What Is Identity Verification And Why Do Cards Ask for It?

Identity verification is required before you can use a crypto card. This guide explains why KYC exists, what it checks, and how KAST verifies users to keep accounts secure and compliant.

Key Takeaways

- KYC is required by law for any card that lets you spend real money, including KAST.

- Verification protects your account by preventing fraud and identity misuse.

- One quick check unlocks spending for most users, with approval usually taking only a short time.

You sign up for a card. You’re ready to start using it.

Then you’re asked to upload an ID and take a selfie.

At that point, the question usually comes up: Why is this necessary? You already shared your email. Your phone number. You just want to use your money.

The short answer is that verification isn’t optional.

The longer answer is that it exists to protect you, the platform, and the financial system as a whole.

Identity verification, also known as Know Your Customer (KYC), is required before you can use a crypto card.

This guide explains what identity verification actually checks, why it’s required, and how KAST handles it.

What Is Identity Verification (KYC)?

Before a company can issue a card or let you spend real money, it has to confirm who you are.

This process is called Know Your Customer, or KYC. It’s required by financial regulators in every country where regulated payment services operate.

KYC exists to make sure:

- You are a real person

- You are the person opening the account

- You’re legally allowed to use the service

To do that, platforms typically ask for:

- A government-issued ID (passport, national ID, or driver’s license)

- A selfie to confirm the ID belongs to you

- Sometimes proof of address depending on features or limits

This isn’t unique to crypto or KAST. Banks, card issuers, and payment apps all follow the same rules.

Why Crypto Cards Require KYC?

To Prevent Identity Theft

Without verification, anyone could open an account using someone else’s name and start spending. Confirming identity makes that much harder.

To Meet Legal Requirements

Financial services are regulated. Companies that don’t verify users aren’t allowed to operate. Verification is a legal obligation, not a preference.

To Enforce Eligibility Rules

Some services require you to be over a certain age, live in a specific country, or meet regulatory criteria. Verification makes sure those rules are followed.

How KYC Works

KAST is a card for spending stablecoins and USD in the real world. Which means it's subject to all those regulations we just talked about.

KAST splits verification into three levels, each unlocking more functionality.

Level 1: Account access

After signing up and confirming your email, phone number and setting up a PIN, you can access the app and receive funds.

Spending and card creation aren’t available yet.

Level 2: Ready to spend

This is where you upload your ID and take a picture following the on-screen prompts.

Then, you need to provide Proof-of-Funds (PoF)

Once approved, you can:

- Create your KAST card

- Send and receive funds

- Spend normally

This level is enough for most users.

Level 3: Extra features

Do you need a USD bank account or global payouts on KAST? Then you'll verify again with a few more documents.

Proof-of-address and an enhanced ID check will unlock extra features, including full compliance for higher limits.

