What’s the Difference Between Coins and Tokens?

Coins and tokens aren’t the same thing, and confusing them can cost you time, fees, or even funds. This guide breaks down the real difference between crypto coins and tokens, explains why stablecoins like USDC and USDT are tokens (not coins), and shows what KAST uses.

Key Takeaways

- Coins are native to their own blockchain. Tokens are built on top of existing blockchains.

- Bitcoin, Ethereum, and Solana are coins. USDC, USDT, and most stablecoins are tokens.

- KAST uses tokens like USDC and USDT for transfers because they're stable, fast, and built on efficient networks.

You've probably heard someone say "I'm sending you some coins" when they're actually sending USDC.

Or maybe you've wondered: is Bitcoin a coin? Is USDC a coin? What about Ethereum?

If you're confused, you're not alone. Even people who've used crypto for years mix up these terms.

Here's the thing: the difference between coins and tokens in crypto isn't just trivia. It actually affects how you use crypto, what transaction fees you pay, and which blockchain network you need to pick.

This guide will explain what coins and tokens really are, why stablecoins are tokens (not coins), and how KAST uses tokens to keep your transfers fast and cheap.

What Is a Coin in Crypto?

A coin is a cryptocurrency that runs on its own blockchain.

That's it. If it has its own network, it's a coin.

Examples of coins:

- Bitcoin (BTC) runs on the Bitcoin blockchain

- Ethereum (ETH) runs on the Ethereum blockchain

- Solana (SOL) runs on the Solana blockchain

- TRON (TRX) runs on the Tron blockchain

Coins are usually used to pay transaction fees on their network. When you send Bitcoin, you pay fees in Bitcoin. When you send something on Ethereum, you pay fees in ETH. When you use Solana, you pay fees in SOL.

Without the native coin, the blockchain doesn't work. Simple as that.

What Is a Token in Crypto?

A token is a cryptocurrency that's built on top of someone else's blockchain.

Tokens don't have their own network. They borrow the infrastructure of an existing blockchain.

Examples of tokens:

- USDC is a token that runs on multiple blockchains (Ethereum, Solana, Arbitrum, etc.)

- USDT is a token that runs on Ethereum, Solana, Tron, and others

- USDe is a token on Ethereum

- Chainlink (LINK) is a token that runs on multiple blockchains

When you send USDC on Solana, you're not paying fees in USDC. You're paying fees in SOL, because Solana is the blockchain doing the work. The token just rides along.

Side-by-Side: Coins vs Tokens

Here's how coins and tokens compare:

Here's the key difference: coins run the blockchain. Tokens use the blockchain.

You can't have tokens without a blockchain for them to live on.

Why Stablecoins Are Tokens, Not Coins

This is where people get confused.

Stablecoins like USDC and USDT are called "coins" in their name, but they're actually tokens.

Here's why:

They don't have their own blockchain. USDC doesn't run on its own blockchain. It runs on Ethereum, Solana, Arbitrum, and other networks.

They don't pay for transaction fees. When you send USDC on Solana, you pay the fee in SOL, not USDC.

They're issued on existing blockchains. Circle (the company behind USDC) creates USDC tokens on multiple blockchains. Same with Tether and USDT.

So even though they're called stablecoins, they're technically tokens.

