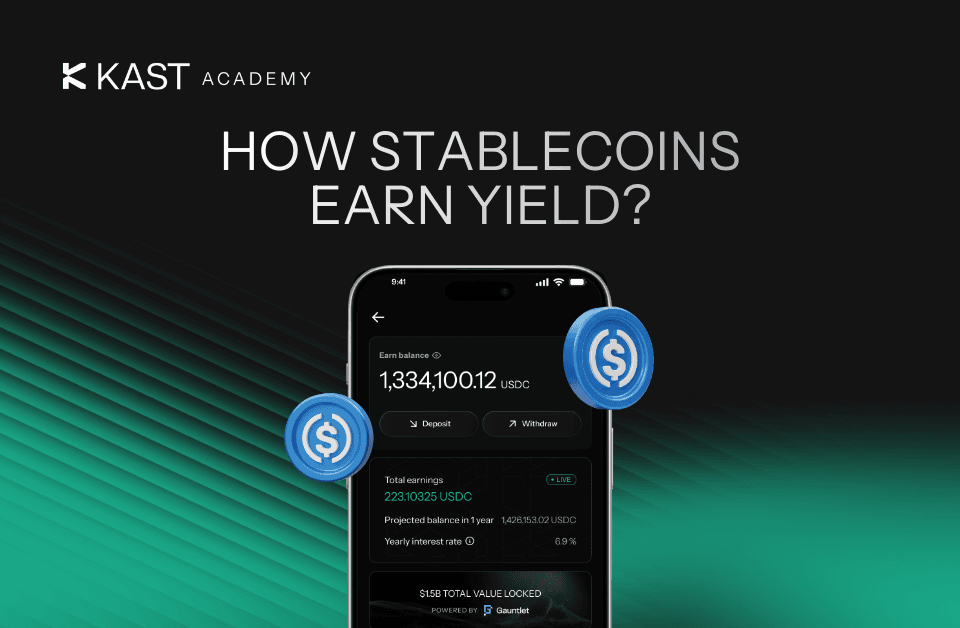

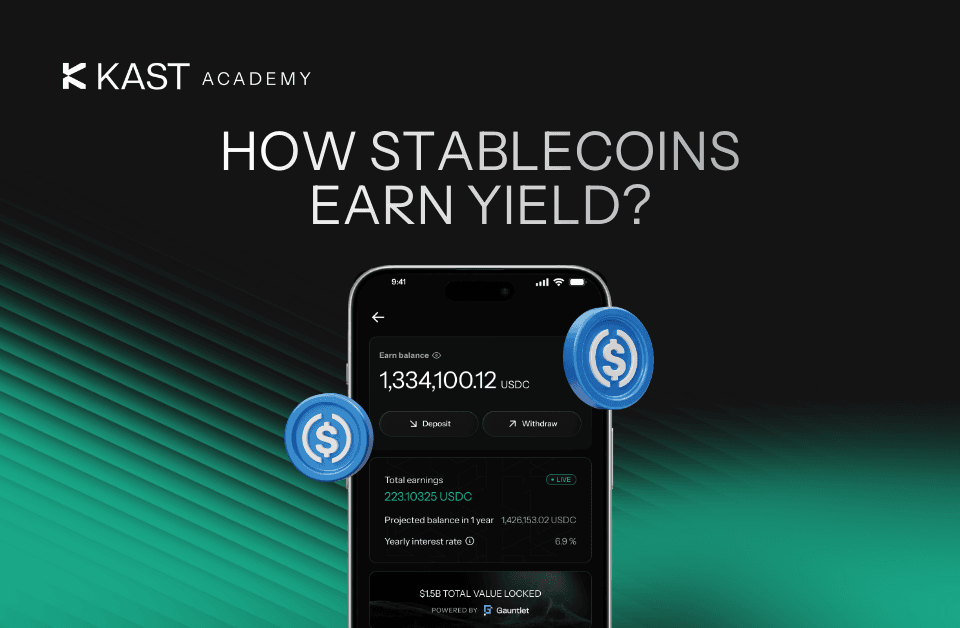

How Stablecoins Earn Yield: The Real Sources Behind Your Returns

Stablecoin yield comes from real onchain demand, borrowing, trading, and capital deployment, not inflation or promos. When demand rises, yields rise. When it falls, so does yield.

Learn how to navigate stablecoins, payments, and Web3 like a pro.

Simple explanations of common crypto terms.

Decentralized applications run on blockchain networks rather than on centralized servers. dApps operate using smart contracts, which automatically execute rules and logic.

A smart contract is a self-executing program stored on a blockchain that automatically enforces rules and actions when predefined conditions are met.

