Mastering Crypto Off‑Ramps: A Complete Tutorial

Off-ramping feels frustrating when it looks like a black box. Once you understand the rails behind it, the process becomes a set of clear choices.

Key Takeaways

- Off-ramping is not one action, it is a set of routes. Bank payouts, card spending, and ATM withdrawals all turn stablecoins into usable money, just in different ways.

- Fees and timing depend on the rail you choose. Local payouts, SWIFT transfers, cards, and ATMs all trade speed, cost, and predictability differently.

- KAST makes off-ramping predictable. You see the route, fees, currency, and timing upfront, so you can choose instead of guessing.

You’re holding stablecoins. You need money in a bank account. This should be easy.

Instead, off-ramping turns into a mini project. You send to an exchange. Swap. Withdraw. Wait. Refresh. Quietly hope your bank doesn’t invent new fees today.

That frustration makes sense. You’re not wrong. But it’s not the full picture.

Off-ramping isn’t a single action. It’s a chain of rails, fees, and checks that change depending on where your money is going. Once you see that, things click. This stops feeling random and starts feeling like a set of choices you actually control.

That’s where KAST helps. Not by adding more steps, but by laying out the options and costs upfront so you can decide without guessing.

What “Off-Ramping” Actually Means

Off-ramping simply means turning crypto or stablecoins into money you can actually use in everyday life. It’s the step where digital assets leave the crypto world and enter the traditional financial system.

There are a few common ways this happens. Sometimes the funds are converted to fiat and sent straight to your bank account. Other times, you might withdraw cash from an ATM or spend the balance directly using a card that automatically converts crypto at the point of payment.

The paths may look different, but the result is the same: crypto becomes usable money. Off-ramps remove friction by connecting wallets, cards and bank accounts, making it easier for people and businesses to move between digital assets and familiar payment methods with confidence.

Off-Ramping as Cash

ATM cash-out is still an off-ramp, because you’re converting stablecoin value into money you can use right away.

It’s fast and convenient, but it comes with trade-offs you’ll notice. You’ll usually pay a mix of card or issuer fees, ATM operator fees, and sometimes FX fees if the currency changes. Limits apply too, which makes this better for access than for large amounts. And if a withdrawal gets declined, it’s usually for boring reasons like limits or extra checks.

This route makes sense when you need cash now and you’re okay paying a bit extra for speed and convenience.

The KAST card has the following ATM withdrawal costs:

Off-Ramping as Card Spending

Card spending is also an off-ramp. Instead of moving money into a bank account first, value converts at the moment you pay.

This is the most invisible type of off-ramp. It’s quick, simple, and easy to use day to day. Costs usually show up in the exchange rate or FX fee, especially when spending in another currency. Occasionally a transaction gets blocked, just like with any traditional card.

This route works best when you want to use your funds immediately, without touching a bank transfer first.

With KAST, you can use the KAST card to spend directly, with your stablecoins converted automatically at checkout. You also earn KAST Points and may qualify for cashback programs while you spend.

The Two Bank Off-Ramp Routes in KAST

When most people say off-ramping, they usually mean one thing: getting money into a bank account. That’s where things feel slow and confusing, so it helps to be clear.

In KAST, off-ramping to a bank account happens through KAST Pay using two routes:

