Seed Phrases Explained: Why KAST Handles the Keys for You

A seed phrase is the master backup to your crypto wallet, and losing it can mean losing access to your funds permanently. This guide explains how seed phrases work, the risks of self-custody, and why custodial models like KAST can make everyday crypto use simpler and safer.

Key Takeaways

- A seed phrase is the master backup to your crypto wallet and anyone who has it can fully control your funds.

- Self-custody gives you maximum control, but it also makes you fully responsible for storing and protecting your seed phrase.

- KAST removes the operational risk of seed phrase management by handling custody infrastructure so you can focus on using your crypto confidently.

A seed phrase is the master backup to your crypto wallet.

You have probably heard it a thousand times:

“Never share your seed phrase.”

That advice is correct. But it is not the whole story.

The real risk in crypto security is not just memorizing 12 or 24 words. The real risk is how easily those words can leak. One screenshot. One automatic cloud backup. One fake wallet recovery site. A small mistake can become very expensive.

Understanding that risk is what separates casual crypto users from confident ones. It is also why different wallet models exist, including custodial products like KAST.

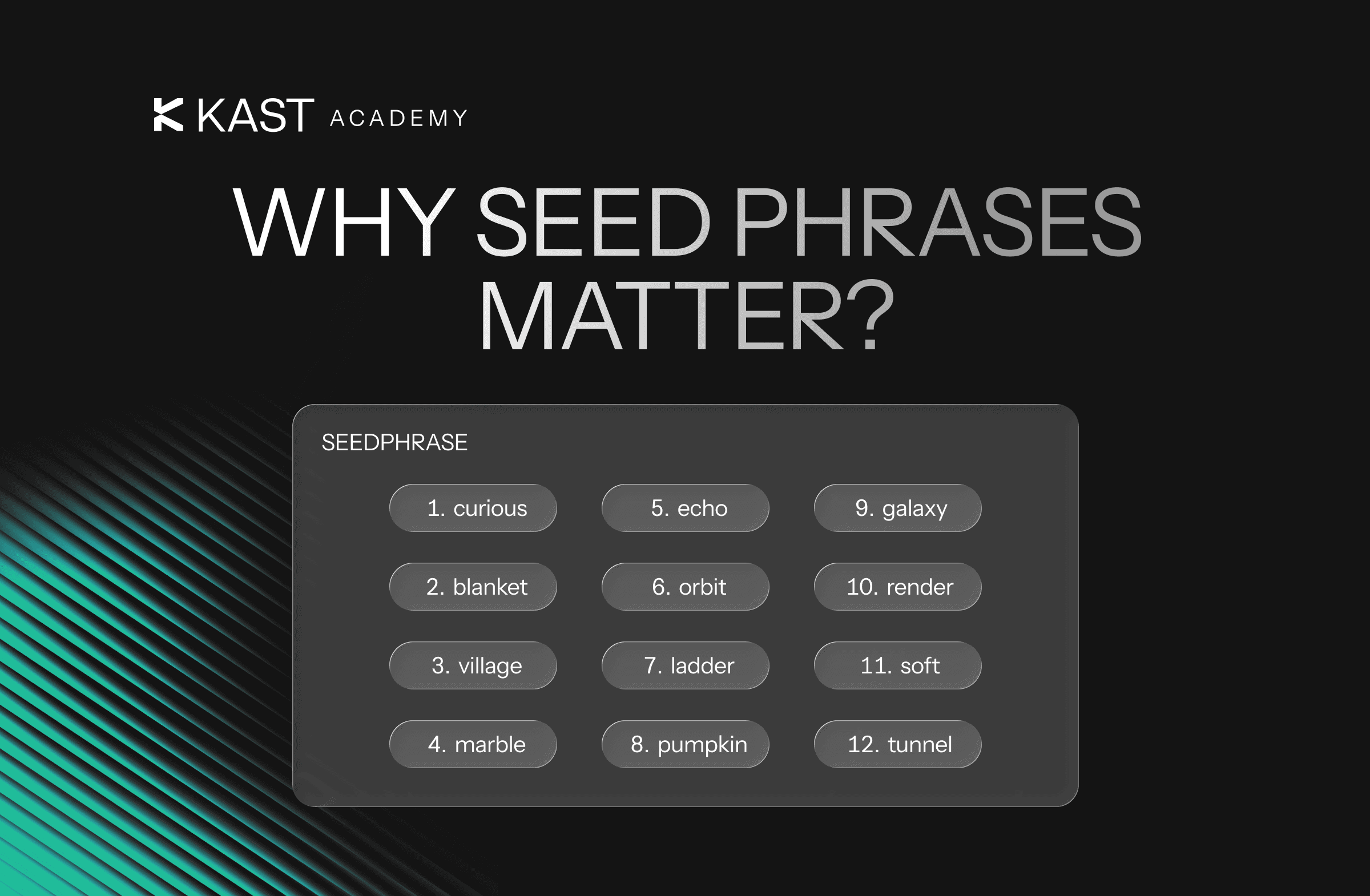

What Is a Seed Phrase in Crypto?