Yield refers to the return earned on digital assets over time. In crypto, it is usually generated through staking, lending or liquidity provision.

Most crypto advice frames storage as a binary choice. A better approach is separating long-term holdings from a working balance. Cold storage keeps funds safe by staying out of reach, while a card wallet like KAST keeps money accessible for spending, transfers, and everyday life.

Off-ramping feels frustrating when it looks like a black box. Once you understand the rails behind it, the process becomes a set of clear choices.

A real in-store payment in Yerevan using a KAST virtual card. See exactly how tap to pay works in Armenia, including the receipt, fees, instant notifications, and rewards, no crypto steps, no surprises.

A strong peso and weak dollar do not affect everyone the same way. Learn how exchange rates, FX fees, and where you earn and spend actually shape your buying power in Mexico.

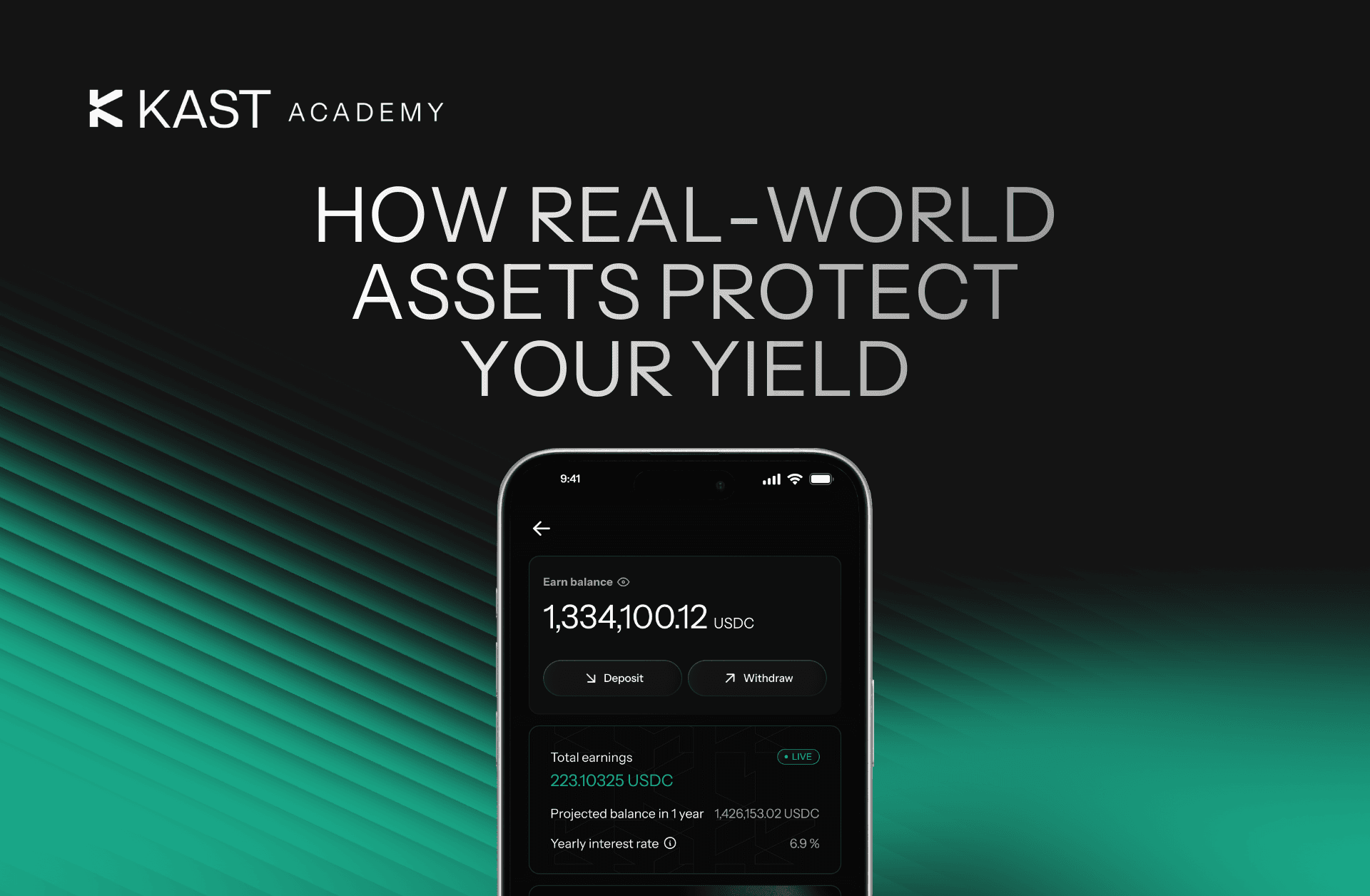

Real-World Assets (RWAs) bring familiar assets like U.S. Treasury bills and bonds onchain. RWAs let you earn yield backed by traditional financial instruments. This guide explains how RWA backing works, why it exists in crypto, and how KAST Earn uses it to help you generate steady yield.

