Peso Strong, Dollar Weak: What It Means for Your Money

A strong peso and weak dollar do not affect everyone the same way. Learn how exchange rates, FX fees, and where you earn and spend actually shape your buying power in Mexico.

Key Takeaways

- A strong peso or weak dollar is not good or bad on its own. What matters is where you earn and where you spend.

- Bank markups, remittance spreads, and card DCC can quietly cost 3–15% per transaction, even when rates look fine.

- KAST lets you hold USD until you actually spend in MXN, so conversion happens only when it matters.

You've probably heard it: "The peso is stronger than ever." Or maybe: "The dollar is weakening." Sounds like good news if you're in Mexico, right?

Pause for a second.

Currency strength isn’t about winning or losing. It’s about what you can actually do with your money, and that depends on where your income comes from and where your expenses go.

If you earn pesos and spend dollars, a strong peso helps. If you earn dollars and pay rent in pesos, a weak dollar hurts more than most people expect.

Let’s walk through how to deal with this when using the KAST Card in Mexico.

What Does "Strong Peso, Weak Dollar" Actually Mean?

When people say the peso is strong, they mean it buys more dollars than before. For example:

- 1 USD = 20 MXN → Weaker peso (you need 20 pesos to buy 1 dollar)

- 1 USD = 17 MXN → Stronger peso (you only need 17 pesos to buy 1 dollar)

So when the peso strengthens, the number goes down. Yes, it’s backwards. You’re not alone if that feels weird.

Why does this happen?

Currency values move based on a few big factors:

- Interest rates: Higher rates in Mexico attract investment, boosting the peso

- Trade flows: More exports than imports increase demand for pesos

- Economic stability: Investors favor steadier economies

- US Federal Reserve policy: Rate cuts or money printing weaken the dollar globally

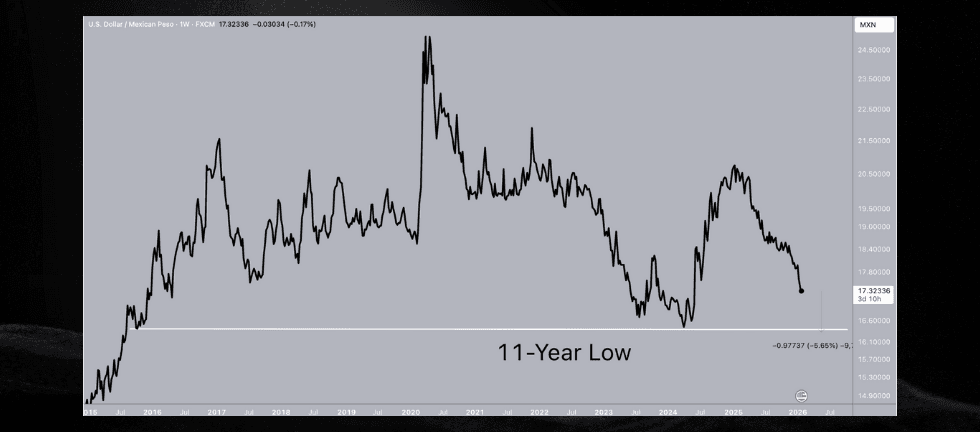

As of January 2026, the bigger story looks like a weaker U.S. dollar, driven by expected rate cuts and trade-related volatility.

On Jan. 23, the Federal Reserve checked in with currency traders on USD–JPY rates. That move hinted at possible coordination with the Bank of Japan to support the yen.

At the same time, the U.S. Dollar Index (DXY) has been falling, while the peso remains relatively stable against other major currencies. That points to dollar weakness more than sudden peso strength.

How This Affects Your Money

Here’s where it gets personal. The impact depends entirely on your setup.

Scenario 1: You Earn in Pesos, Spend in Pesos

Impact: Very little day to day

If your income and expenses are both in pesos, exchange rates don’t change much for you directly. That said:

- Imported goods may get cheaper

- International travel costs less

- Your peso savings buy more dollars if you convert

Scenario 2: You Earn in Dollars, Spend in Pesos

Impact: You feel it

This is where a strong peso stings. If you’re a remote worker, freelancer, or receive USD:

- Your $1,000 paycheck converts to fewer pesos

- Rent and groceries don’t drop, but your buying power does

- A full month can quietly shrink to three weeks

Example:

- At 20 MXN/USD: $1,000 = 20,000 pesos

- At 17 MXN/USD: $1,000 = 17,000 pesos

Same dollars, 3,000 fewer pesos.