A seed phrase is a set of 12 or 24 simple words that can recreate your wallet’s private keys.

That matters because a private key proves ownership and authorizes spending on a blockchain. If someone gets your private key, they control the funds tied to it. If you lose it, you can lose access permanently.

Crypto uses public key cryptography. Your public key, or the wallet address derived from it, is what you share to receive funds. Your private key is what you keep secret to sign transactions and prove ownership.

Most wallets do not show raw private keys. Instead, they generate a seed phrase as a human-readable backup. If your device is lost, stolen, or replaced, that phrase can restore your wallet.

In simple terms, those 12 or 24 words are the master backup to your crypto.

Yes, it is a lot of responsibility for a short list of words.

Why Do Seed Phrases Matter?

Seed phrases matter because they define who controls your crypto.

If you use self-custody or cold storage, you are responsible for securing that phrase. There is no password reset. No central authority. No recovery email.

Cold storage reduces remote attack risk because your signing keys stay offline. But it introduces a different risk: losing access yourself.

If your seed phrase is destroyed, misplaced, or exposed, the outcome is final. Custody and backups are entirely on you.

What Happens If You Lose Your Seed Phrase?

If you lose your seed phrase and your wallet device fails, you can permanently lose access to your funds.

If someone else finds your seed phrase, they can recreate your wallet and move your crypto.

Most seed phrase compromises do not involve advanced hacking. They involve normal human behavior:

- A photo saved to cloud backups

- Words typed into a fake recovery website

- A screenshot left on a laptop

- A notebook stored in an obvious place

The technology is strong. The weak point is usually storage and handling.

A backup only works if it is stored securely, separately, and still accessible when you need it.

Is a Seed Phrase the Same as a Private Key?

A seed phrase generates private keys, but it is not the private key itself.

Think of it as the root from which your wallet’s private keys are derived. With the phrase, you can recreate the keys. Without it, recovery becomes impossible in a self-custody setup.

Do You Actually Need a Seed Phrase?

If you use self-custody, yes.

A seed phrase is the mechanism that allows you to restore access to your crypto. If you choose full control, you also accept full responsibility.

If you use a custodial wallet, you typically do not manage seed phrases directly.

That is not automatically less secure. It is simply a different security model.

The real question is not “Which is safer?", it is “Which model fits how you use crypto?”

Self-Custody vs Custodial Wallets

Here is the core difference:

With self-custody, you hold the private keys. You manage the seed phrase. Recovery depends entirely on you.

With a custodial wallet, the provider holds the private keys. You manage account access instead. Recovery happens through account verification and support processes.

Self-custody often makes sense for long-term storage and crypto-native workflows.

Custodial wallets often make sense for spending, transfers, payouts, and day-to-day use.

If you want a deeper breakdown of cold wallets versus hot wallets and when to use each, read the full guide here:

Why a Custodial Wallet Can Make Sense

Custodial wallets are often labeled less secure. That oversimplifies the trade-off.

If your goal is to actively use your crypto, pay, transfer, convert to fiat, or move funds across borders, a custodial model can reduce operational risk.

Instead of managing seed phrase backups yourself, you focus on account security. The provider manages custody infrastructure.

KAST is built around that approach.

KAST uses institutional custody and layered monitoring controls built to bank-level security standards. Account protection, transaction monitoring, and infrastructure management happen behind the scenes so you can focus on using your funds.

Support also matters. KAST Concierge is available 24/7, with typical responses within about 15 minutes.

When it comes to real-world usability, integration with traditional finance is key. KAST Global Payouts converts stablecoins and delivers funds directly to bank accounts through regulated payment networks, with fees and timelines shown upfront.

You can also send USD via SWIFT or use U.S. payment rails like ACH and Fedwire.

In short, you can move between crypto and bank rails, or spend directly with your KAST card, without managing seed phrases day to day.

You stay in control of how much you hold long term and how much you keep ready to use. KAST handles the operational side so you do not have to manage wallet backups yourself.

Where KAST Fits in Your Crypto Setup

Most people naturally divide their crypto into two categories:

- Long-term holdings that are rarely touched.

- Working funds that need to move.

Self-custody can make sense for long-term storage.

KAST is designed for the usable side. The funds you want to spend, convert, or transfer without friction.

You decide how much to keep in cold storage and how much to keep accessible. KAST supports the part of your crypto that needs to work for you.

No seed phrase management required.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

Cold Storage vs. Card Wallet: How Much Should You Keep on KAST?

Most crypto advice frames storage as a binary choice. A better approach is separating long-term holdings from a working balance. Cold storage keeps funds safe by staying out of reach, while a card wallet like KAST keeps money accessible for spending, transfers, and everyday life.

What Is Identity Verification And Why Do Cards Ask for It?

Identity verification is required before you can use a crypto card. This guide explains why KYC exists, what it checks, and how KAST verifies users to keep accounts secure and compliant.

KAST vs RedotPay: Which Crypto Card Is Better for Everyday Spending?

A clear comparison of KAST vs RedotPay. See fees, cashback, limits, and real-world costs to choose the right crypto card for your spending.