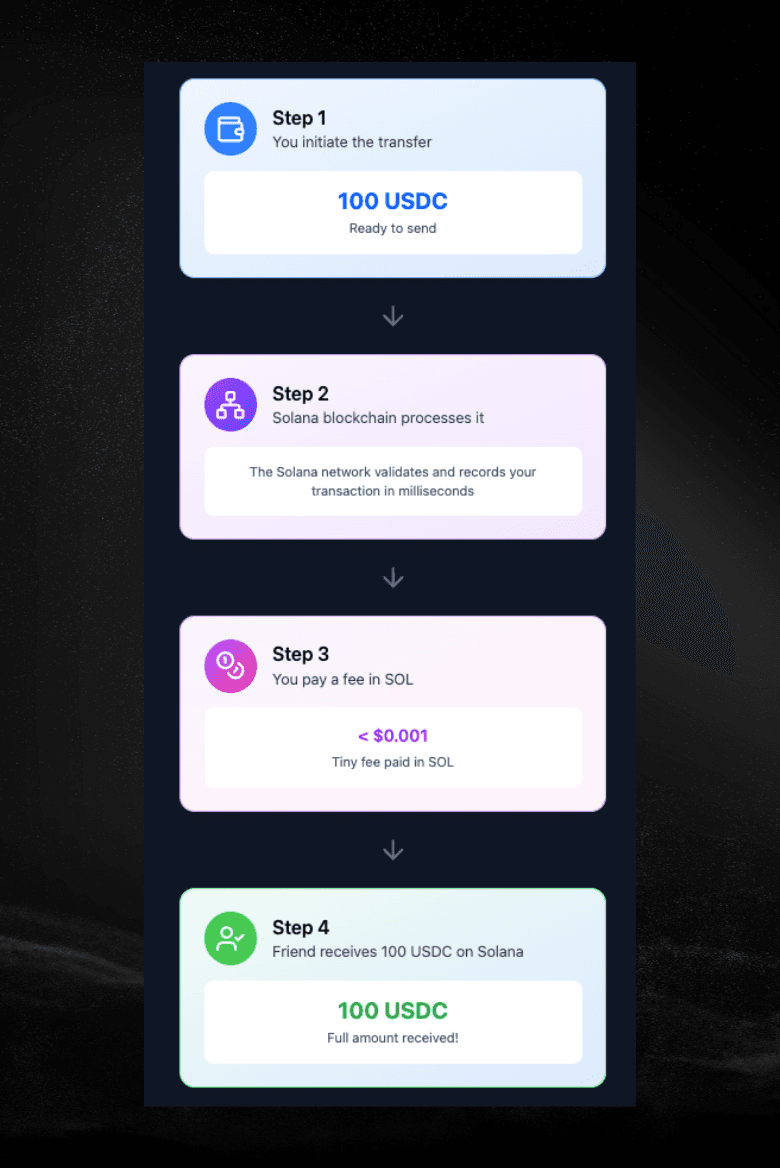

Example: Sending USDC on Solana

Let's say you want to send 100 USDC to a friend using the Solana network.

Here's what actually happens:

- You initiate the transaction from your wallet

- The Solana blockchain processes it (not a USDC blockchain, because there isn't one)

- You pay a fee in SOL (less than $0.001)

- Your friend receives 100 USDC on Solana

USDC is the token. Solana is the blockchain. SOL is the coin that pays for the transaction.

Without SOL, you couldn't move USDC on Solana. The coin powers the network. The token just represents value.

