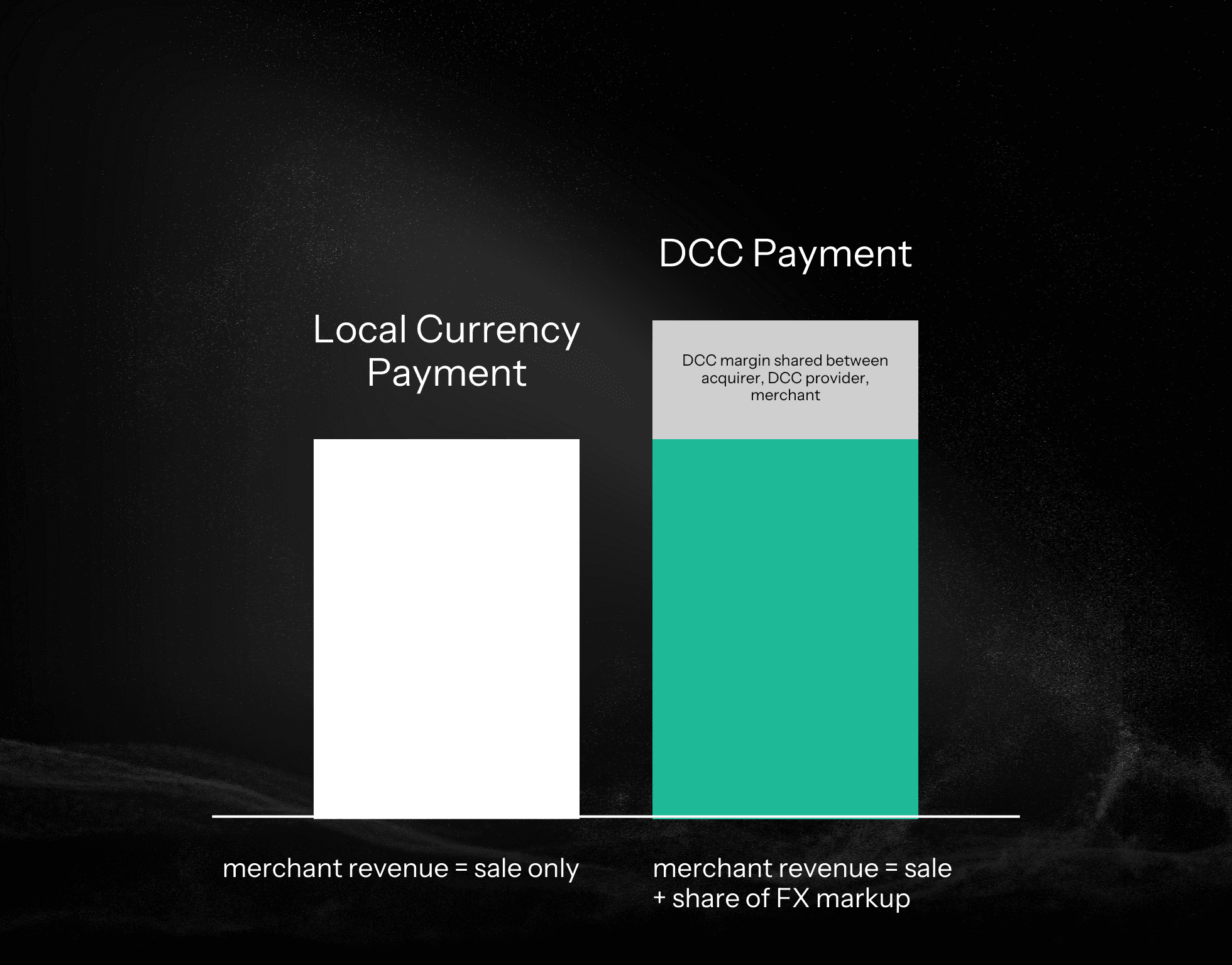

DCC is so common because it’s profitable for everyone except the cardholder. The DCC provider sets a worse exchange rate than the mid-market, and that extra margin is shared between the provider, the acquiring bank, and sometimes the merchant.