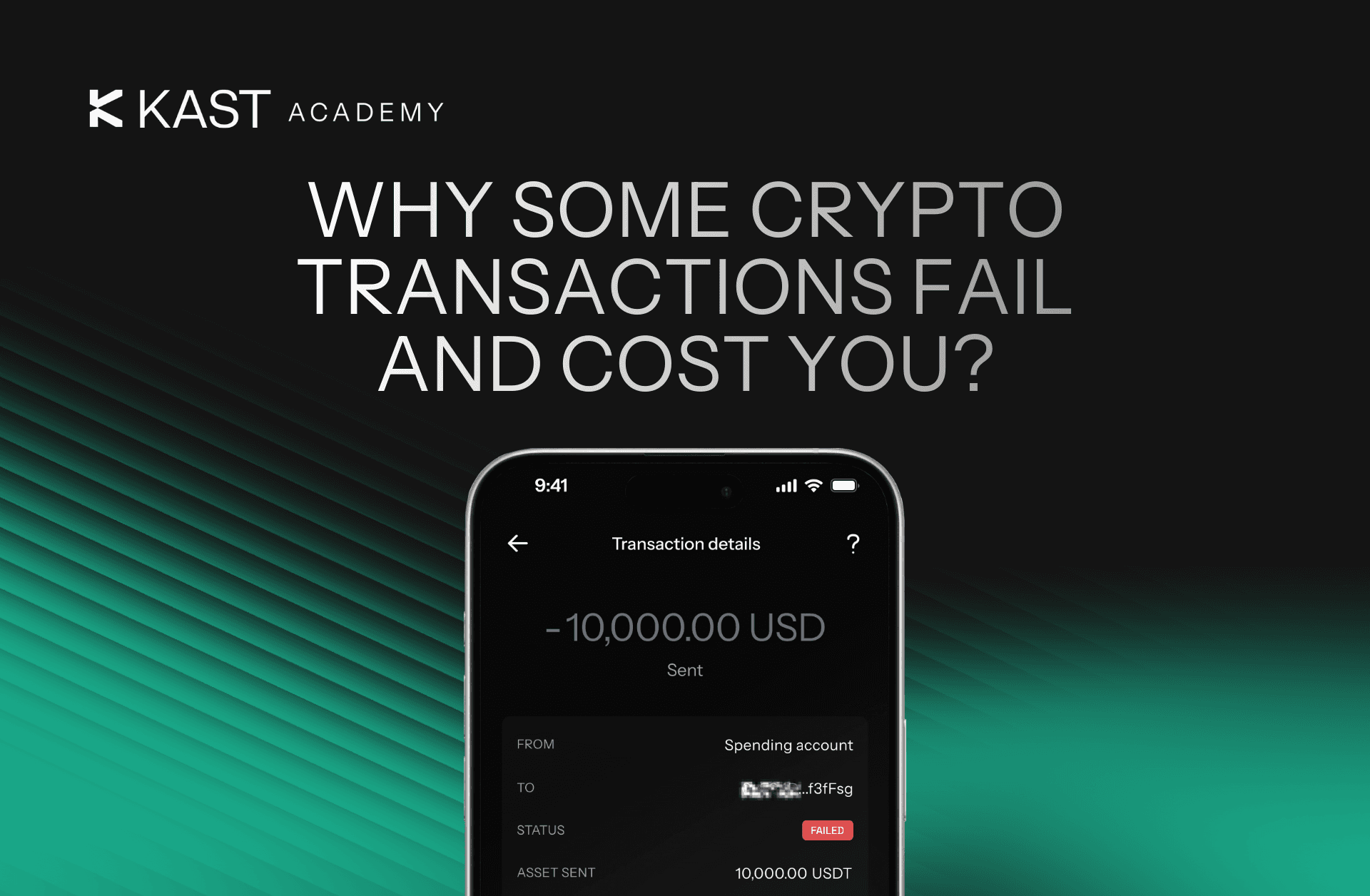

Gas limits and gas prices decide whether a crypto transaction succeeds, fails, or gets stuck waiting. This guide breaks down what those numbers actually mean, how fees are calculated, and how to avoid paying for transactions that don’t go through.