Scenario 3: You Earn in Pesos, Spend in Dollars

Impact: This works in your favor

If you pay for U.S. -based services or plan to travel abroad:

- Subscriptions cost less

- Flights and hotels in USD are cheaper

- Saving or sending dollars goes further

Scenario 4: You Earn in Dollars, Spend in Dollars (While Living in Mexico)

Impact: Exchange rates mostly fade into the background

If your income and expenses are both in USD:

- Day-to-day costs stay predictable

- A strong or weak peso barely touches your budget

- FX only matters when you dip into pesos (rent, cash, local services)

Even if you understand the exchange rate, there’s another problem most people miss.

The Hidden Cost: FX Fees and Markups

Exchange rates aren’t the only thing at work. Fees quietly do damage too.

Banks often add 3–5% to the exchange rate without making it obvious.

Remittance services may advertise “no fees,” but they usually make up for it with wider spreads.

Paying in USD by card can be the most expensive option of all, since Dynamic Currency Conversion (DCC) can add 10–15% to a single purchase.

These costs stack on top of currency moves.

How KAST Helps You Navigate This

KAST is built for people managing money across currencies in Mexico.

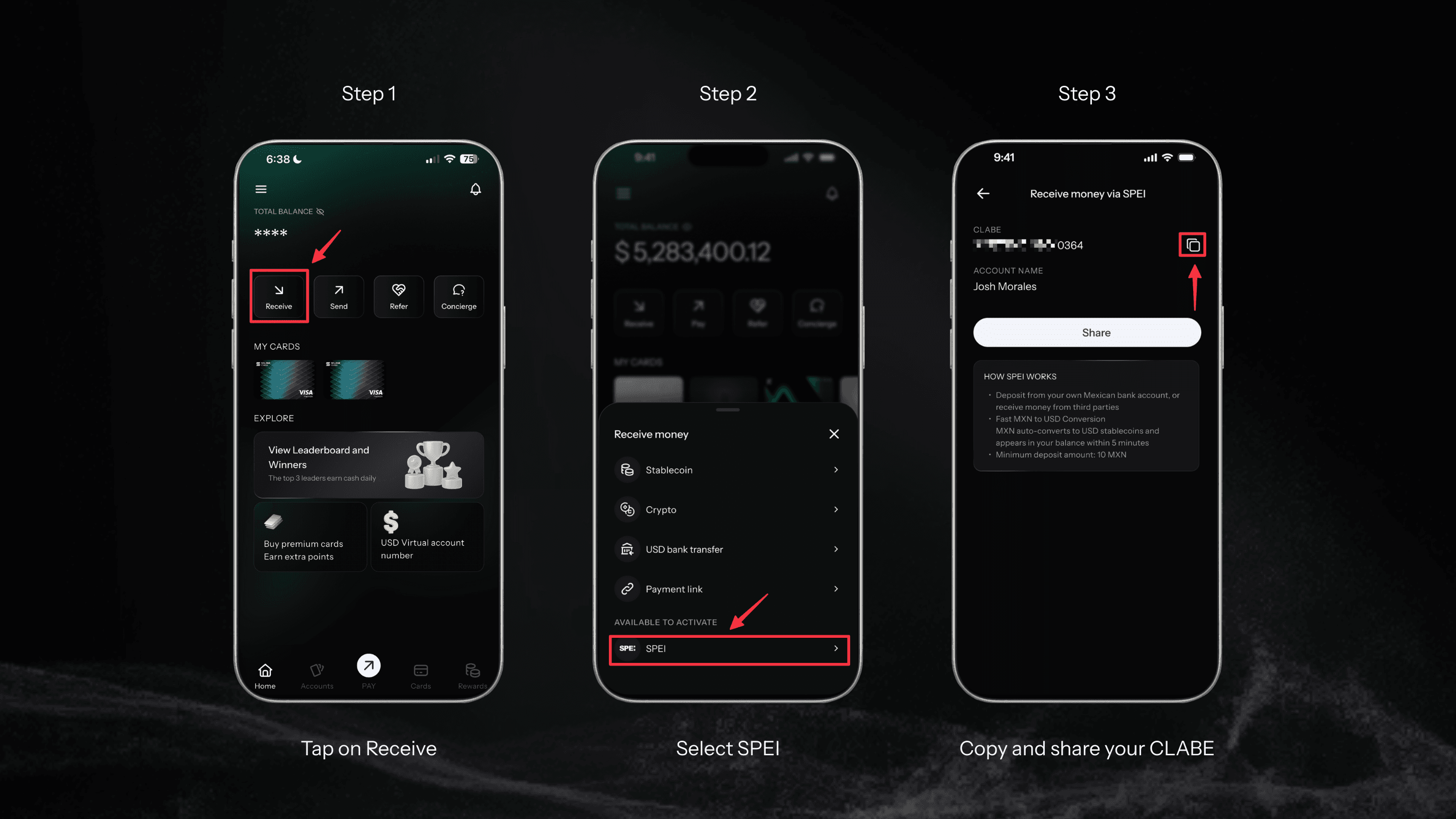

You can hold dollars as stablecoins, receive and send pesos locally through SPEI, and pay anywhere in Mexico with your KAST card.