From the merchant’s perspective, there’s little downside: they still get paid in AED, may earn a share of the FX margin, and appear helpful by showing prices in your home currency.

Card networks like Visa and Mastercard require that you’re given a choice between local currency (AED) and your billing currency (USD), and that the exchange rate is disclosed.

In reality, many terminals still steer users toward USD by labeling it as “recommended” or “easier,” even though it usually costs more.

So when a UAE terminal asks “Pay in AED or USD?”, you’re not questioning the peg. You’re choosing who gets to charge you for converting around it.

A spread is the small difference added on top of the mid-market exchange rate. It’s how banks and payment providers make money on currency conversion, and it shows up as a slightly worse rate for you.

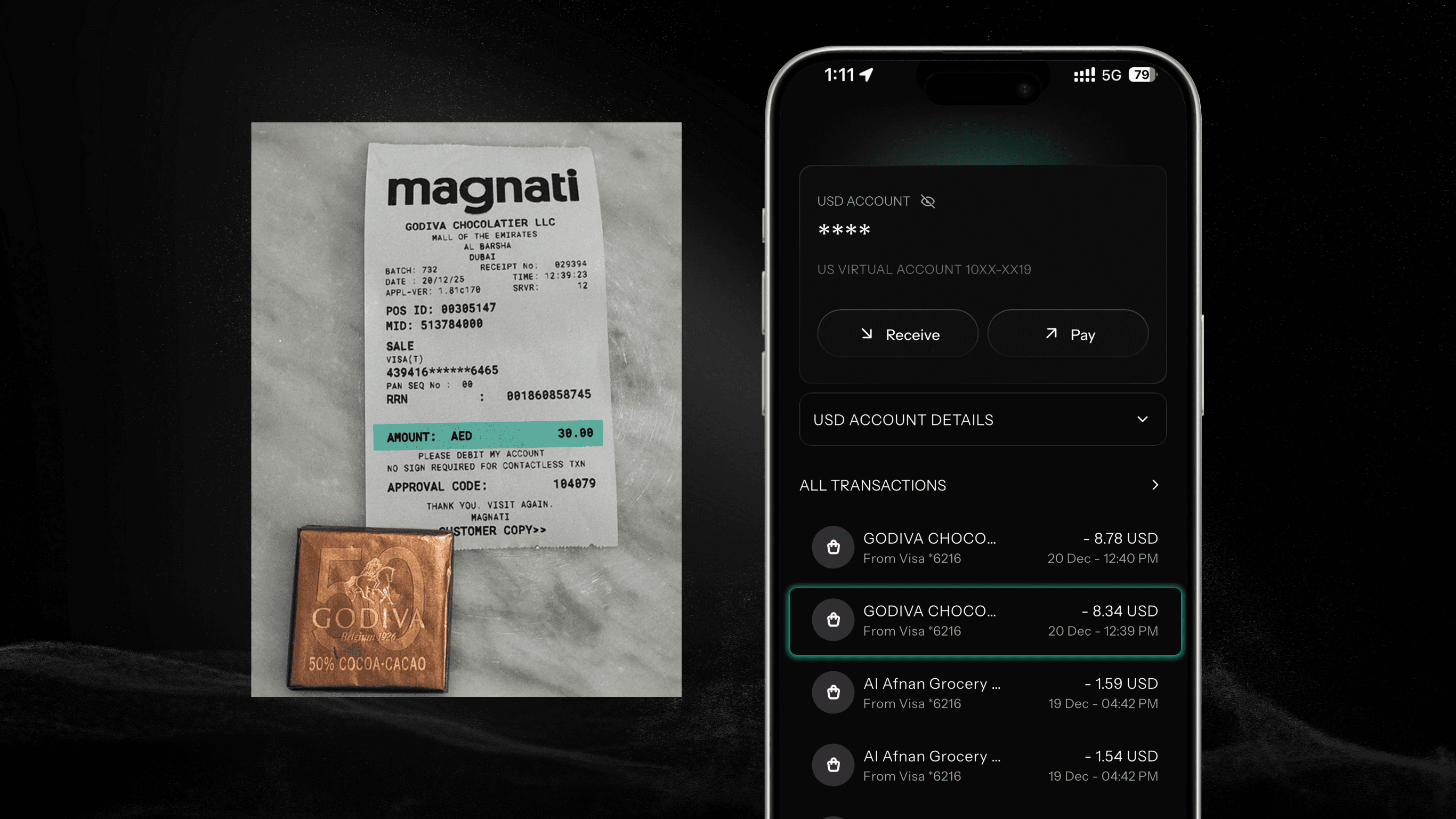