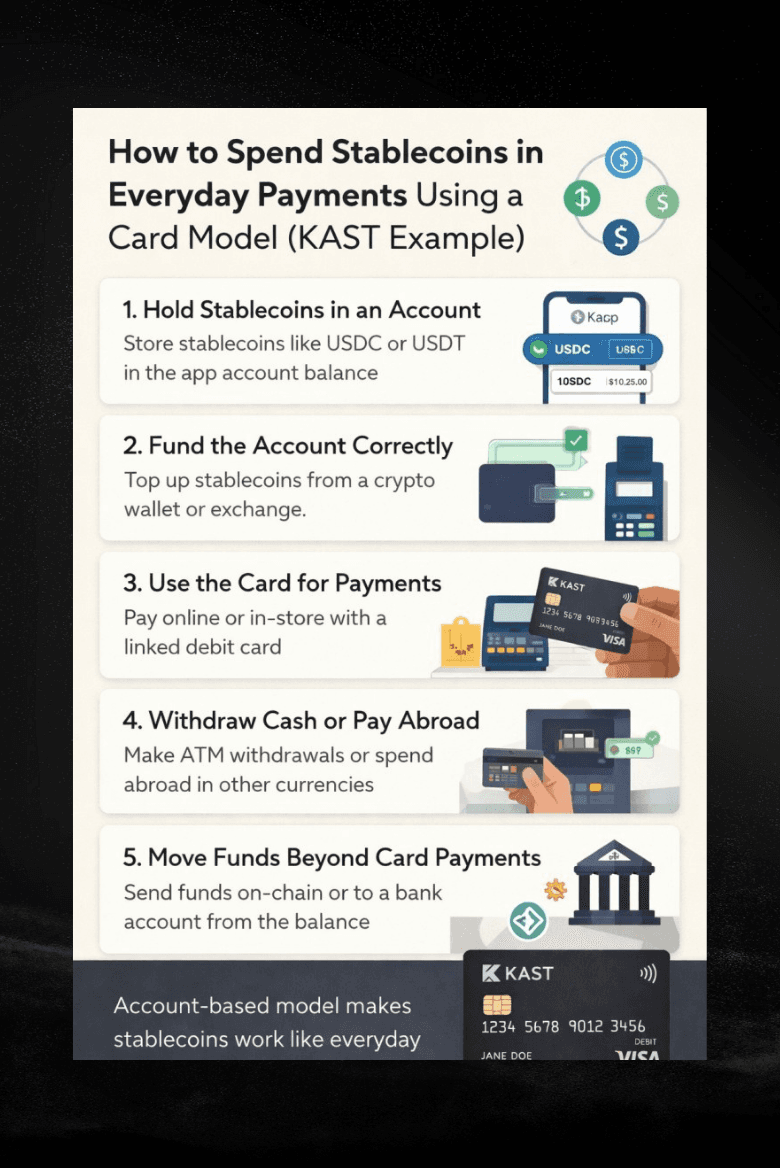

How KAST Uses Tokens for Transfers

KAST Card lets you spend stablecoins like regular money.

When you top up your KAST account or make a transfer, you're using tokens, not coins.