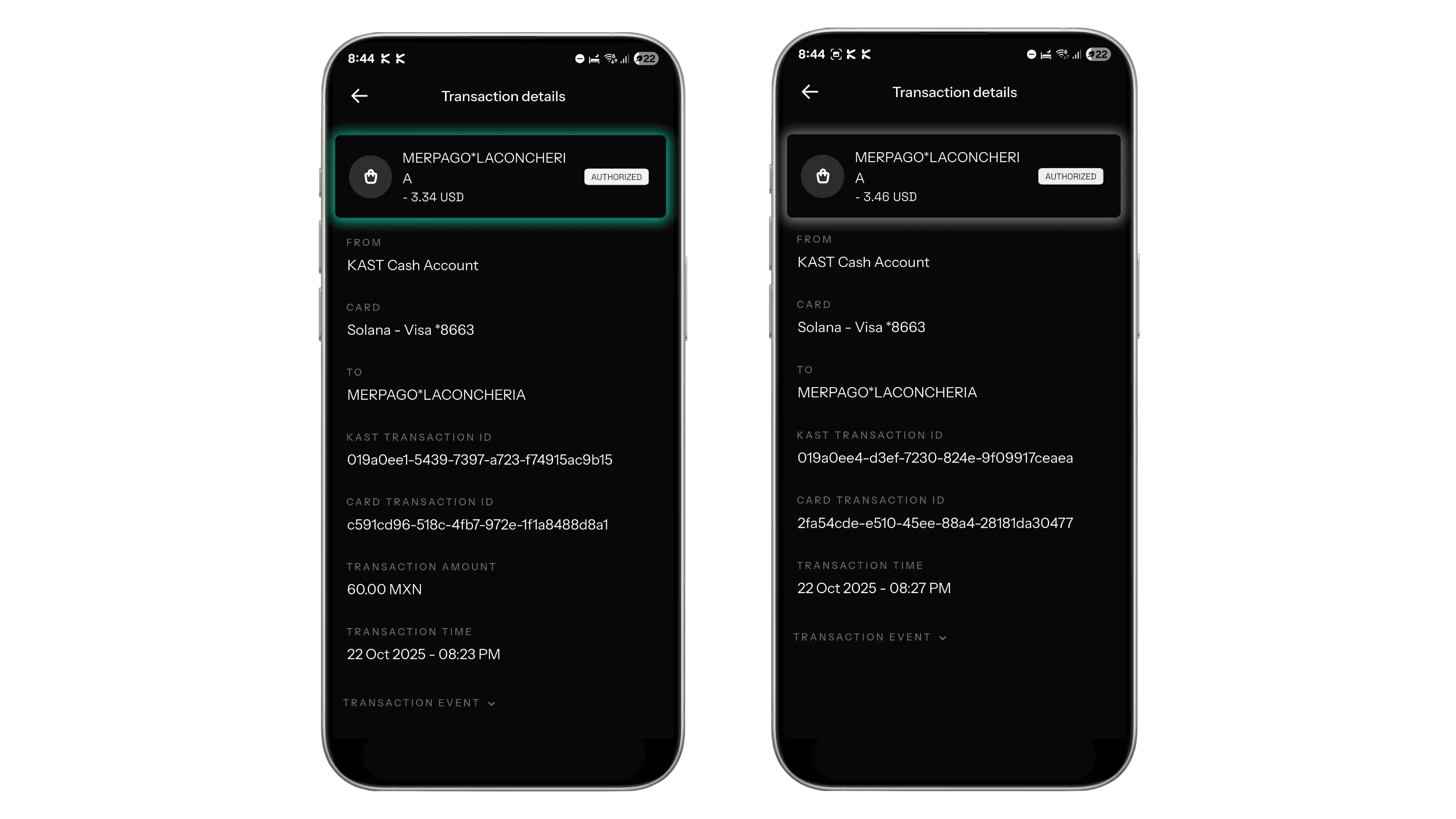

The key difference is timing: you’re not forced to convert money ahead of time. Payments happen in MXN when you spend, without surprise FX markups or Dynamic Currency Conversion.

Why this matters:

This matters because you’re not forced to convert money before you actually need it.

You avoid unnecessary FX fees, payments happen automatically in MXN, and you don’t get hit with surprise DCC markups at checkout.

You stay in control of when and how conversion happens.

What You Can Do About It

You can’t control exchange rates, but you can avoid making them worse.

When a payment terminal asks whether to charge you in USD or MXN, always choose MXN. Paying in USD triggers Dynamic Currency Conversion, which often adds 10–15% for no upside.