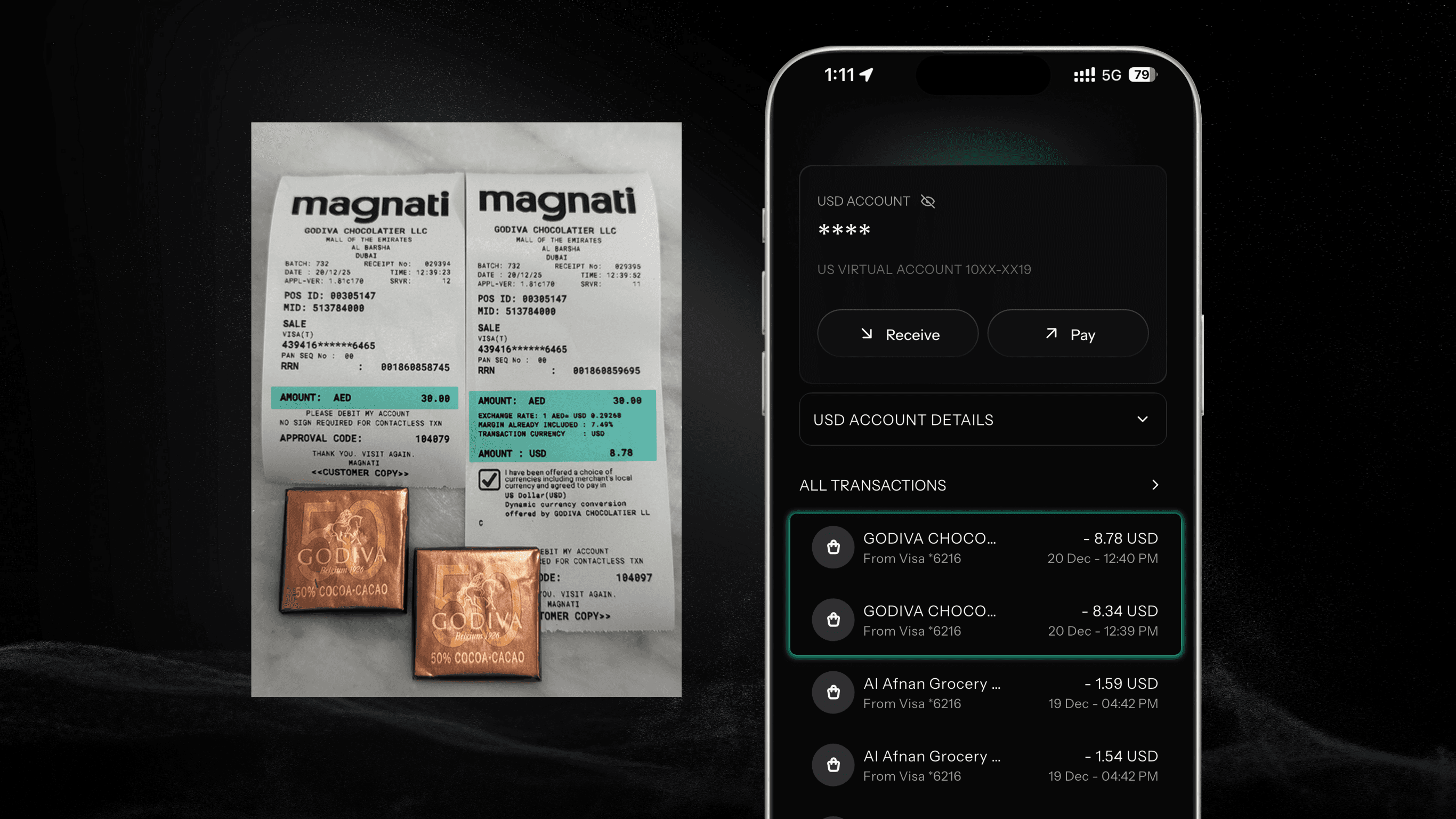

One Example: 30 AED Purchase, Two Different Bills

Let’s run one clean example.

Assume:

- Purchase amount: 30 AED

- Peg: 1 USD = 3.6725 AED

- Mid-market conversion: about 8.17 USD

Now compare two paths:

Option 1: Pay in Local Currency (AED — No DCC)

Option 2: Pay in USD (Dynamic Currency Conversion)

Cost Comparison Summary

In plain language:

- Paying in AED and letting your card handle FX costs you roughly 2% more than a theoretical perfect peg in this example.

- Paying in USD through DCC costs you roughly 5% more than the same peg.

Over time, if you spend 10,000 AED, that extra 3 percentage points adds up to a meaningful difference in your total bill.

Real-world tests in Europe and consumer research repeat the same pattern: DCC usually ends up more expensive for the cardholder than sticking to local currency and letting the issuer convert.

The exact numbers vary by card, but the relative difference between issuer FX and DCC is consistent.

When Convenience Matters More Than FX Cost

In most cases, paying in USD using Dynamic Currency Conversion (DCC) is more expensive. However, there are a few narrow situations where someone might still choose it, not to save money, but to simplify admin or meet specific requirements.

Corporate reimbursement

You might choose to pay in USD if your employer:

- Requires receipts to be issued in USD.

- Reimburses exactly the USD amount shown on the receipt, without adjusting for exchange rates.

In this case, paying in USD can make expense reporting and reimbursement easier. You’re not getting a better exchange rate, you’re trading slightly higher FX costs for simpler paperwork and faster approval.