Here’s How You Actually Do It

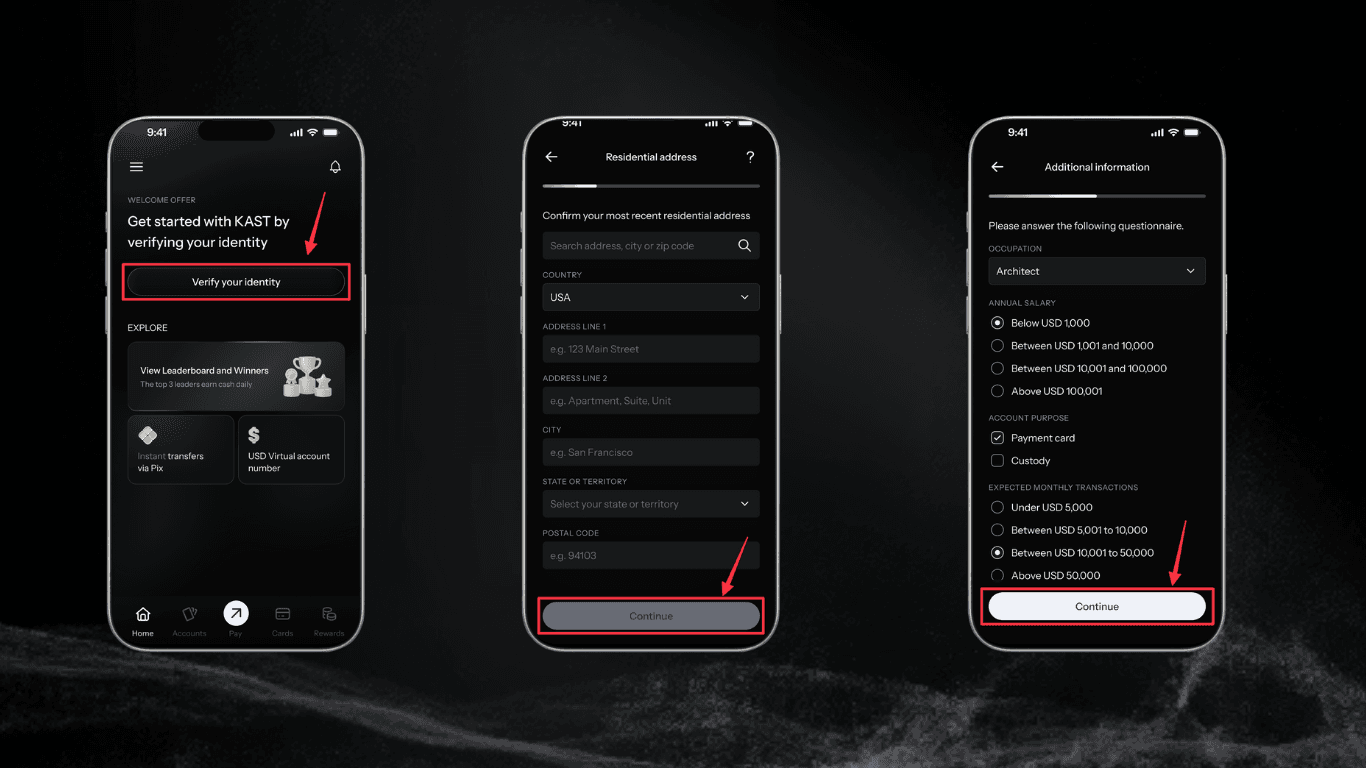

Open the KAST app. Tap the button that says verify your identity.

Upload a clear photo of your ID. Make sure it's not blurry, cropped, or expired. If your ID expired last week, find a different one.

Take a selfie. Follow the instructions on screen. No funny faces. Just look at the camera like a normal human.

Submit it.