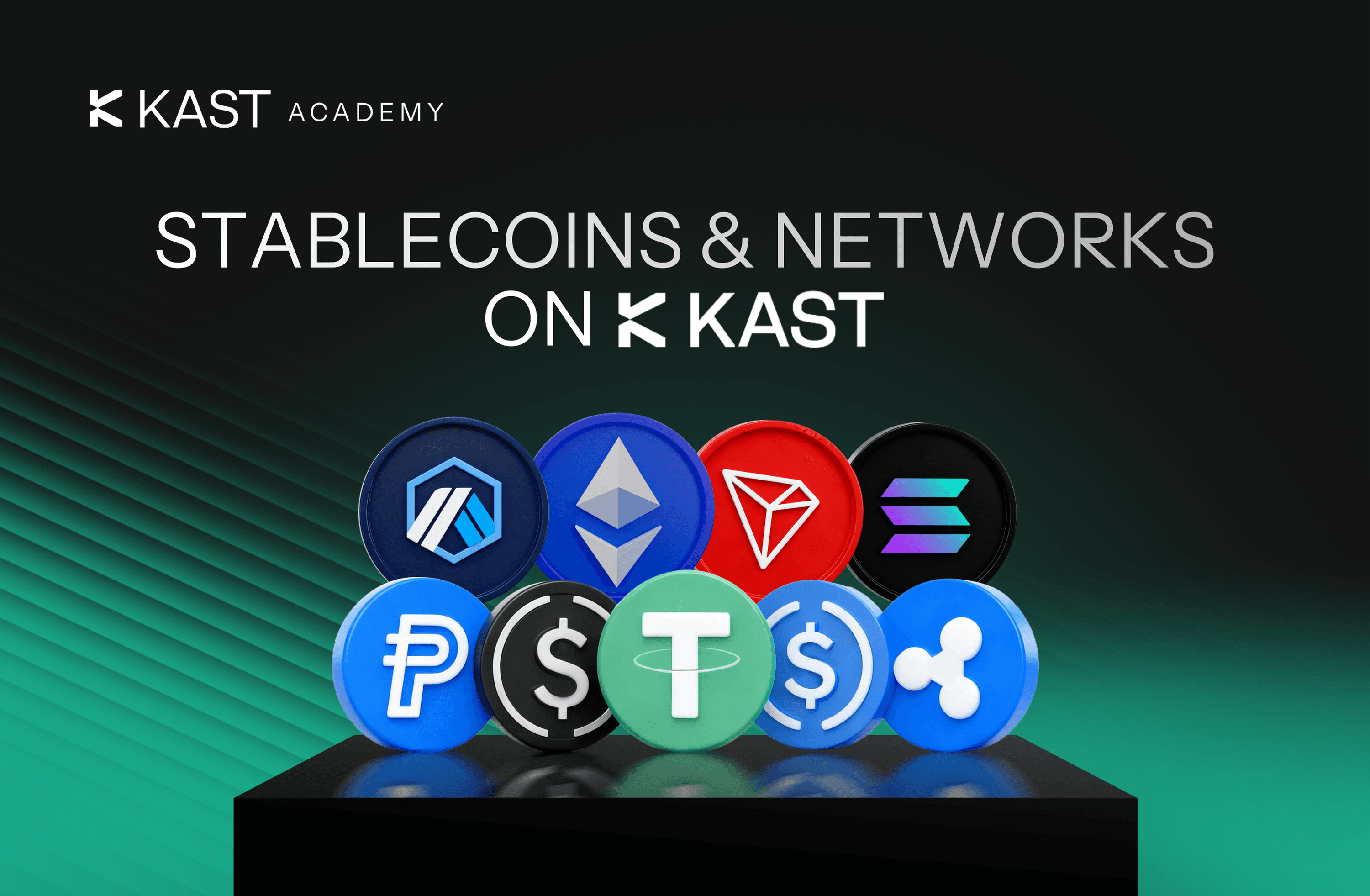

Stablecoins KAST supports:

- USDC (on Solana, Arbitrum, and Ethereum)

- USDT (on Solana, Tron, and Ethereum)

- USDe (on Ethereum)

- PYUSD (PayPal's stablecoin)

- RLUSD (Ripple's stablecoin)

All of these are tokens. None of them have their own blockchain.

Why KAST Uses Stablecoins Instead of Volatile Coins

Coins like Bitcoin, Ethereum, and Solana fluctuate in value.

That's fine for investing, but it's terrible for everyday spending.

Stablecoins like USDC and USDT are designed to stay at $1.00, which makes them predictable and practical for payments.

You don’t want to buy coffee with Bitcoin and later realize it cost way more than expected. Everyone learns that one eventually.

That's why KAST focuses on stablecoins.

Why Network Speed and Fees Matter

KAST supports stablecoins on multiple fast, low-cost networks, including Solana, Polygon, Arbitrum, Tron, and others.

Here’s why the blockchain you choose matters:

Speed. Networks like Solana and Polygon confirm transactions in under a second. Your balance updates fast.

Cost. Fees are usually under $0.001. Easy to miss, even if you try not to.

Efficiency. These networks handle high volume without much congestion.

When you send USDC on Solana to your KAST account, you're using:

- USDC (the token) to hold stable value

- Solana (the blockchain) to move it quickly and cheaply

- SOL (the coin) to pay the tiny network fee

You get the best of both: stable value and fast, cheap transfers.

Same token. Different blockchain. Completely different experience.

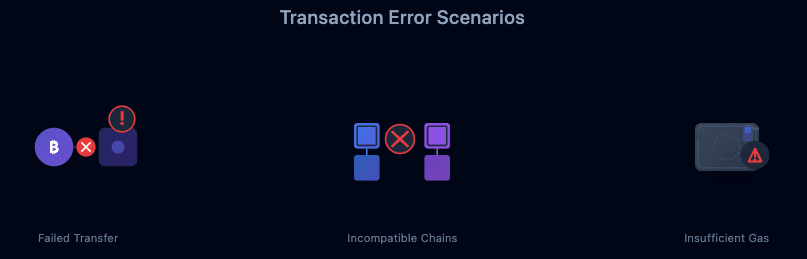

What Happens If You Send the Wrong Type?