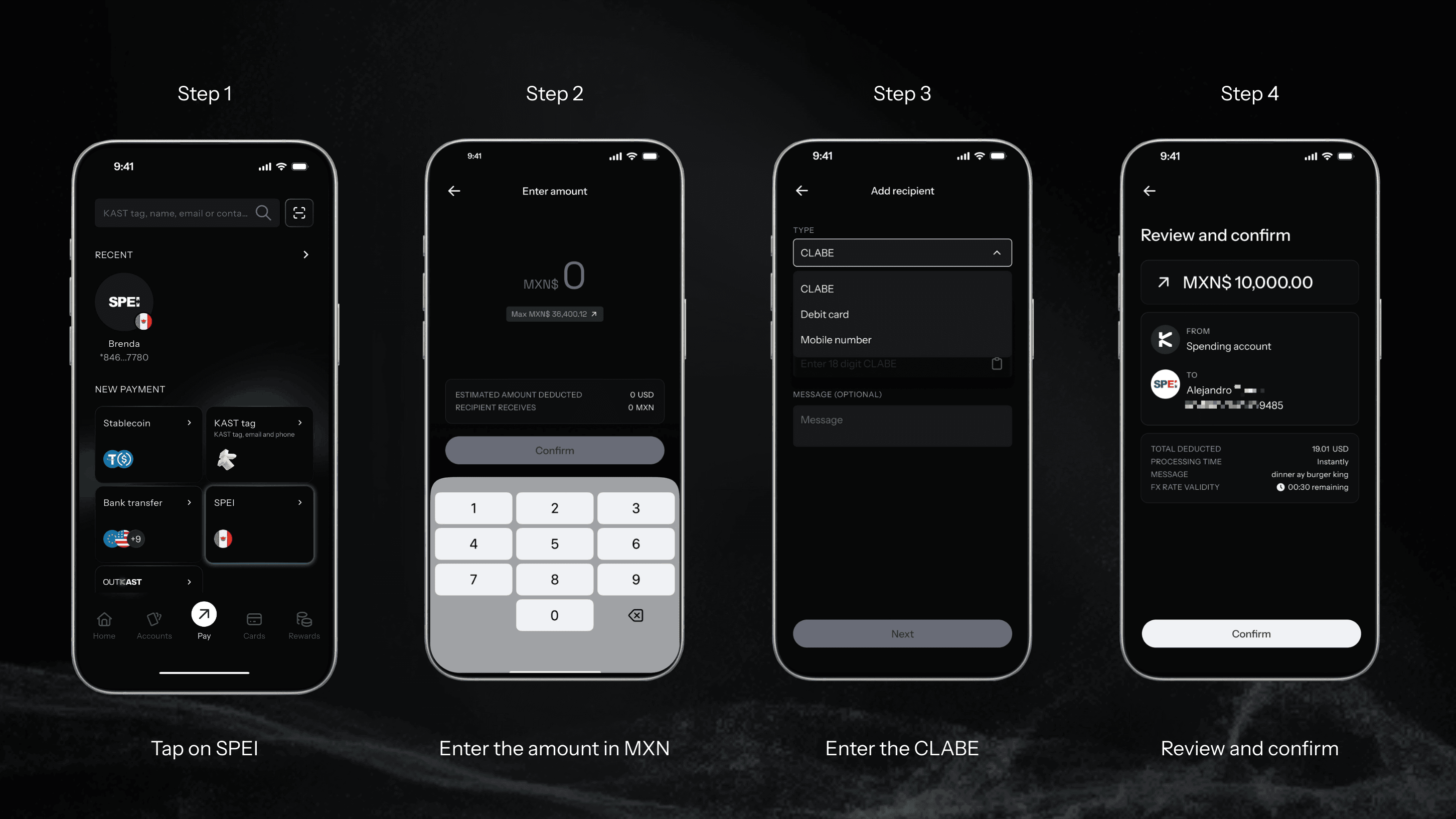

For moving money inside Mexico, use SPEI. It’s fast, cheap, and avoids unnecessary conversion.

You also don’t need to convert everything at once. If you already hold pesos in a Mexican bank, you can transfer only what you need to KAST when it’s time to spend.

Those pesos convert instantly in your account and can be used with your card anywhere Visa is accepted. This way, you avoid guessing future rates and reduce how much money sits exposed to FX swings.

Before any conversion, it’s worth doing a quick check.

Compare the mid-market rate you see on Google with the rate you’re offered, and look for any extra fees. If the gap is more than about 1%, you’re probably paying more than you should.

The goal isn’t to time the market perfectly. It’s to avoid bad rates, hidden fees, and forced conversions that quietly eat into your money.

Example: Freelancer Earning in USD, Living in Mexico

Say you earn $2,000 USD per month and live in Mexico City.

Without KAST:

- Get paid in a US bank

- Wire to Mexico ($25–40 + 3–5% FX)

- Lose $100+

- Sit in pesos even if you need dollars later

With KAST:

- Receive $2,000 as USDC

- Pay rent and bills with your card (auto-conversion)

- Send pesos via SPEI when needed

- Keep the rest in USD until you spend it

- FX cost: about $10

That’s ~$90 saved every month. Small change adds up.

How to Handle a Falling Dollar

If you earn pesos but sometimes need dollars:

- Keep pesos in BBVA/Banorte/etc.

- When you need to buy something or send money abroad, SPEI transfer to KAST (takes seconds)