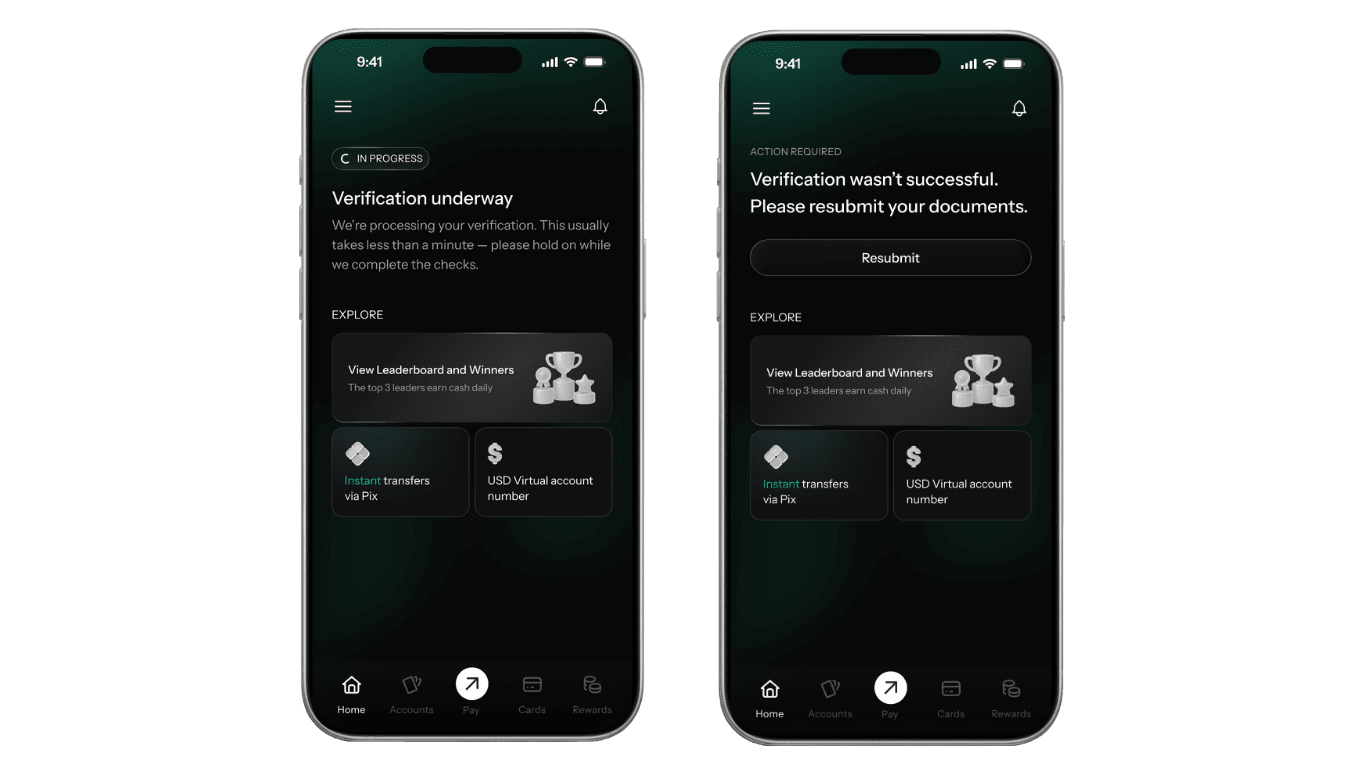

Wait a few hours. KAST usually reviews it fast. You'll get a notification when it's done.

Common KYC Verification Problems

Your ID expired

Get a valid one. Expired IDs don't work, even if they expired last week.

Your photo is blurry

Take it again. Use better lighting. Keep your phone steady.

You cropped your ID

Don't. Take a photo of the whole thing. All four corners need to be visible.

You used a screenshot

That won't work. You need a photo of the physical document.

They rejected your verification

KAST will tell you why. Fix whatever the problem is and try again.

Address Verification and Source of Funds

In some cases, KAST may ask for additional information.

Proof of Address

You may be asked to upload a document from the last 3 months showing your name and address, such as:

- A utility bill

- A bank statement

- A government-issued letter

The address must match the one in your KAST account.

Source of Funds

For compliance reasons, KAST may ask where your money comes from. This is standard anti-money laundering practice.

Accepted documents include:

- Payslips

- Bank statements

- Other proof of income

Is KYC Data Safe on KAST?

You're uploading your ID to an app. It's fair to wonder if that's safe.

Yes, it is. KAST encrypts your documents. Only authorized people can see them. They're stored according to data protection laws. They're not shared with random companies.

If KAST wasn't doing this properly, they wouldn't be allowed to operate.

The Bottom Line

Every card provider does identity verification. Every platform that handles real money does too. KAST is no different.

You upload your ID. You take a selfie. You wait. Then you're verified.

Is it a bit annoying? Sure. But it's also what keeps someone else from pretending to be you and spending your money.

Once you're done with verification, you're in. You can use your card however you want.

So open KAST, upload your ID, and get started.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

How Can I Spend Crypto Using My KAST Card in Mexico?

KAST makes it easy to spend, send, and receive dollars in Mexico using cards, SPEI transfers, and digital wallets. Learn how currency selection at the terminal affects your costs and how to avoid hidden conversion fees.

How Can I Spend My Crypto Using KAST Card in Armenia

A real in-store payment in Yerevan using a KAST virtual card. See exactly how tap to pay works in Armenia, including the receipt, fees, instant notifications, and rewards, no crypto steps, no surprises.

How Can I Spend Crypto Using PIX In Brazil with KAST?

Spend crypto in Brazil with KAST. Convert crypto to USD instantly, then pay anywhere using PIX Scan, KAST Card, or Apple Pay. Get transparent rates, low fees, and instant BRL payments at any merchant.