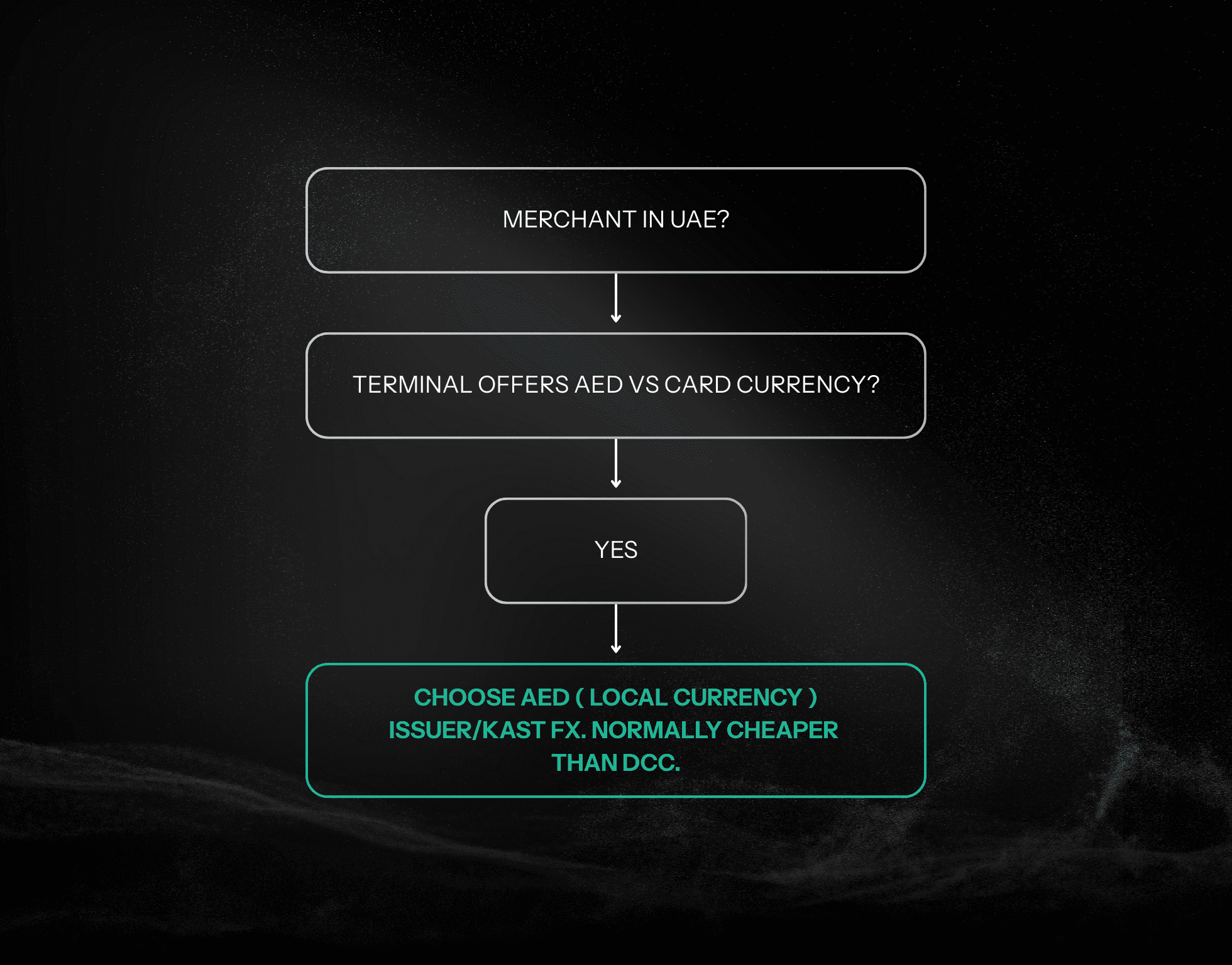

Two-Second Checkout Checklist in the UAE

When you’re paying at a terminal in Dubai, Abu Dhabi, or Sharjah and see this question:

“Pay in AED or pay in USD?”

Here’s a simple way to decide:

- You’re in the UAE, so the local currency is AED.

- If the screen offers AED vs USD, the terminal is offering Dynamic Currency Conversion (DCC) on the USD option.

- In most cases, especially if you’re using a modern fintech card like KAST, the cheaper option is: Choose AED on the terminal and let your card issuer handle the conversion.

You don’t need to calculate exchange rates on the spot. The way fees and markups are structured already points you in that direction.

For KAST users, this fits into the bigger picture. You already use KAST to hold value in stablecoins, move money across borders, and spend through a Visa card without traditional bank friction. Paying in the local currency and avoiding unnecessary DCC markups is simply another way to keep your setup efficient.

So the next time a terminal in the UAE asks “USD or AED?”, think of it as a pricing choice, not a language preference, and pick the option that keeps extra costs to a minimum.

Ready to bridge the gap between crypto and everyday spending?

Start using your crypto with KAST Card today.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

Peso Strong, Dollar Weak: What It Means for Your Money

A strong peso and weak dollar do not affect everyone the same way. Learn how exchange rates, FX fees, and where you earn and spend actually shape your buying power in Mexico.

USD to Naira Conversion Fees Explained: KAST vs Bitget P2P

USD to local currency fees include exchange-rate spreads, platform or trading fees, and payout costs. Understanding these fees helps you compare platforms and avoid hidden reductions in your final payout.

Can I Withdraw Cash at an ATM Using My Crypto Card?

Crypto cards can withdraw cash at ATMs worldwide, but understanding how the process works matters. This guide breaks down how crypto card ATM withdrawals function behind the scenes, where fees come from, what determines limits, and when using an ATM actually makes sense.