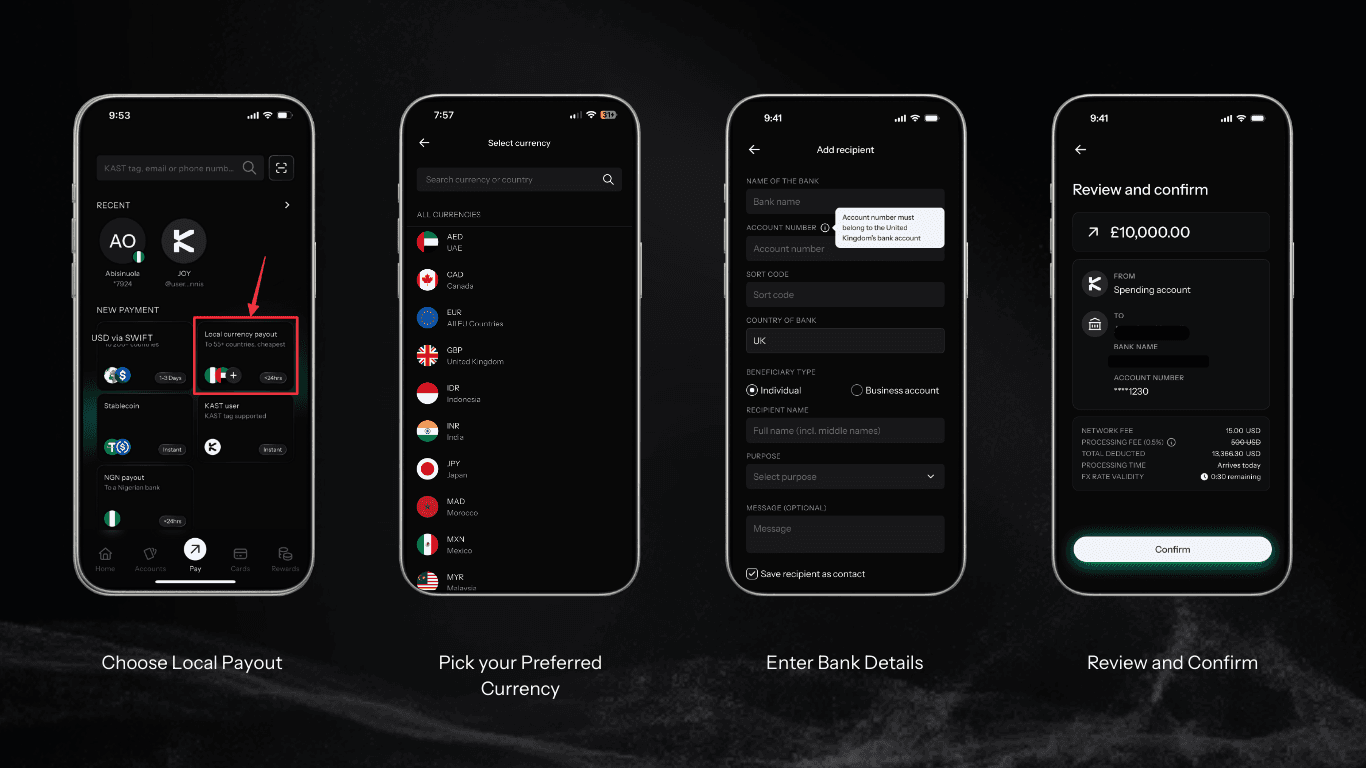

Step-by-Step: Cash Out to Your Local Bank

Local Payout sends money through domestic banking rails and delivers funds in the destination’s local currency.

This route is usually faster and more predictable when it’s available.

Local Payout is built for the “just get it into my bank” moment.

The flow is straightforward and familiar:

- Open the KAST app and go to the Pay tab

- Select Local Payout

- Choose the currency you want to receive

- Enter the amount

- Enter your local bank details

- Review the fees and delivery estimate, then confirm

After that, the payout is handled by licensed payment partners, behind the scenes. If it takes longer than expected, checking the transaction status is the first and best step.

Local payouts typically include a 1% conversion fee for non-USD transfers, plus a fixed transfer fee of around $2.