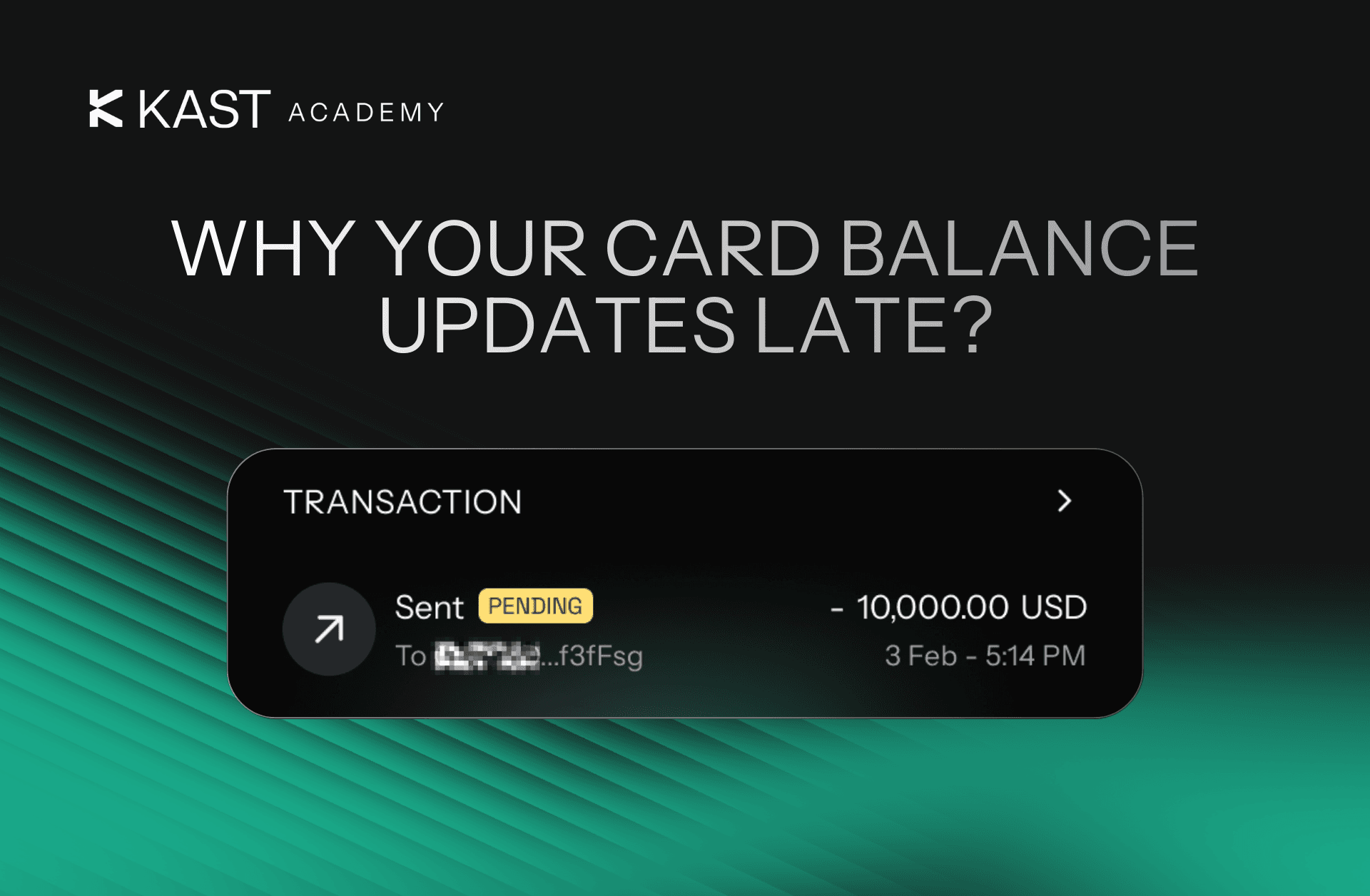

Ever notice your card balance update hours or days after you’ve already paid? That delay is settlement time. This guide explains how card transactions really work, why balances don’t change instantly, and how on-chain settlement with KAST helps your balance update faster and more transparently.

Coins and tokens aren’t the same thing, and confusing them can cost you time, fees, or even funds. This guide breaks down the real difference between crypto coins and tokens, explains why stablecoins like USDC and USDT are tokens (not coins), and shows what KAST uses.

USD to local currency fees include exchange-rate spreads, platform or trading fees, and payout costs. Understanding these fees helps you compare platforms and avoid hidden reductions in your final payout.

Identity verification is required before you can use a crypto card. This guide explains why KYC exists, what it checks, and how KAST verifies users to keep accounts secure and compliant.