This is where understanding coins vs tokens really matters. Get it wrong, and things disappear.

Scenario 1: Sending a coin to a token address

If you try to send ETH (a coin) to an address expecting USDC (a token), the transaction will fail or the funds could be lost. Oops.

Scenario 2: Sending a token on the wrong blockchain

If you send USDC on Ethereum to a Solana address, your funds won't show up. The blockchains don't talk to each other. Your money just vanished into the void.

Scenario 3: Not having enough of the native coin for fees

If you try to send USDC on Solana but don't have any SOL in your wallet, the transaction won't go through. You need the coin to pay the fee, even if you're just moving a token.

What to check before sending:

- Are you sending to the correct blockchain?

- Do you have enough of the native coin to pay the fee?

- ✓Is the receiving address compatible with that blockchain?

Double-check everything. Crypto doesn't have an undo button.

Do You Ever Need Coins?

Yes, but mostly in the background. You need a small amount of the native coin to pay transaction fees.

Sending USDC on Solana? You need a tiny bit of SOL. Sending USDT on Tron? You need TRX.

Most wallets remind you if you're running low.

On a centralized exchange like Binance, this happens off-chain via an internal ledger update, allowing the fee to be deducted directly from the asset you are sending.

Coins, Tokens, and Your KAST Card

When you use your KAST card, you hold stablecoins (tokens) in your wallet, deposit them on a supported blockchain, and spend them instantly through standard Visa payment processing.

No volatility. No delays. No fee math.

It matters when you're moving money between wallets, checking transaction fees, or reading a block explorer.

It doesn't matter when you're just spending or holding stablecoins.

Knowing the difference helps you avoid costly mistakes.

How to Choose Between Coins and Tokens

Coins have their own blockchain. Tokens borrow someone else's.

Bitcoin, Ethereum, and Solana are coins. USDC, USDT, and most stablecoins are tokens.

KAST uses stablecoin tokens on fast, cheap blockchains so you can spend without losing value to volatility or fees.

You don't need to be a blockchain expert to use your money. You just need to know where it is and how to spend it.

Ready to spend stablecoins the easy way?

Get your KAST card and start using your crypto like regular money.

Disclaimer: This content is provided by KAST Academy for educational purposes only and is not intended as financial advice or a recommendation to engage in any transaction. All information is provided "as-is" and does not account for your individual financial circumstances. Digital assets involve significant risk; the value of your investments may fluctuate, and you may lose your principal. Some products mentioned may be restricted in your jurisdiction. By continuing to read, you agree that KAST group, KAST Academy, its directors, officers and employees are not liable for any investment decisions or losses resulting from the use of this information.