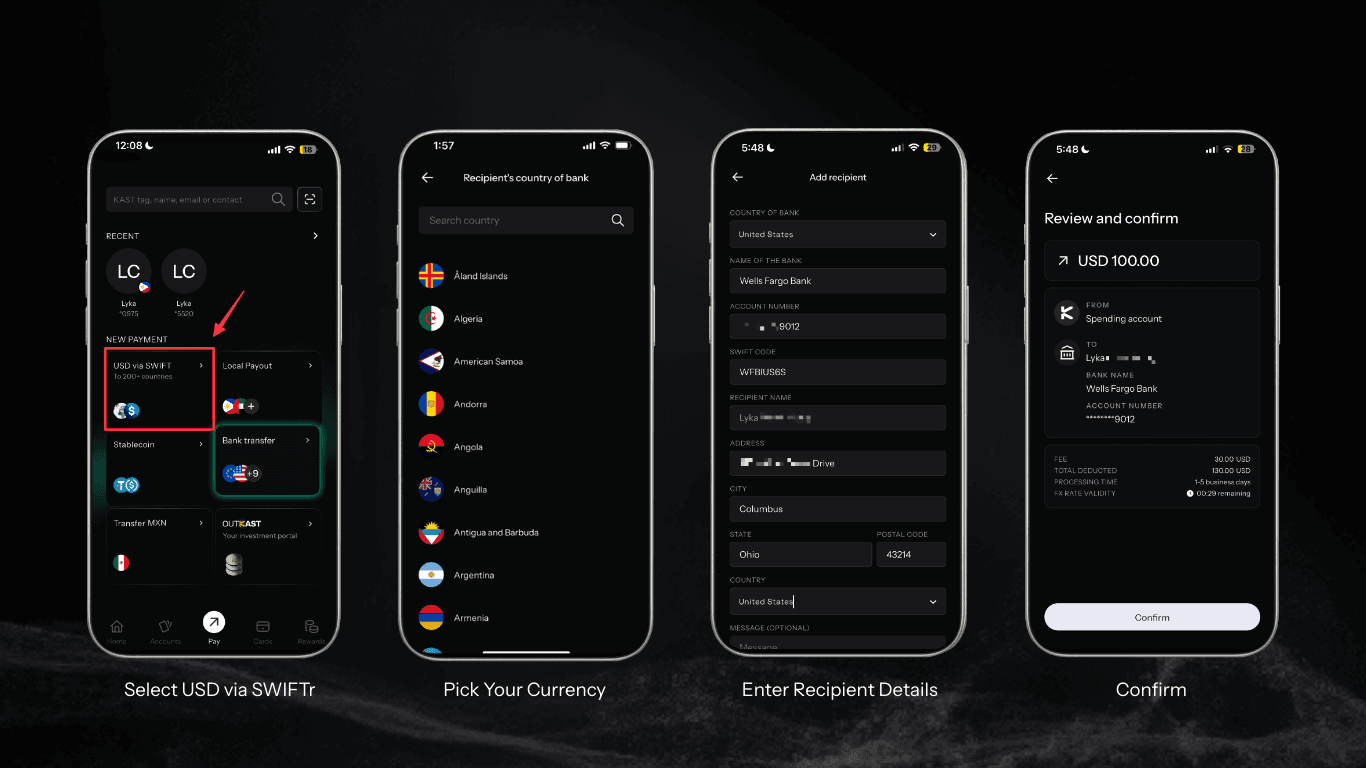

Step-by-Step: Send USD By Global Payout

Global Payout sends USD internationally through the SWIFT network, with broad country coverage.

This route is typically the right choice when local rails aren’t available, or when the recipient specifically needs USD.

You’ll need full bank details, including a SWIFT or BIC code.

Then the flow is:

- Open the KAST app and go to the Pay tab

- Select USD via SWIFT

- Choose the recipient’s bank country

- Enter the amount

- Add the recipient’s bank and SWIFT details

- Review the fees and delivery estimate, then confirm

SWIFT transfers usually take a few business days. KAST typically charges $30 for these transfers, which is refunded for amounts over $5,000

How to Choose the Right Route

Choosing the right route comes down to one simple question: do you want the money to arrive as local currency, or as USD?

If you want local currency and it’s supported, Local Payout is usually the cleanest option. If you need USD delivered internationally, Global Payout via SWIFT is the better fit.

Fees and Timing: What You’re Really Paying For

Off-ramp fees are almost never just one fee. They’re usually a mix of conversion cost, transfer fees, and time.

Some routes are faster. Some are cheaper. Some are simply more predictable. What matters is seeing the fees and delivery estimate before you confirm, so you know exactly what trade-off you’re making.

As a rough guide, SWIFT transfers often take 1 to 5 business days. Local payouts can be same day or next business day, depending on the country and currency.

What Can Go Wrong

Most off-ramp issues aren’t mysterious. They usually come down to a few simple causes:

First, bank details are wrong or incomplete. That can cause delays or failure, and funds are typically returned once the reversal finishes.

Second, SWIFT routing includes other banks. Intermediary or receiving banks may deduct fees from the amount received. This is normal on the SWIFT network and not something any app can fully control.

Third, extra checks happen. Some transfers trigger additional compliance or verification steps. That doesn’t mean you did anything wrong. It’s just how global money movement works.

Where KAST Fits

Once you understand the rails, KAST fits naturally into the picture:

Local Payout is for local-currency delivery on domestic rails.

Global Payout is for USD reach through SWIFT.

That’s the idea. Fewer steps. Clearer expectations. And yes, your brain deserves better than convert, withdraw, wait, refresh.

Before you send, know which currency you want, double-check the bank details, and review the fees and delivery estimate on the confirmation screen.

You shouldn’t have to guess where your money went. Now you don’t.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Readers also like

How Can I Spend My Crypto Using KAST Card in Armenia

A real in-store payment in Yerevan using a KAST virtual card. See exactly how tap to pay works in Armenia, including the receipt, fees, instant notifications, and rewards, no crypto steps, no surprises.

Peso Strong, Dollar Weak: What It Means for Your Money

A strong peso and weak dollar do not affect everyone the same way. Learn how exchange rates, FX fees, and where you earn and spend actually shape your buying power in Mexico.

USD to Naira Conversion Fees Explained: KAST vs Bitget P2P

USD to local currency fees include exchange-rate spreads, platform or trading fees, and payout costs. Understanding these fees helps you compare platforms and avoid hidden reductions in your final payout.