Stablecoins are designed to hold a $1 value, but history shows they can lose their peg. This guide explains how stablecoins work, why depegs happen, which designs are riskier, and how KAST decides which stablecoins to support.

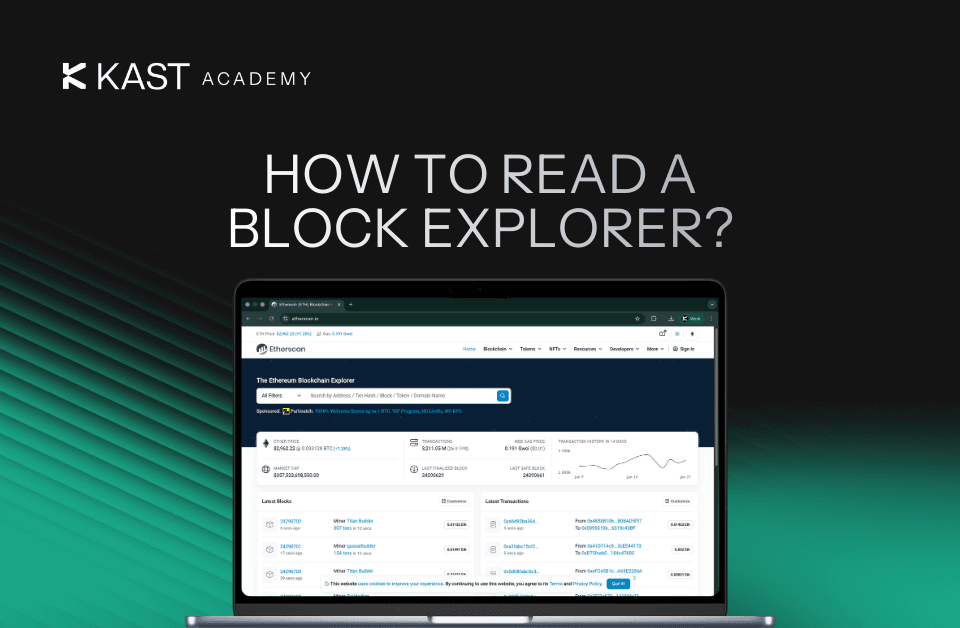

Ever sent crypto and wondered if it actually went through? This guide shows you how to use a block explorer to track your transaction in real time, understand confirmations, and see exactly when your KAST card top-up is ready to spend.

Gas fees are the cost of processing transactions on a blockchain. Some networks charge dollars or more per transaction, while others charge fractions of a cent. The difference comes down to how each blockchain is designed, and why Solana makes everyday crypto spending fast and cheap.

Stablecoin yield comes from real onchain demand, borrowing, trading, and capital deployment, not inflation or promos. When demand rises, yields rise. When it falls, so does yield.

KAST makes it easy to spend, send, and receive dollars in Mexico using cards, SPEI transfers, and digital wallets. Learn how currency selection at the terminal affects your costs and how to avoid hidden conversion fees.

Crypto payments feel instant, but finality takes time. Here’s what really happens after you hit send, why confirmations matter, and how KAST removes that friction from everyday spending.

When a card terminal in the UAE asks whether to pay in USD or AED, that choice decides who sets your exchange rate. In most cases, choosing AED is cheaper. Here’s why.

Spend crypto in Brazil with KAST. Convert crypto to USD instantly, then pay anywhere using PIX Scan, KAST Card, or Apple Pay. Get transparent rates, low fees, and instant BRL payments at any merchant.

Crypto cards can withdraw cash at ATMs worldwide, but understanding how the process works matters. This guide breaks down how crypto card ATM withdrawals function behind the scenes, where fees come from, what determines limits, and when using an ATM actually makes sense.

Did you know KAST supports stablecoins like USDC, USDT, PYUSD, RLUSD and networks like Solana, Ethereum, Polygon, Tron, BSC, and more? Learn how to choose the right network based on transaction fees, speed, and compatibility.

Ever tapped your card and thought, “Wait, did I just spend Bitcoin?” That’s the magic of a crypto card - simple on the surface, but powered by incredible tech underneath. Let’s unpack how it all works, and how your KAST Card makes it real, simple, and powerful for you.

Crypto cards work everywhere traditional cards do: in-store, online, and at ATMs. Learn how to spend your Bitcoin and stablecoins seamlessly at any retailer accepting Visa or Mastercard, with instant crypto-to-fiat conversion happening behind the scenes.

Crypto cards are powerful tools for spending your digital assets in the real world. Like any other card, they're safe when you follow the right security practices.