Related articles

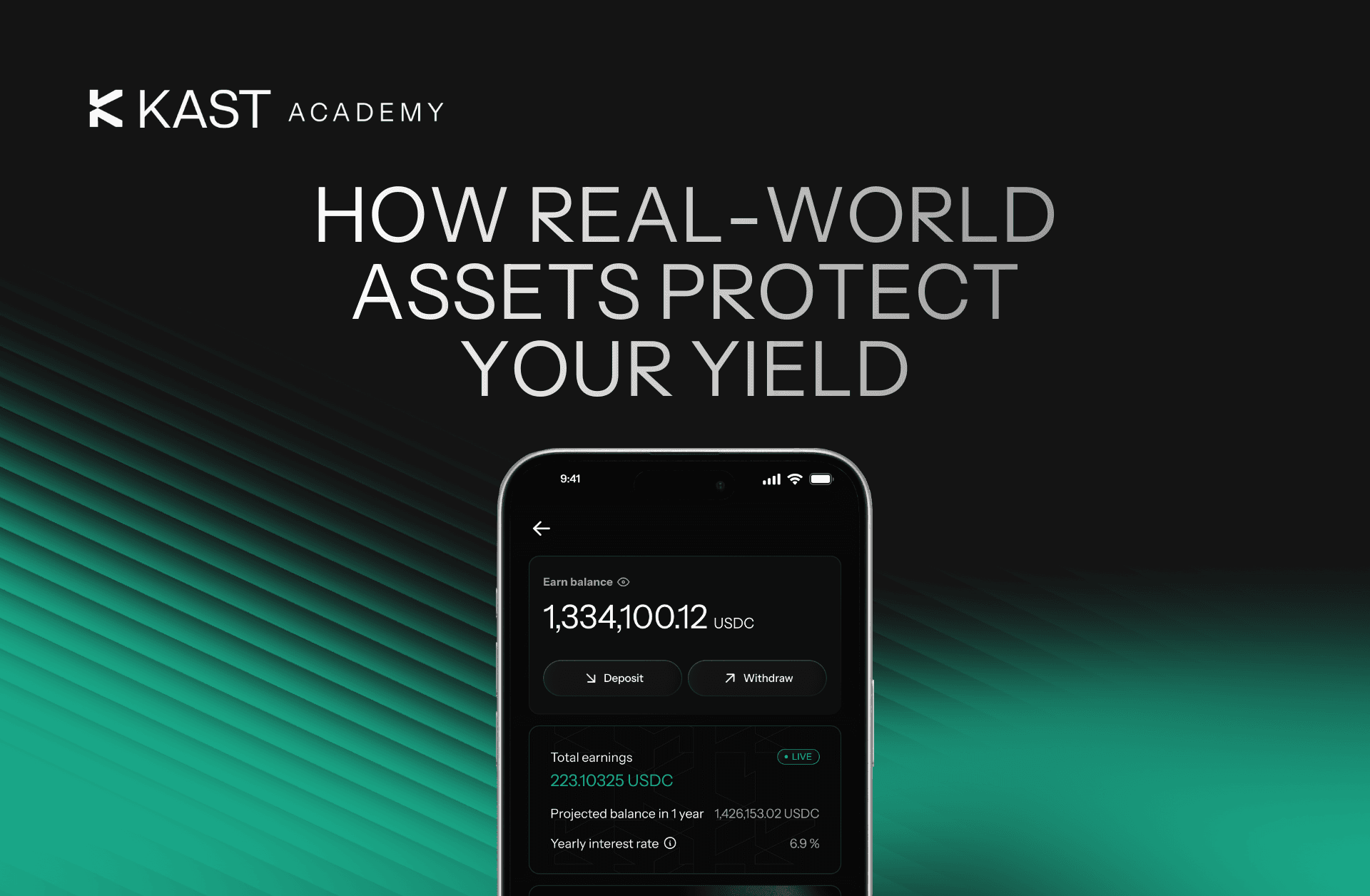

What Is RWA Backing? Tutorial on How Treasury Bills Secure Your Yield

Real-World Assets (RWAs) bring familiar assets like U.S. Treasury bills and bonds onchain. RWAs let you earn yield backed by traditional financial instruments. This guide explains how RWA backing works, why it exists in crypto, and how KAST Earn uses it to help you generate steady yield.

What Stablecoins And Networks Are Supported By KAST?

Did you know KAST supports stablecoins like USDC, USDT, PYUSD, RLUSD and networks like Solana, Ethereum, Polygon, Tron, BSC, and more? Learn how to choose the right network based on transaction fees, speed, and compatibility.

Can a Stablecoin Lose Its Value? Real Risks Explained

Stablecoins are designed to hold a $1 value, but history shows they can lose their peg. This guide explains how stablecoins work, why depegs happen, which designs are riskier, and how KAST decides which stablecoins to support.