- Pay with your KAST card or send internationally

- Total cost: ~0.5% deposit fee + conversion spread

This gives you flexibility without forcing all your money into dollars upfront."

You Shouldn't Have to Think This Hard About Money

Exchange rates change. That part’s real. The extra fees, bad timing, and forced conversions don’t have to be.

You now know how exchange rates actually affect you, why choosing MXN at terminals can save 10–15%, how SPEI keeps peso transfers cheap, and why holding the right currency matters.

KAST gives you the tools. You make the calls.

Ready to Take Control?

If you move money between USD and MXN, KAST keeps it simple.

You get a Mexican CLABE, hold stablecoins until you spend, pay anywhere in Mexico, and convert at real rates.

Hold pesos. spend dollars. Cash out anywhere in Mexico.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

USD to Naira Conversion Fees Explained: KAST vs Bitget P2P

USD to local currency fees include exchange-rate spreads, platform or trading fees, and payout costs. Understanding these fees helps you compare platforms and avoid hidden reductions in your final payout.

USD vs AED: Which One Should You Pick on the Terminal in the UAE?

When a card terminal in the UAE asks whether to pay in USD or AED, that choice decides who sets your exchange rate. In most cases, choosing AED is cheaper. Here’s why.

Mastering Crypto Off‑Ramps: A Complete Tutorial

Off-ramping feels frustrating when it looks like a black box. Once you understand the rails behind it, the process becomes a set of clear choices.